- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

What is your AGI? What are your medical expenses?

As previously stated only the amount of medical expenses that is greater than 7.5% of your AGI can be entered as an itemized deduction.

For example if your AGI is $50,000 and your medical expenses are $25,000 then the amount of medical expenses you can deduct is $25,000 - $3,750 ($50,000 * .075) = $21,250

Using the TurboTax online editions -

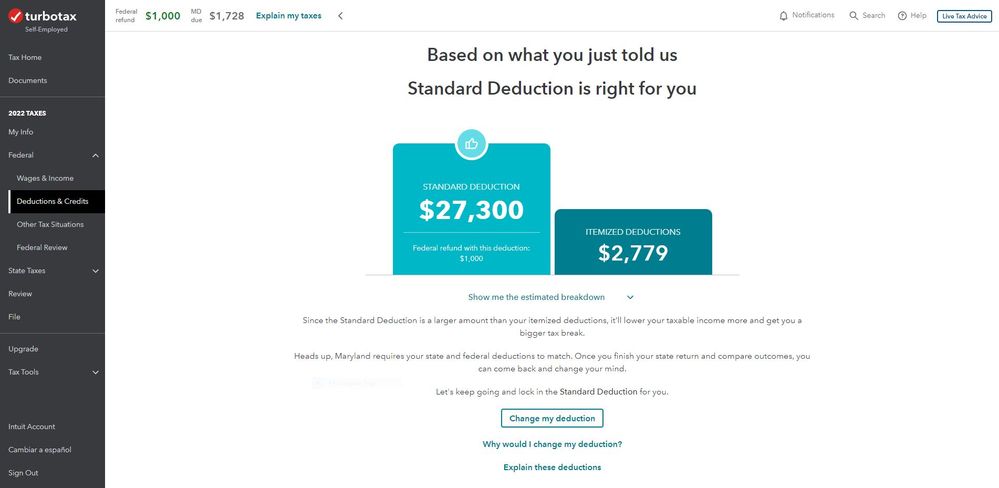

To change your deduction type you need to click on Federal then Deductions & Credits. Scroll to the bottom of the Deductions & Credits screen and click on Continue. After two or three additional screens you will come to the screen that shows your Standard and Itemized Deductions. Click on Change my deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Are you married? Are you filing a Joint return or Married filing Separate. If you are filing MFS you might need to go to My Info and check what you said deduction your spouse is taking. Are your Itemized Deductions more than the Standard Deduction?

If the FAQ instructions don't work you should call in.

How to contact Turbo Tax

https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-contact-turbotax/00/26991

What is the Turbo Tax phone number

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Single, a head of household

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

@vladius - can you clarify "single, a head of household".

if you are not married, you need a qualifying relative to file HOH.

Simply living by your self does not meet the IRS definition of "a head of household"

why do you want to force TT to flip from standard to itemized? if you have enough things to itemize, TT will make that determination for you. you get the better of itemized or standard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Someone can be not married and a head of household at the same time. Anyway, the issue is, I entered medical expenses, which are well above the standard deduction, $19400, but still locked in to the standard deduction mode... Can someone from Turbotax chime in, please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Your medical expenses have TWO very difficult thresholds to meet, not just the difference between the standard deduction and itemizing.

MEDICAL EXPENSES

The medical expense deduction has to meet a rather large threshold before it can affect your return. The amount of medical (including dental, vision, etc.) expenses that will count toward itemization is the amount that is OVER 7.5% of your adjusted gross income.

You will see your AGI on line 11 of your Form 1040.

You should only enter the amount that you paid in 2022—do not include any amounts that were covered by insurance or that are still outstanding. Of course, your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund.

To enter your medical expenses go to Federal>Deductions and Credits>Medical>Medical Expenses

2022 STANDARD DEDUCTION AMOUNTS

SINGLE $12,950 (65 or older + $1750)

MARRIED FILING SEPARATELY $12,950 (65 or older + $1750)

MARRIED FILING JOINTLY $25,900 (65 or older + $1400 per spouse)

HEAD OF HOUSEHOLD $19,400 (65 or older +$1750)

Legally Blind + $1750

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

@vladius - yes, you can be "not married" and head of household at the same time, but that requires you to have a qualifying dependent to file HOH. Otherwise, you are required to file "SINGLE".

When yiou are 'not married', there are only two filing status options: Single or HOH, but that HOH option requres the qualifying relative.

Only the medical expenses that exceed 7.5% of your income are tax deductible. and if that resulting number (assume no other deductions) doesn't exceed your standard deduction, TT will use the standard deduction.

if you are filing SINGLE, your 2022 standard deduction is $13,950. If you can file HOH (and I am not clear you can), your standard deduction is $19,400.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Am I Head of Household?

https://ttlc.intuit.com/questions/1894553-do-i-qualify-for-head-of-household

https://ttlc.intuit.com/questions/2900097-what-is-a-qualifying-person-for-head-of-household

If you qualify as Head of Household, when you enter your marital status (single or married filing separately) into MyInfo, and then enter your qualifying dependent, TurboTax will offer HOH as your filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Sure, medical expenses are greater than 7.5% of AGI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

Then only the amount over the 7.5% of AGI is deductible. Then is the amount that's over the 7.5% more than the 19,400 Standard Deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

What is your AGI? What are your medical expenses?

As previously stated only the amount of medical expenses that is greater than 7.5% of your AGI can be entered as an itemized deduction.

For example if your AGI is $50,000 and your medical expenses are $25,000 then the amount of medical expenses you can deduct is $25,000 - $3,750 ($50,000 * .075) = $21,250

Using the TurboTax online editions -

To change your deduction type you need to click on Federal then Deductions & Credits. Scroll to the bottom of the Deductions & Credits screen and click on Continue. After two or three additional screens you will come to the screen that shows your Standard and Itemized Deductions. Click on Change my deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't see "Change My Deduction" button/link. I followed the instructions in the "How do I change from the standard deduction to itemized (or vice-versa)?" help topic

This is exactly what I was looking for. Thank you:

Using the TurboTax online editions -

To change your deduction type you need to click on Federal then Deductions & Credits. Scroll to the bottom of the Deductions & Credits screen and click on Continue. After two or three additional screens you will come to the screen that shows your Standard and Itemized Deductions. Click on Change my deduction

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blessedftw

New Member

CTinHI

Level 1

biggertcate

New Member

kgsundar

Level 2

kgsundar

Level 2