- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

Exactly what it says .... there is a form in your return that is NOT YET READY to be filed ... so you must WAIT until it is ... only then will you be able to efile the return. The REVIEW screen tells you which forms that are holding you back, an estimation of when they may be ready AND the option to get an email alert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

The state and federal government approve the most common forms first and work their way down the list. Please see these links for form availability. Once a date shows up, the reality should be close. Once released, Turbo Tax will work quickly to get it working in the program. Links are updated constantly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

I'm trying to file my federal taxes for 2020 tax season in 2021. Im getting E-File is not available because your tax return includes forms that can't be e-filed. Revisit the Review section to see which forms. I go to the review section and it doesn't show me any forms that can't be efile. Im not doing anything different then last year except, since the rule changed, im using last years earned income for the eitc and child credit. I have a child and I have unemployment. I cant even view my return to see what forms are being used. I logged out and back in again on a different browser.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

I am getting the same message. I noticed the EITC may me the issue. I'm not sure

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

I called turbo tax support for the free version and that rep just kept me on hold for awhile and when I explained my issue he had no ideal what I was talking about. So I thought maybe the free version wasn't able to handle the new tax update. So I paid for the deluxe version, I got the same issue of course after I paid, so I called support, he was helpful, he was able to see my screen, but he didn't see any issues and I asked if he could look into it and get back to me. I said I'm sure I'm not going to be the only call about this. I just want to know if I have to mail it then fine, but the software should tell me why and what form is causing this. I tired on my phone to file with Firefox, chrome, turbotax app and on a laptop on more then one browser.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

I file my federal already, but since I file it before my state tax now I'm getting the same notification. Someone said maybe if you filed one tax form first, then you will have to wait until it is approved in order to file the other one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

@Rossy083 That is correct. Once the IRS accepts your tax return, then you will be able to e-file your state. Please note the IRS will not start processing (accepting) tax returns until February 12, 20202. See the TurboTax FAQ Tax Year 2020 Calendar: Important Federal Dates and Deadlines for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

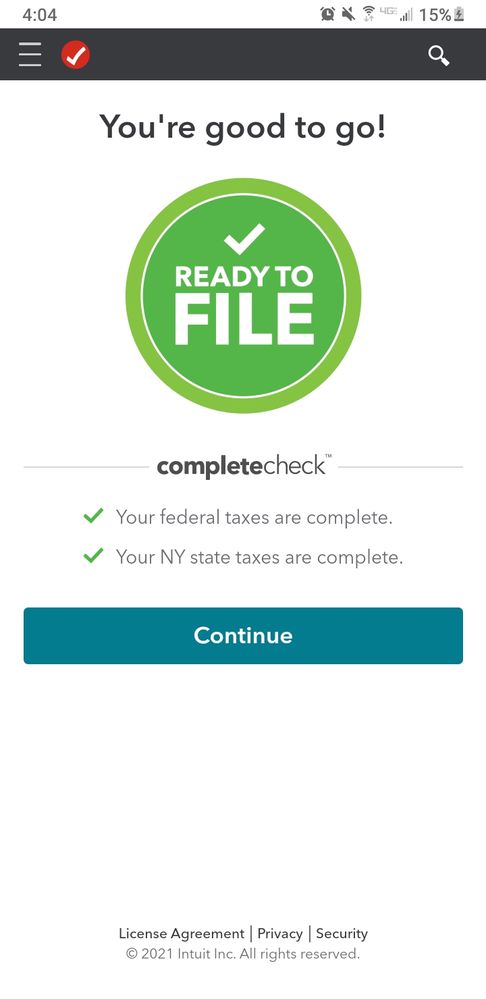

I also spoke to a rep and she was unable to find any issues too. When I checked back on a few minutes ago and redid it I got this message-

It looks like you have a tax situation in your federal return that makes it ineligible for e-filing, according to IRS rules. "YOUR EARNED INCOME TAX CREDIT (EITC) IS BASED ON NON-DOCUMENTED EARNED INCOME".

I just wondering if all filers using the new tax standard have to file by mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

I was wondering that also about the new tax rule. Maybe I will call the IRS and ask. It just means they will get more mailed tax returns then they normally would.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

@Cynthi88128 wrote:

I also spoke to a rep and she was unable to find any issues too. When I checked back on a few minutes ago and redid it I got this message-

It looks like you have a tax situation in your federal return that makes it ineligible for e-filing, according to IRS rules. "YOUR EARNED INCOME TAX CREDIT (EITC) IS BASED ON NON-DOCUMENTED EARNED INCOME".

I just wondering if all filers using the new tax standard have to file by mail.

Are you claiming EIC based on your 2019 tax information? That could be a situation where e-filing is not allowed. I tried to look for it but finding information on the e-filing rules on the IRS web site is not easy. The IRS may have been unable to program their systems to automatically handle an EIC claim based on last year's income under the COVID rules.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

Yes my eitc is based off 2019 earned income. I also couldn't find anything posted on the IRS site. But turbotax should still give some feedback on the website or by a rep.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

I think the message is the feedback. You can't e-file because you are claiming EIC based on income that is not contained in this year's tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

Well good news. I got to file mine using the e-file. in my case I was filling as a resident of NYC and my spouse was filling as a non resident which it was a mistake. then I change it all to full year resident and it fixed it. I believe if you are filing in a state and your partner has a residency in another state or have to add another state income this will be the issue. Hope this help you .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?"E-File is not available because your tax return includes a tax situation that can't be e-filed. Revisit the Review section to see more details...."

Thats not exactly feedback. It states to go to the review page for further information. Yet nothing is on that page. I am talking to the IRS now and they said no extra forms are needed, that it can be efile still. So im holding off until the 2/12 to file. Maybe by then this issue will be resolved by turbotax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eshwar_s

New Member

user17672869738

Returning Member

lisamd82

New Member

pattiv

Level 1

Ryanmaddox747

New Member