- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Rejected Taxes Return 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

I want to know why it was denied for state and federal taxes and what I need to do to fix it.....?????

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

What does the email you received from TurboTax say about the rejection?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

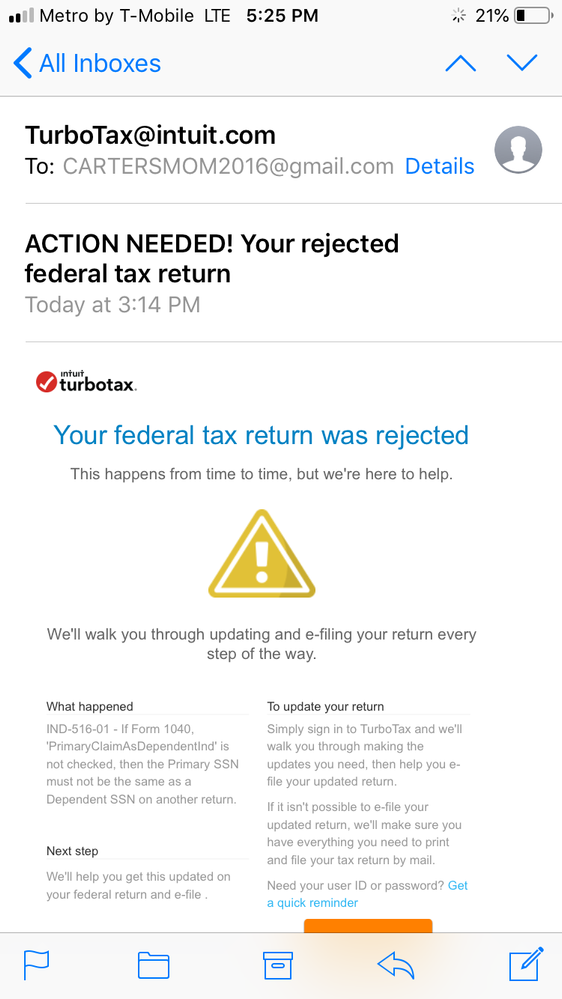

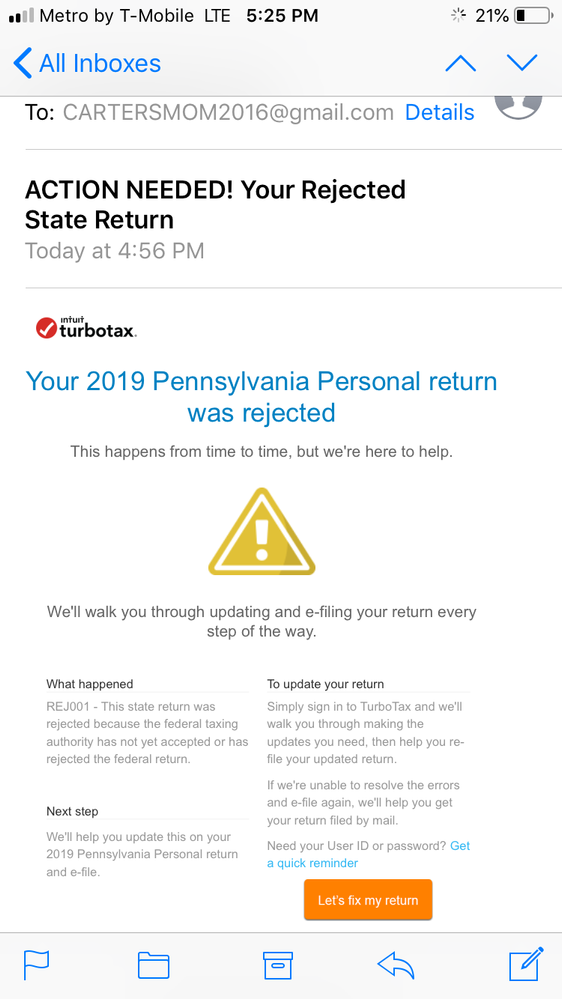

Federal tax

State Refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

See this TurboTax support FAQ for the IRS error IND 516-01 - https://ttlc.intuit.com/community/rejections/help/rejection-code-ind-516-if-the-primary-taxpayer-is-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

AGI for 2018 was supposedly wrong. I checked it and it is the correct amount. My husband died last year

so I don't know if that has anything to do with it, because his name was the first on our tax returns. But the signature info was my date of birth not his. How do I get this fixed?

Is there anyway I can speak to someone and have it take less time than messaging?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

I don't know the employers id number i put all 0's. I keep trying and get rejected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

@Teesmitty69 wrote:

I don't know the employers id number i put all 0's. I keep trying and get rejected

The employer EIN will be on the 2019 W-2 you received from the employer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

It Needs to Corrected!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

What do you need to correct? @nora_lea_lynch

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

I too am getting the same error. The AGI I entered for 2018 is correct. I too am signing with my date of birth. There is federal tax owed on my return. Did you find a resolution. I hate to do a paper filing and prefer e-File.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

For AGI Reject code 031

https://ttlc.intuit.com/community/rejections/help/e-file-reject-ind-031-04-or-ind-032-04-the-agi-or-...

When did you file 2018? If it was late in the year try putting in zero for the AGI. And see, https://ttlc.intuit.com/community/rejections/help/what-if-i-entered-the-correct-agi-and-i-m-still-ge...

How to correct the AGI

https://ttlc.intuit.com/community/agi/help/where-do-i-correct-my-agi-in-turbotax-online/00/26311

If you can’t get it to efile you will have to print and mail it.

How to mail a return from the Online version

https://ttlc.intuit.com/community/printing/help/how-do-i-print-and-mail-my-return-in-turbotax-online...

Be sure to attach copies of your W2s and any 1099s that have withholding on them. You have to mail federal and state in separate envelopes because they go to different places. Get a tracking number from the post office when you mail them for proof of filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejected Taxes Return 2019

I tried all possible things but still the e-file gets rejected with code IND-031-04.

I made sure that the 2018 AGI is correct. It still gets rejected. I entered AGI as zero to trick the system to say I did not e-file 2018 returns, the 2019 tax return still gets rejected. My case is this: e-Filed 2018 tax return as Married filing jointly. My husband passed away in 2019. e-Filing 2019 tax return as Married filing jointly (Turbo Tax recommends this) but during e-filing it asks for my date of birth and self-pin. I enter it correctly but sill the e-file gets rejected with code IND-031-04. Tax filing deadline is approaching and I prefer e-file over paper filing. Any suggestions?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hettygirl67

New Member

jdjackson011

New Member

shaniceneeley

New Member

Marciasparks1

New Member

panda-wishes15

New Member