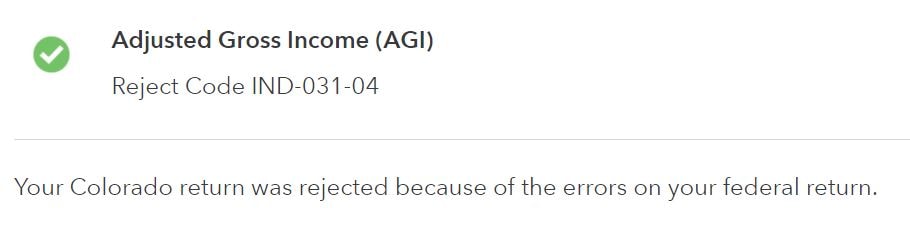

You can troubleshoot by finding your rejection code. It's in the email you received, or you can view it in TurboTax after signing in and selecting Fix my return. Here's an example:

If your return continues to be rejected when attempting to e-file, you can print your return and file by mail.

Review this list of reject codes for solutions specific to your situation.

To fix your rejected return, sign in to TurboTax and we'll guide you through fixing and refiling your return.

Note: If your TurboTax navigation looks different from what’s described here, learn more.

- Sign in to TurboTax.

- Select Fix my return to see your rejection code and explanation.

- Select Fix it now and follow the instructions to update the info causing the reject.

- Once you've fixed the error, select File in the left menu and follow the instructions to either e-file or file by mail.

If you're using TurboTax Live Full Service, read this article.