in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Who is TPG, and why is my Federal Return payout so much lower than expected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

See this info

Topic No. 203 Reduced Refund | Internal Revenue Service

Why is my direct-deposited refund or check lower than the amount in TurboTax?

Why is My Tax Refund Not What I Expected

The third Economic Impact Payment of $1400 per person was sent out in March of 2021. The IRS may be saying you got it and are asking for it again on you return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

@ jmann1115 asked: "Who is TPG...?"

TPG (or SBTPG) is Santa Barbara Tax Products Group, which is an intermediary company that initially receives one's Federal refund if one chose to pay any TurboTax fees out of a Federal refund.

If you used that payment method to pay TurboTax fees, the IRS first sends the Federal refund to an intemediary bank where the fees are subtracted. Then that bank sends the rest of your funds to your bank account (or card) in a second direct deposit. SBTPG (aka TPG) is the company that administers that process. There is a 39.99 service fee when using that payment method (44.99 for California filers.)

If you paid TurboTax fees by that method, you can lookup your refund at SBTPG's website using their tool. It should show you how much they received from the IRS, and how much they took out for fees.

To log in, choose the "For taxpayers" portal at:

https://www.sbtpg.com/

If the IRS lowered your refund, they should send you a letter in about 3 weeks or so explaining why, and itshould include steps you can take if you disagree with them.

If you have a state refund, it comes separately and does not go through SBTPG.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

I would like to know why my refund was less than what it shows on the irs website. I was charged a extra $101.42 dollar after I was charged by turbo Tax. I would like to know if I would getting the money sent to my account. Please let me know i was never told of any other fees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

It could be this: TPG charges an extra fee (plus state tax as applicable) if its attempt to direct deposit the balance of your refund is declined by your bank, and they then have to mail you a check. This was disclosed when you signed up for Pay with Refund. Please contact TPG for more details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

@Chino581 wrote:I would like to know why my refund was less than what it shows on the irs website. I was charged a extra $101.42 dollar after I was charged by turbo Tax. I would like to know if I would getting the money sent to my account. Please let me know i was never told of any other fees.

Did you choose to pay your fees out of the Federal refund?

If so, the TurboTax fees with that method are not paid upfront. They are paid after the IRS releases your refund and sends it to the intermediary bank (unless there is a long delay.)

There is also a 39.99 service fee (44.99 for California residents) for that payment method.

We don't know what product you used. Here's an example if you used Deluxe:

Deluxe Federal return $59

Option to pay fee out of the Federal refund 39.99 (44.99 for California residents.)

Plus possible sales tax

If that's your situation, then 59 + 39.99 = 98.99 plus possible sales tax

You can probably see what TPG received from the IRS and what they deducted by using the refund lookup tool on their website.

To log in, choose the "For taxpayers" portal at:

https://www.sbtpg.com/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

What a ripoff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

You can avoid the extra charge by paying your TT fees upfront with a debit or credit card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

I need verification that my payment came from a tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

I have not got my refund for IRS I need to know what's going on with it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 35a of your 2021 Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

OR——if you filed by mail, expect a long wait. It is taking the very backlogged IRS six to nine months to process mailed returns. Until a human opens your envelope and enters the data into the system, nothing will even show up on the refund site, so you will have to be very patient.

Your tax refund was not sent to TurboTax. TurboTax does not handle your refund at all.

Santa Barbara Tax Products Group, LLC (SBTPG) is the bank that handles the Refund Processing Service when you choose to have your TurboTax fees deducted from your refund. This option also has an additional charge from the bank that processes the transaction.

You can contact them SBTPG, toll-free, at 1-877-908-7228 or go to their secure website www.sbtpg.com

https://ttlc.intuit.com/questions/2580357-who-provides-the-refund-processing-service

https://ttlc.intuit.com/community/refunds/help/who-provides-pay-with-my-refund/00/26410

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

I was supposed to get approximately $3900.00 but instead received approximately $1100.00.

Why is this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

Did you have 2800 on 1040 line 30 for the Recovery Rebate Credit for the 3rd Stimulus? Did you already get the 3rd Stimulus (1,400 per person) they sent out last year starting in March 2021? You each should also get IRS letter 6475 for half saying what they sent you. Line 30 is only if you didn't get the full amount or qualify for more.

If you claimed a missing stimulus payment on your return but the IRS took it off you have to ask the IRS. They think they already sent it to you. Maybe it went to an account you don't remember. Or you got a check or a card. It was probably easy to miss the debit card in the mail and think it was junk mail. They have to put a trace on it.

Double check your bank accounts and check your IRS account (both accounts if married) to see how much the IRS sent you.

https://www.irs.gov/payments/your-online-account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

Okay so

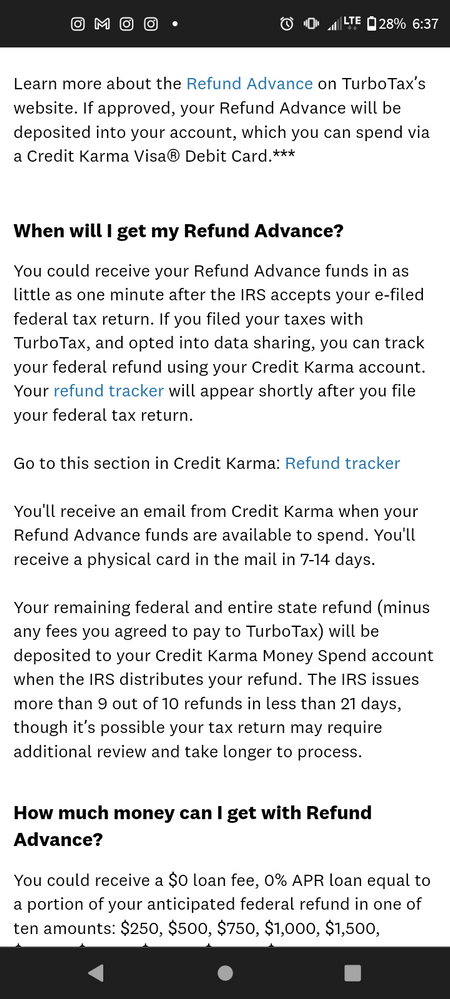

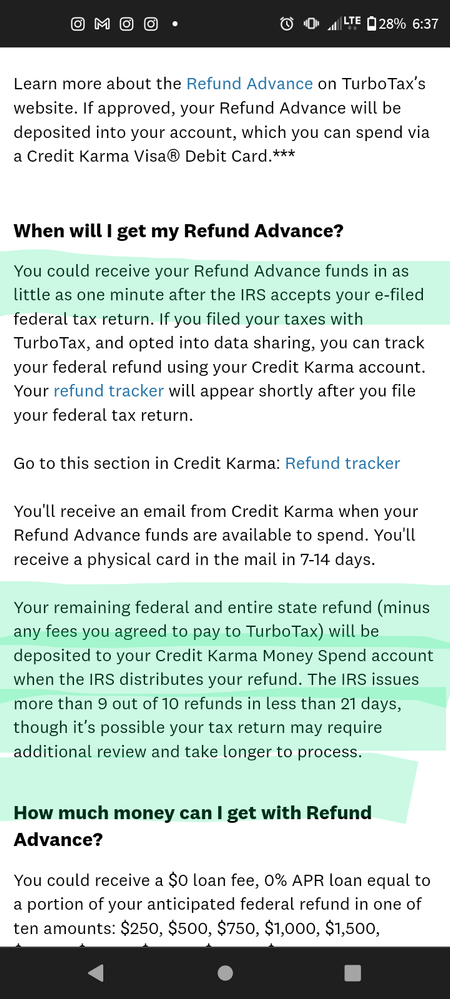

I believe the unexpected much lower amount deposit is actually a loan of a portion of your refund..So you can have some money right away..It says "early pay day" so ....I believe we will see the rest of the refund in a few days.. It better be because mine is $9,000 short...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Who is TPG, and why is my Federal Return payout so much lower than expected?

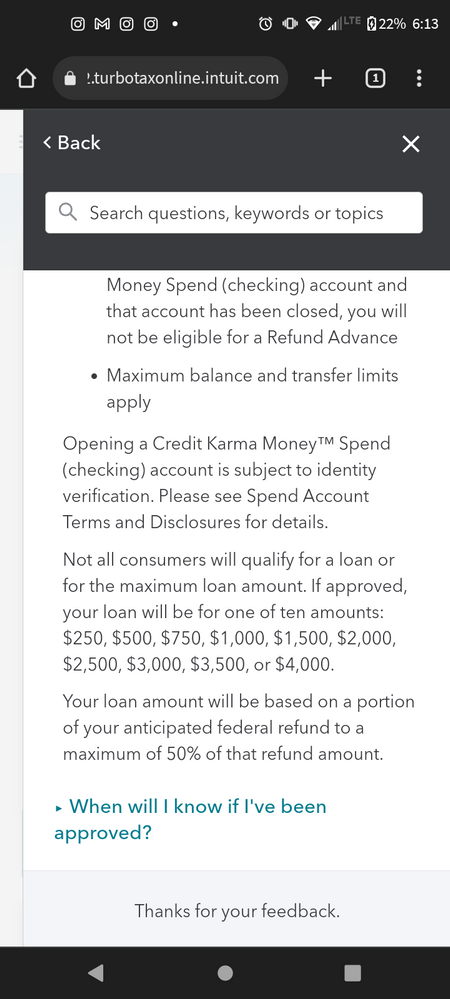

So I believe your deposit was your advanced loan from TurboTax or credit karma.. it's a portion of your federal tax refund.. and yes there's a fee you already agreed to pay.. so you should get the rest of your refund soon

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

timulltim

Level 1

user17524425162

New Member

oliver-newell2001

Level 2

halberman

Level 1

Jennifercrow

New Member