- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Okay TurboTax.. please explain yourself...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

I've purchased and downloaded TurboTax Home and Business. (desktop version, obviously, since it was bought and downloaded) Everyone knows that comes with a free state. Perfect. This has been asked before and answered in various ways but I'll ask again:

I've purchased your software, which is not cheap. You've told me a state file is part of that purchase. The state I need to file for DOES NOT charge to eFile taxes. Why then, am I being asked to pay $24 to efile the state tax?

You see why this would make me (and many of your other users from what I've read) furious, right?

Yes, yes, I know I can avoid that fee if I print and mail the state return, but telling me that is not an explanation. So please explain yourselves.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

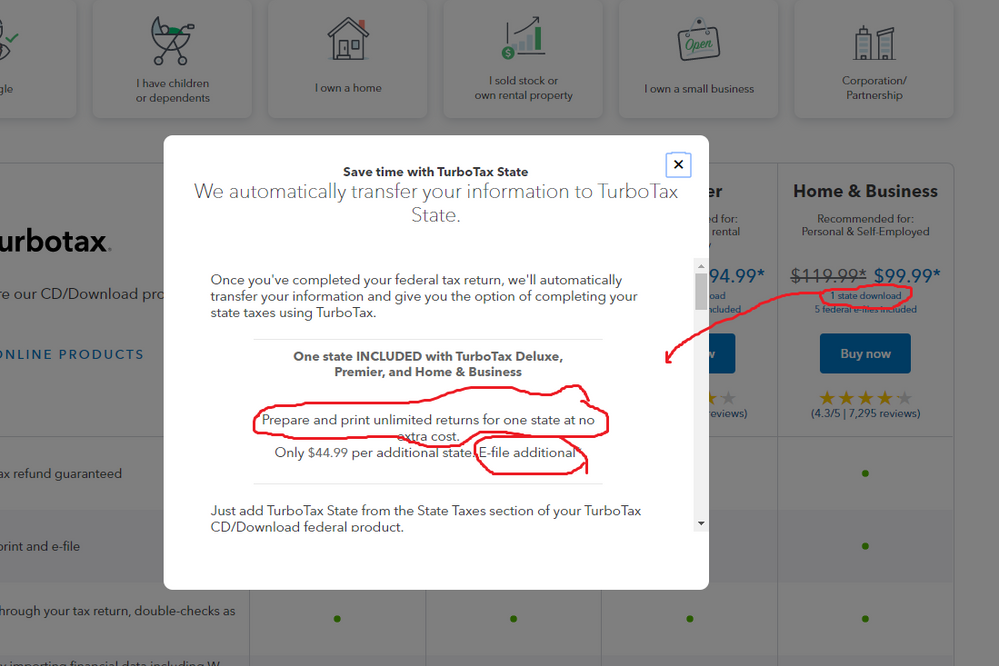

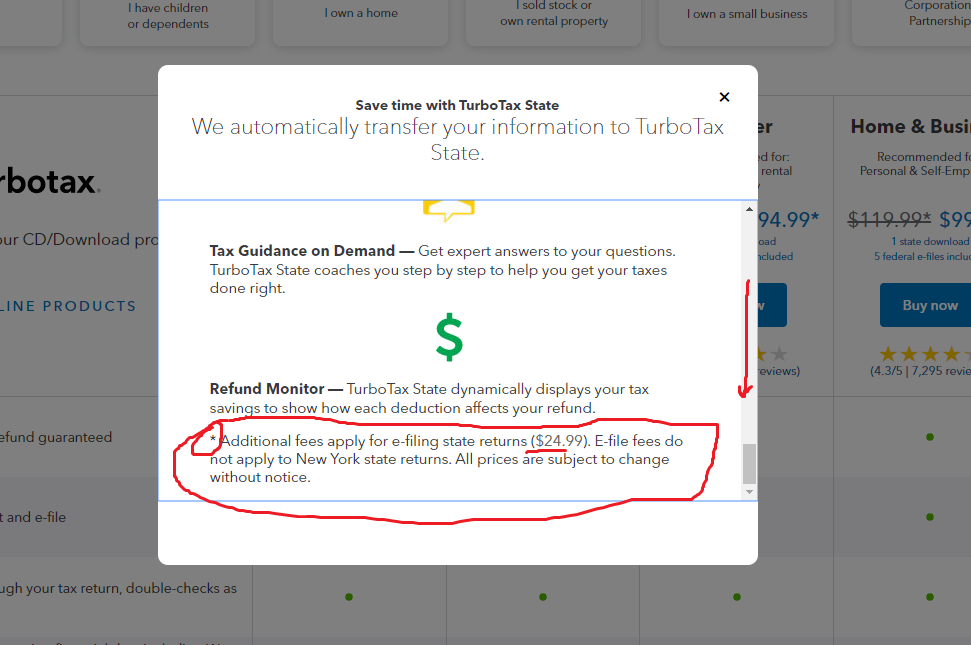

@mische7 Unfortunately, many new desktop users fail to read the full information...or misinterpret it even if they do read it. longtime desktop users are fully aware of it...but yeah, TTX could make it more obvious.

Only the one state "software" download is free.....and you can print and mail-file that state yourself as many times as you need to for yourself and your family members for no additional cost (other than paper, envelope, and postage). But E-Filing the state is 19.99 early in the season and 24.99 starting sometime in March. (except for NY residents)

_______________________________________

_______________________________________

or

_____________________________________

and

___________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

….still.... as noted by @mische7 there's plenty of room on the front of the box, or in the Fry's description, to actually say...

- One state download (additional fee to e-file state *)

and then the only subnote for the * is that a NY e-file is free.

TTX marketing has had plenty of time over the years to make this perfectly clear to everyone. This really should not be dumped into the squint print...but I have no idea how to get the higher-ups at TTX to stop a moment, and really look at the issue that has been a major gripe point for many years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

TurboTax could charge you $79 to e-File state return but they figure correctly that most people will pay $24.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

That's not an answer at all.

I'd like for them to explain why I bought a version that includes a free state, the state I'm paying to does not charge for that service and yet, I'm being charged. That is not accurate advertising. I'm already paying for their state-level expertise via the version I've purchased. Of course I want to e-file. That should certainly be figured into the price.

Intuit, please explain. I think others would quite like to hear why too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

@mische7 Unfortunately, many new desktop users fail to read the full information...or misinterpret it even if they do read it. longtime desktop users are fully aware of it...but yeah, TTX could make it more obvious.

Only the one state "software" download is free.....and you can print and mail-file that state yourself as many times as you need to for yourself and your family members for no additional cost (other than paper, envelope, and postage). But E-Filing the state is 19.99 early in the season and 24.99 starting sometime in March. (except for NY residents)

_______________________________________

_______________________________________

or

_____________________________________

and

___________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

Hi SteamTrain. Thanks for taking the time to write and create the screenshots. Yeah, this is incredibly frustrating and I'm pretty sure they've received more than enough feedback on this to know better. I would never do this to my customers.

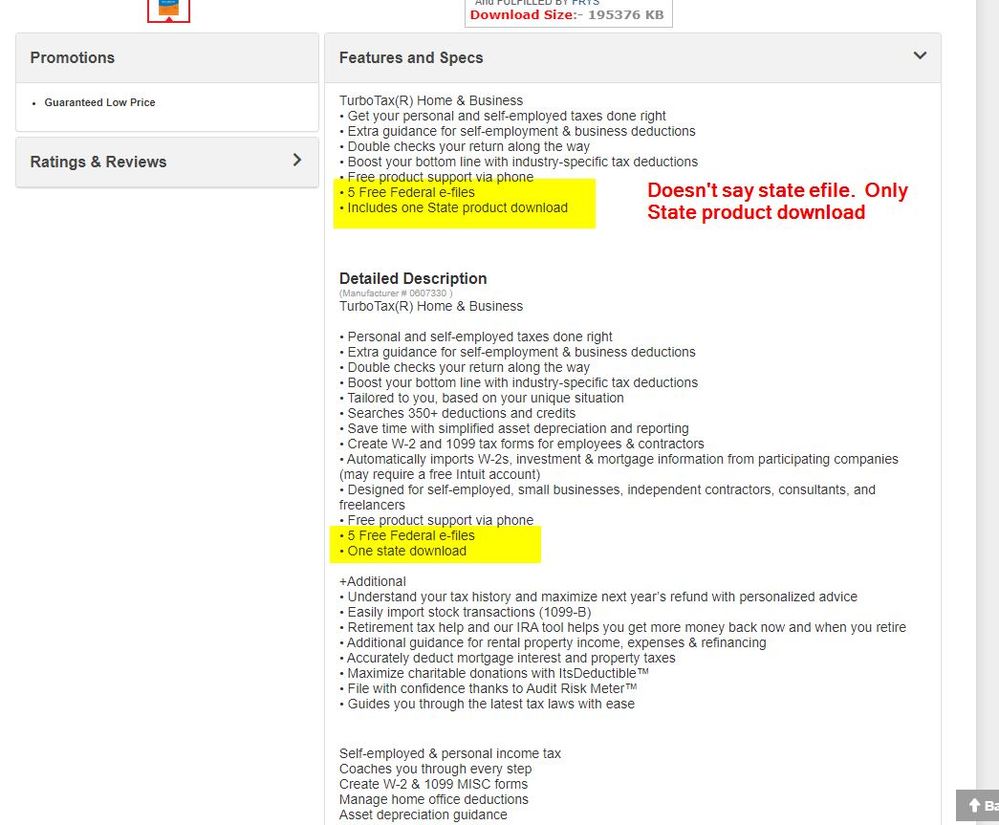

Sadly, there is not fine print that mentions any additional payment from the site where I purchased. (Much like Amazon, Intuit is still the seller where Fry's is the provider. I'm sure, like Amazon, Intuit is responsible for all of the text being provided to the customer in the product description.) https://www.frys.com/product/9958256?site=sa:Homepage%20Pod:Pod5

Anyway, thanks for taking the time.

Intuit, I think you guys need to speak up and make a change here. Misleading customers through omission is still misleading customers. Expecting us to notice and distinguish the difference between what you're saying about federal vs. state is not okay. In the detailed information where I purchased your product, there was nothing about additional costs. Here is how this should read:

- 5 Free Federal e-files

- One state download (*additional fee to e-file)

Seriously, when every dime is precious to people right now, where is your support?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

@mische7 I'm sure you're a nice guy, but you are customer 5,271,009 to raise this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

What state are you in? You said your state does not charge to efile. Is it New York? It is free to efile New York. But that's the only free state.

I'll add my notes.........

There is a lot of confusion about this. For the Desktop version it's a free download of one state PROGRAM, not returns filed. You can prepare unlimited federal and unlimited state returns. Some people need to file in more than one state so they have to buy another state program. You can print and mail the state for free or each state is 19.99 early or 24.99 to efile. If you buy the cd at the store the Basic version does not include the state. And Deluxe is available both with and without the state. Because some states don't have an income tax.

The State has a fee to efile but it is free to print and mail unlimited returns. And to have the fee deducted from your federal refund is an EXTRA 39.99 Refund Transfer fee. Or you can use a credit card and avoid the extra charge.

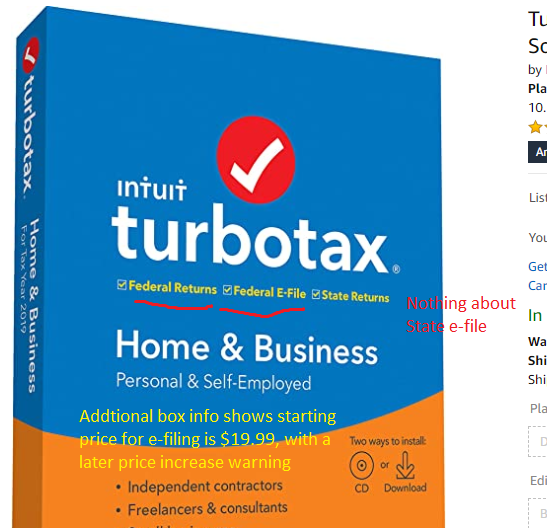

Box or online description says Federal Returns + Federal E-File + State returns. It does not say state efiling is included. It also says on the back on my CD case in the chart comparing the versions.....

1 state product via download (print free or efile for $19.99 each) prices subject to change without notice.

And the prices always increase in March. The last several years it was March 1. So we try to file before then for 19.99.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

Here is your Fry's page. It says included one State product download

And at the top it does say TurboTax Home and Business Fed + Efile + State 2019

Only State, not + state Efile too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Okay TurboTax.. please explain yourself...

….still.... as noted by @mische7 there's plenty of room on the front of the box, or in the Fry's description, to actually say...

- One state download (additional fee to e-file state *)

and then the only subnote for the * is that a NY e-file is free.

TTX marketing has had plenty of time over the years to make this perfectly clear to everyone. This really should not be dumped into the squint print...but I have no idea how to get the higher-ups at TTX to stop a moment, and really look at the issue that has been a major gripe point for many years.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wrshirleytaxes101

Level 1

ikner7913

New Member

hjw77

Level 2

roginawm

New Member

user17537184588

New Member