- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How can I complete the 2019 return I’d started online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

See this TurboTax support FAQ for completing a 2019 tax return originally started with the online editions - https://ttlc.intuit.com/community/prior-year-return/help/how-do-i-finish-a-prior-year-return-that-i-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

I followed these instructions but I'm unable to download my tax data file for the 2019 return I started online. Do you know if there is another method to import my 2019 data entered online to my desktop version so I don't have to start all over again?

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

@johnlkelly wrote:

I followed these instructions but I'm unable to download my tax data file for the 2019 return I started online. Do you know if there is another method to import my 2019 data entered online to my desktop version so I don't have to start all over again?

Thanks in advance.

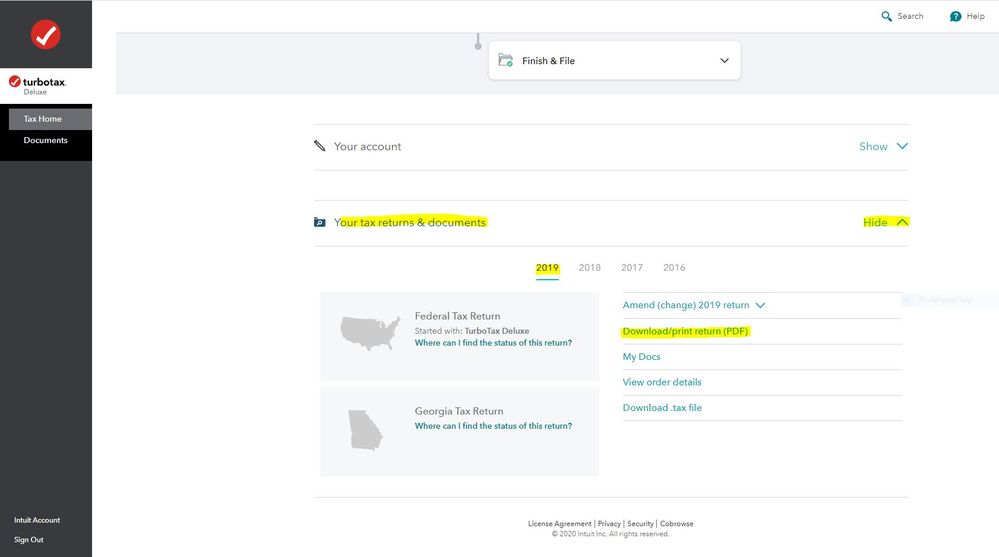

You may have to start a 2020 tax return before the links on the Tax Home web page become available. In that case start the 2020 tax return with the User ID you used for the 2019 return. Once some basic information has been transferred over, Tax Home should be visible on the left column. Click on Tax Home and then the other links will be shown as in this screenshot.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF) and Download .tax file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

Thanks for responding so quickly. I went ahead and started the 2020 online return but I'm still having the same issue. When I try to download the 2019 tax data file it says I didn't file with turbo tax in 2019 and redirects me to select a 2020 plan. The same thing happened earlier when I followed another set of instructions and downloaded the 2019 desktop version, hoping to import the online data file into that version to complete and file. Do you know if there is any other method to accessing all the 2019 data I entered online? I was almost finished so just hoping I don't have to start all over if possible.

Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

It's common to end up with multiple accounts. First LOG OUT of whatever TurboTax account you're logged into right now. Then use this TurboTax account recovery website to get a list of user ID's for an email address. Run the tool against any email addresses you may have used

https://myturbotax.intuit.com/account-recovery/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

Help, I need to finish my 2019 return amd cant find

It everytime it takes me to start 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I complete the 2019 return I’d started online?

Sorry, Online for 2019 and prior is closed now so you can not start a new 2019 or prior return or finish one. Online is only for 2020. Oct 15, was the last day to efile. 2019 is now the prior year.

Did you start an Online return? How to finish a prior year online return

https://ttlc.intuit.com/community/prior-year-return/help/how-do-i-finish-a-prior-year-return-that-i-...

Or How to file a prior year

https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-prepare-a-prior-year-tax-return/00/25...

You can only buy the download for prior years. You have to buy a separate program for each year. They only sell the last 3 years. You need a full Windows or Mac computer to install it on. Buy the download here

https://turbotax.intuit.com/personal-taxes/past-years-products/

You have to print and mail prior year returns. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS received the return. Don’t forget state.

Important! Mail Federal and State in separate envelopes and mail each year in separate envelopes.

If you are getting a refund, there is not a penalty for filing past the deadline. You have 3 years to file for a refund. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment. The IRS will bill you for this; it will not be calculated by TurboTax.

If you want to file for free you can fill out the forms by hand. Here are some basic forms…..

Here is the IRS 2019 Form 1040

https://www.irs.gov/pub/irs-prior/f1040--2019.pdf

or if you want bigger type use 1040SR for Seniors,

https://www.irs.gov/pub/irs-prior/f1040s--2019.pdf

And 2019 Instructions https://www.irs.gov/pub/irs-prior/i1040gi--2019.pdf

2019 Tax and EIC Tables

https://www.irs.gov/pub/irs-prior/i1040tt--2019.pdf

Sch 1 : https://www.irs.gov/pub/irs-prior/f1040s1--2019.pdf

Sch 2 : https://www.irs.gov/pub/irs-prior/f1040s2--2019.pdf

Sch 3 : https://www.irs.gov/pub/irs-prior/f1040s3--2019.pdf

Then when you do file 2020 enter 0 for the 2019 AGI since you are filing 2019 late.

I have links for other years too.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cwr64

New Member

TurboLover2

Level 5

marcos-vargas7254

New Member

in Education

Romasurus

Level 2

Falloutgirl

New Member