- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How can I talk to a live person?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

There is no way to determine that accurately.

Once you receive confirmation that your federal return has been accepted, you'll be able to start tracking your refund at the IRS Where's My Refund? site.

Once you have e-filed your tax return, there are a few ways to check the status of your refund:

- You can use the IRS Where’s My Refund? tool (fastest option)

- Call the IRS at 800-829-1954

The tool will get you personalized refund information based on the processing of your tax return. They will provide an actual refund date as soon as the IRS processes your tax return and approves your refund. Most refunds will be issued in less than 21 days. You can start checking the status of your refund within 24 hours after you have e-filed your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

I need a copy of my 2018 tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

Please refer to the following article to access your prior-year return.

How do I access a prior year's return? - TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

How can I speak with someone

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

@Norman1986 wrote:

How can I speak with someone

See this TurboTax support FAQ on how to contact Support - https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-contact-turbotax/00/26991

Or -

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or -

Use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

Or -

On every TurboTax web page, including this one, scroll down to the bottom of the page and click on Contact Us

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

Federal return accepted 2/13. No refund of $1200 yet. I understand that Turbo fees of $70 will be deducted from this $1200. How do I get the difference: mail or direct deposit. Please respond ASAP. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

Need to talk to live person

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

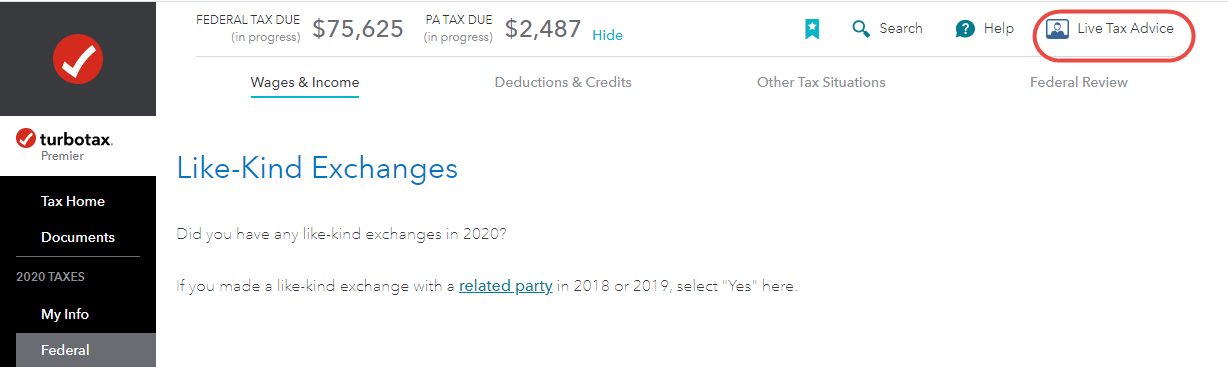

If you are using TurboTax Online, you can click on the Live Tax Advice link at the top right of your screen. [See screenshot below.]

You can also call TurboTax and speak with an agent. TurboTax customer service/support does not have a single phone number but has many different phone numbers based on the type of platform used. So that we can direct your call to the best person/department to help you:

- Click on this link: https://support.turbotax.intuit.com/contact/

- Select your TurboTax platform.

- Ask your question / state your problem. Do NOT use the word "refund' or you will get a phone number for tax refunds.

- Click Submit.

- On the next screen, choose the Call option and follow the instructions. You will be given the approximate wait time.

You'll get a toll-free number to a TurboTax expert who is specially-trained to handle your particular issue.

@Rinksgw

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

I have ordered my Turbotax disc FOUR TIMES over the past three months. I have given my credit card number every time. I have used Tutbotax for many years and love it. But it getting close to tax time and I still have not received anything. I tried calling the number to talk to a representative many times but it does not even ring. I am very frustrated. Someone needs to call me and soon!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

See this TurboTax support FAQ on how to contact Support - https://ttlc.intuit.com/questions/3401489

Or –

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or –

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or –

Use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

Or –

On every TurboTax web page, including this one, scroll down to the bottom of the page and click on Contact Us

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

I have not received my taxes yet irs said my check was mailed march 1 2021 it will take 7-10 business Days for my check to arrive tomorrow will be 9 days I filled e-filed on January 30th 2021 and my refund was excepted on february 12, 2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

To reach an IRS Agent:

Call the IRS: 1-800-829-1040 hours 7 AM - 7 PM local time Monday-Friday

When calling the IRS do NOT choose the first option re: "Refund", or it will send you to an automated phone line.

So after first choosing your language, then do NOT choose Option 1 (refund info). Choose option 2 for "personal income tax" instead.

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions."

- When it asks you to enter your SSN or EIN to access your account information, don’t enter anything.

- After it asks twice, you will get another menu.

Then press 2 for personal or individual tax questions.

It should then transfer you to an agent.

You can also contact your local IRS office. See this IRS website for local IRS offices - http://www.irs.gov/uac/Contact-Your-Local-IRS-Office-1

Or, you may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll-free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

I filed my taxes and haven’t received them yet so I reviewed my return and didn’t enter the second stimulus check them out should I go ahead and file an amendment or wait until I hear something from the IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

Wait for your return to be fully processed before you file an amendment.

If you filed, it is like dropping it into a mailbox - you cannot get it back.

You'll have to wait until your return is either accepted or rejected.

-

If rejected, you can make any necessary changes.

-

If accepted, you'll need to amend your return.

-

To avoid unnecessary delays, do not amend until your original return has been fully processed.

-

You can e-file your 2020 amended federal tax return, but most states require amendments to be printed and filed by mail.

-

Allow 16 weeks for processing.

See this TurboTax FAQ for help with amending.

You can check the status of your amended return here, but allow 3 weeks after filing for it to show up.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I talk to a live person?

I have a MAC and a windows computer. Yesterday I talked with Leah Finecy and she was very helpful. I down loaded to my MAC but i wanted to transfer it to my window computer. So how can I do it? I have been a Turbotax customers for many tears. I do have a license code but it said the done had already been used.!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tgwill1966

New Member

shuli05131999

New Member

mboyd1298

New Member

Stephendsmith377

New Member

agilebill4dinfo

New Member