- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Need a copy of 2020 Tax return for 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

I had a hard drive (HDD) crash and lost my 2020 tax file I prepared with the CD version of TurboTax. My question is are the transcripts you can get from the IRS enough to file my 2021 Taxes or will I need to go the paid route with form 4506? I already requested and have received my 2020 Transcript from the IRS, but it seams like its not enough. I normally use TurboTax Desktop Premier (CD) and I just want to make sure I have all the right info for the 2021 tax filing. I don't mind paying the $43 with the 4506 form, but if I don't have to that would be great. This really is a bummer as I always backup my data and have since 2007, but I dragged my feet doing it this year and now 2020 is missing from my archive :( and I'm not about to pay the ridiculous fees HDD recovery placed charge in the hopes that they "might" be able to restore the HDD. Please let me know soon, if I have to I would like to get this 4506 form mailed out ASAP as they state it could take up to 75 days to receive the copy of my requested tax return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

Hello ALL!

I'm the OP on this thread and I'm here to update you all with my horrible experience with the IRS and Form 4506 and paying the $43 to get my complete copy of my 2020 1040, not just the free transcript. So after not getting a very good answer from the community as to if the transcripts would be enough to recreate the info needed to complete my 2021 taxes, I decided F-it and sent in Form 4506 along with my $43 payment for my 2020 form 1040 copy. I did this shortly after my last post in this thread and my $43 check cleared mid September 2021. Seeing how the IRS states it could be up to 75 days to get the copy I figured I had plenty of time. Well as of this writing it has been 228 days (154 Business days) since my check cleared and still no copy of form 1040 has been sent to me. I have tried to contract the IRS with over 300 phone calls about this issue and have not been able to get through to a live person, just the endless robot and eventual hang-up.

Tax day was nearing so I tried to wing it with the transcripts and of course made a mistake and now owe even more money then I originally claimed for 2021 because of this mistake I now also owe penalties and interest.

My advice, if you have to order a paid copy of your return from the IRS, DON'T! They will keep your $43 and never send you what you ordered.

Try your best with the free transcripts you can download from irs.gov or recreate your missing Turbo Tax CD return from your physical documents the best you can.

Best solution of all... BACK UP BACK UP BACK UP!!!! Then you wont have this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

Do you have anything from 2020 you will need to transfer into 2021? Like business info or depreciation? You might only need your 2020 AGI to efile 2021. You didn't save any backups of the .tax2020 or pdf files?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

I have all the documents I used to create my original .tax2020 file, but I don't want to "wing" it trying to recreate it for accuracy's sake. No, as I stated in my first post my HDD crashed and unfortunately this year I dragged my feet on making a backup (I normally make a backup right away, since 2007 I have every tax return backup). No I don't have the PDF either. I do have the 2020 return transcripts from the IRS but they seam very lacking. I have no issue paying the $43 for a full copy of my return but just want to know if I can or not, I'm not sure. If I don't have to pay the $43 and the transcripts are enough that would be great.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

We are just other users in a public user forum. You are essentially asking us to assess your ability to interpret and use the information on your transcript as opposed to getting the information from your Form 1040. We do not know about your reading/reasoning skills or know anything about your tax return. If you do not trust using the transcript then pay the $43 for the Form 1040 and set yourself up for success.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

No, I'm asking the community that hopefully has more experience with this then I, in the hopes of getting an educated answer as to if the transcripts are enough. Someone that maybe had to do this in the past maybe? I depend an the TurboTax software heavily so yes I'm confused when looking at the transcripts, this is why I came here for an educated answer, and to hopefully save $43. But if you're saying this an impossible task then I'll "set myself up for success". In setting myself up for success, if I do pay the $43 will the form I get from the IRS be EVERYTHING I need? Just want to make sure there isn't something else I might need.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

As I said it depends what you need to transfer to 2021. Look at your 2019 return. See what needed to transfer from 2018 and what needed to transfer into 2020. You can wait until you fill out 2021 next year to see what you might need, besides the AGI. Maybe you can get it from the transcript or order the full copy then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

I need a copy of my 2020 tax filed in2021,federal only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

Only need 2020 AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

NO!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

I saved no back up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

@bchuck wrote:

I need a copy of my 2020 tax filed in2021,federal only.

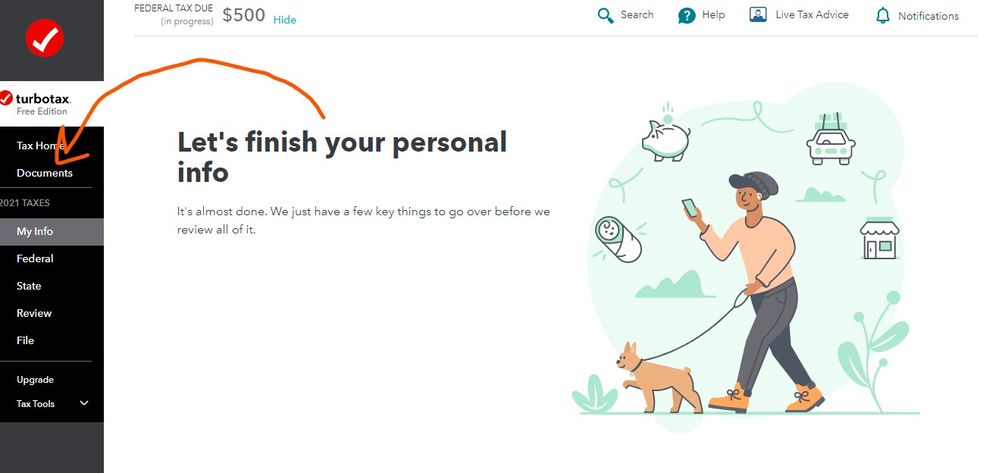

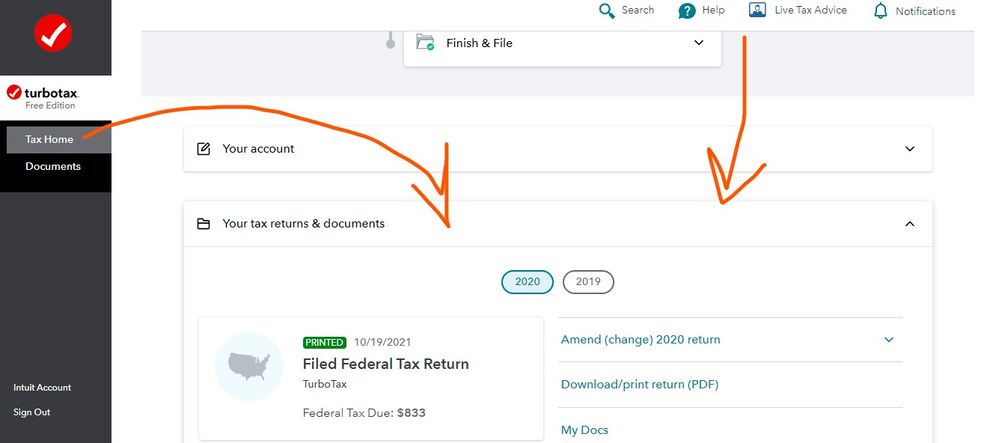

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

Or -

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2020 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

First ... get a free transcript.

Then you can recreate the return if you want to.

If the transcript/recreated return is not enough then spend the money to get a complete copy of the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

I need a copy of my 2020 federal Income Tax return I filed with Turbo Tax. [PII removed]. SSN [removed]. E-mail [email address removed]. Phone [phone number removed]

Thank you

[PII removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

Only you can get a copy. Turbo Tax can't send it to you. Did you use the Online version for 2020?

How to Access prior year online returns

https://ttlc.intuit.com/community/prior-year-return/help/how-do-i-access-my-prior-year-return/00/270...

If you can't get the side menus to open up to access the prior year..... You need to start entering some basic Personal Info in 2021 for the side menu to open up. Just continue a little ways into 2021.

Or request a transcript from the IRS

https://www.irs.gov/individuals/get-transcript

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2020 Tax return for 2021?

OMG ... what part of DO NOT POST PII did you not understand ? Good thing the filter removed most of it ... this is a public internet forum where scammers troll for victims so don't try that again.

How do I access a prior-year return?

Here's how to view and download your prior-year returns. You can access returns for the past seven years.

First time signing in this year

- Sign in to your TurboTax account and continue through your prior year summary (EVEN IF YOU WILL NOT USE THE TT PROGRAM FOR THE 2021 RETURN). Make sure you're using the same TurboTax account (user ID) as in prior years.

- On the next screen click on TAX HOME then scroll down and select Your tax returns & documents.

- Select the year you want, then select Download/print return (PDF).

- If the year you're looking for isn't there, it might be in a different account. Go here to find all of your accounts.

If you've started your return already

Sign in to your TurboTax account. Make sure you're using the same TurboTax account (same user ID) as in prior years.

There are two ways to get your prior-year returns.

- Select Documents from the side menu, use the drop-down menu to choose the tax year you want, and select Download tax PDF.

- From Tax Home, scroll down and select Your tax returns & documents. Select the year you want and select Download/print return (PDF).

Note: If the year you're looking for isn't there, it might be in a different account. Go here to find all of your accounts. One of them should have the return you're looking for

Need to prepare a prior-year return? Go here instead.

Related Information:

- How do I get a copy of a return I filed this year in TurboTax Online?

- How do I find last year's AGI?

- How do I save my TurboTax Online return as a tax data file?

- Can I get a copy of my tax return from the IRS?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

janetkeehobbs

New Member

girishapte

Level 3

kperez1016

New Member

travisbens

New Member

rajasekhar-madugula

New Member