- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

What is your AGI? What are your medical expenses?

As previously stated only the amount of medical expenses that is greater than 7.5% of your AGI can be entered as an itemized deduction.

For example if your AGI is $50,000 and your medical expenses are $25,000 then the amount of medical expenses you can deduct is $25,000 - $3,750 ($50,000 * .075) = $21,250

Using the TurboTax online editions -

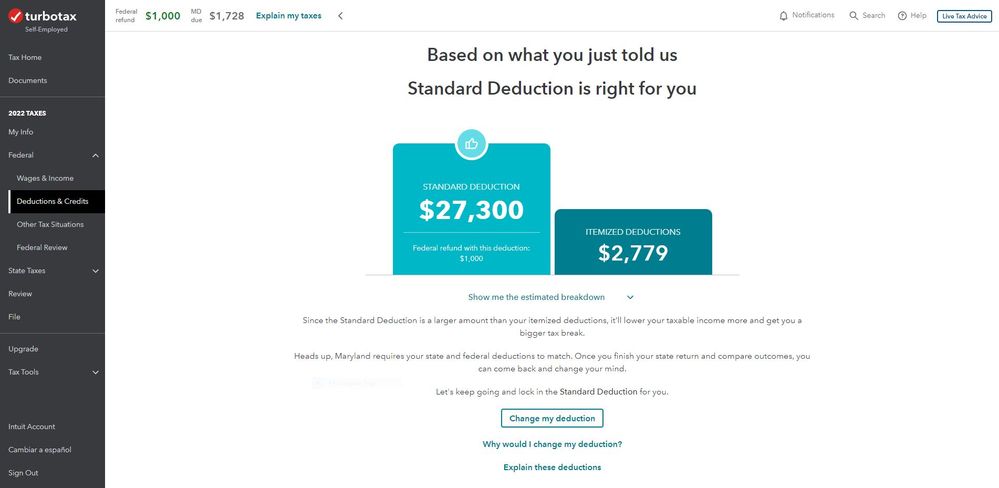

To change your deduction type you need to click on Federal then Deductions & Credits. Scroll to the bottom of the Deductions & Credits screen and click on Continue. After two or three additional screens you will come to the screen that shows your Standard and Itemized Deductions. Click on Change my deduction

August 31, 2023

9:03 AM