in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: You can remove Audit Defense by removing MAX Benefits. Pl...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

@rwonders wrote:

This is an incorrect solution. You do not know what you are talking about. There is NO left hand menu on 2019 Turbo Tax Deluxe for selecting the "file" option. The only file option is at the top menu bar and it does not contain anything remotely similar to what you have described for removing Max Benefits or Audit defense. One should not have to go through this to opt out of obviously deceitful marketing scheme to get one to pay for a service they do not want. Not sure how one gets to be a "Turbo Tax Specialist" but Intuit needs much better training for those trying to help with issues/questions. Can you please offer a real remedy for opting out of this useless audit defense FOR 2019 Turbo Tax Deluxe.

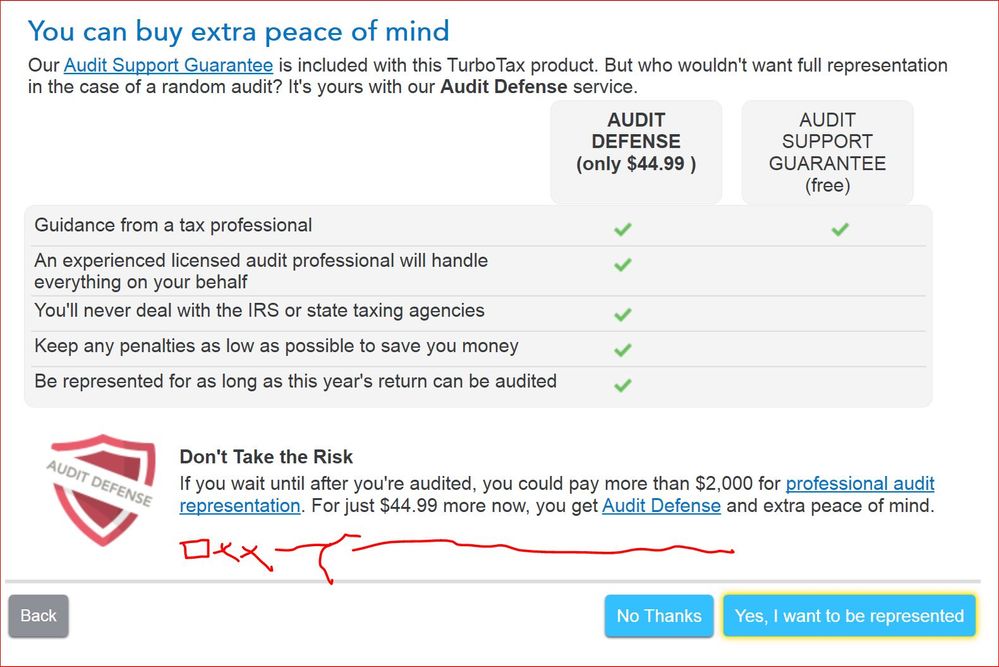

The Only way to have Audit Defense added to your order when using the TurboTax desktop CD/Download editions is for the user to click on the blue button labeled Add Audit Defense to My Order

To remove Audit Defense from the order you need to click on File at the top of the desktop program screen. Click on File a Return or Continue. Go through the steps of the File section until you arrive on the Payment screen. Under the price for Audit Defense click on the blue Remove link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

Steps provided by DoninGA did not work. None of the steps provided on this thread work for me. I am using desktop deluxe version. I am still FORCED to pay $44.99 otherwise the tool just won't proceed. I had *almost* paid it but then I did a Google search to land here.. Knowing that this is an actual tool glitch (?) so many are facing, this is really shady on behalf of Intuit. When will you folks fix this? I am still getting TurboTax updates every week.

UPDATE: Clearly a misunderstanding on my part (which I believe many are having here). When we hit next, it shows $44.99 in BOLD (which is also the amount one has to pay for audit defense). And this is where the confusion is. I still need to make payment for the state tax e-file.. and the $44.99 is saying that IF you want to pay that via federal refund, you need to upgrade to premium for this fee. I didn't read this since the prices exactly matched and made me believe I was forced to buy audit defense. May be something to be fixed by the UI team since I am not the only one who had this confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

@ andakaka

It looks like you figured it out, but I'll explain a little more for the benefit of others. This confusing situation with Premium Services arises only for California filers, as explained below. I admit that section is confusing. To me it's showing Premium Services (with Audit Defense included) is 44.99, while add-on Audit Defense is 59.99. I'm not sure when @DoninGA made that image above, but it looks like the Audit Defense add-on now costs more than that shown in his image.

If you are in California and choose to pay the state efile fee of 24.99 out of the Federal refund, then that requires Premium Services for 44.99. Premium Services is a bundle of benefits that includes Audit Defense, ID monitoring and restoration, the ability to pay out of the Federal refund, etc. If you were being billed for Premium Services, then you were not being billed for standalone optional purchase of Audit Defense, and thus you cannot remove Audit Defense independently. You have to either decline or remove Premium Service by paying upfront with credit/debit card instead of paying out of the Federal refund.

You may not have actually ended up with Premium Services if you didn't actually select to pay by that method. But for those who end up in it without realizing it, the correct way to remove Premium Services in California and thus decline all the benefits included in it is to choose to simply pay your 24.99 state efile fee by credit/debit card. When you review your order, be sure it is only charging you the 24.99 plus sales tax.

The method to remove Audit Defense discussed in the image above is only for users who electively or accidentally added Audit Defense to their order as an add-on option, and does not apply to California users who are being offered or chose Premium Services in order to pay fees out of the Federal refund.

For those (mostly non-California) filers who want to remove add-on Audit Defense chosen in error (i.e., not the Premium bundle in California invoked by "paying out of Fed refund"), they can remove it like the image shown by DoninGA above. OR they can go to the REVIEW tab, select the subtab "Audit Protection", navigate past the Audit Risk meter, and then scroll way down on the Audit Defense screen and decline Audit Defense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

I just went through this yesterday. I spoke with a polite customer rep for about 40 mins. because my AT&T firewall and McAfee wouldn’t allow mirroring. The rep also was told this was a CA problem. Finally. After not getting a solution, I had the idea of jyst advancing ahead, FINALLY reasoning that usually you have to approve transactions in a cart and I had not given my credit card or selected charge to Federal. Lo and behold! It only charged me the CA 24.99 (or whatever the charge was) and NOT the audit protection. I filed both electronically and all is fine. I’m glad I’m not the only one who was frustrated by this but I hope to prevent others from going through such angst. I gave a negative customer satisfaction to Intuit. I think they have that on the Deluxe download to squeeze out many thousand of extra bucks from us consumers. I just got stubborn and thought I may as well have gone to an in-person tax professional versus them for how clunky the program was and how bad that second to the last screen was!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

I found a solution!

I talked to a support rep for about an hour. She asked me to try things left and right, with no vail. Then finally, I found the solution.

Under REVIEW tab, click Audit Protection. It will tell you you audit risk with a color bar. Click Continue, you should see the page in picture below. Just below the red shield, you should see a button with some fine prints to opt out ( I don't remember exact wording). It worked for me. I live in TX, no State tax (Horay!). So the State Tax route did work for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

Thank you for sharing your solution!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

Turbo Tax 2019 $44.99 Audit Defense Coverage -

I cannot remove Turbo Tax 2019 $44.99 Audit Defense Coverage from my returns. My total in the review is the CA State Filing for $24.99, but Turbo Tax keep adding the $44.99? All the suggested options from Turbo Tax Reps DO NOT WORK. Their video is out dated. I have Turbo Tax Deluxe, with no file options on the right side of the screen. What are my options, I do not want to be force to pay for a service that I may not use...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

@ gm1959 wrote:Turbo Tax 2019 $44.99 Audit Defense Coverage -

I cannot remove Turbo Tax 2019 $44.99 Audit Defense Coverage from my returns. My total in the review is the CA State Filing for $24.99, but Turbo Tax keep adding the $44.99? All the suggested options from Turbo Tax Reps DO NOT WORK. Their video is out dated. I have Turbo Tax Deluxe, with no file options on the right side of the screen. What are my options, I do not want to be force to pay for a service that I may not use...

If you are a California filer, how did you choose to pay your 24.99 state efile fee? Did you choose to pay it out of your Federal refund? If you chose to pay your 24.99 efile fee out of your Federal refund, in California it will automatically add on Premium Services (a bundle that includes Audit Defense, ID monitoring/restoration, and the ability to pay the fee out of the Federal refund, etc.) for 44.99.

If you chose that method to pay your fee, then in order to remove Premium Services (and thus remove Audit Defense), you'll need to instead pay upfront with a credit/debit card. Paying by credit/debit card "should" automatically remove Premium Services and thus Audit Defense.

To avoid that 44.99 fee for Premium Services (and Audit Defense) you have to change the payment method and choose to pay the 24.99 fee upfront with a credit/debit card or a prepaid debit card you can buy in a store. Make sure before filing that you look at the "order review" screen and are only going to be paying 24.99 (plus possible sales tax.)

Or if you haven't yet chosen a payment method yet, the screen might be asking IF you want to use Premium Services to pay out of the refund, have Audit Defense, etc. In that case, just continue on until you get to the credit/debit card payment screen, and it should only charge the 24.99.

If you continue on past that screen and simply pay by credit/debit card, that "should" automatically take care of it, but if your card ends up getting charged the 44.99 anyway, you'll need to talk to TurboTax Support and ask for a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

I tried the "Best Answer" to opt out the "Audit Defense Charge $44.95". When I clicked "file", I only saw 2 "Remove" options under "remove state return" and "remove imported data"'

There was not a "remove Max benefits" at all.

Therefore, the "Best Answer" did not work at all.

We, as a Turbo Tax user community must resolve this problem all together and hope Turbo Tax resolves this forced sale error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

@Damay wrote:I tried the "Best Answer" to opt out the "Audit Defense Charge $44.95". When I clicked "file", I only saw 2 "Remove" options under "remove state return" and "remove imported data"'

There was not a "remove Max benefits" at all.

Therefore, the "Best Answer" did not work at all.

We, as a Turbo Tax user community must resolve this problem all together and hope Turbo Tax resolves this forced sale error.

You appear to be using the desktop version (CD/download), so that's why you didn't see the steps in that answer you mentioned which was for Online TurboTax, and your situation has nothing to do with MAX. MAX is a product only for ONLINE TurboTax. The desktop software does not have MAX, so ignore anything you see about MAX, which pertains to Online TurboTax only. I can tell you how to avoid or remove Audit Defense in the desktop product.

You didn't say anything about your situation, so I'll make some assumptions. How to remove Audit Defense depends on whether you are in California or not. Since I don't know if you are in California or not, I'll mention both methods below. This problem seems to crop up more for California filers, however, as explained below.

If you are in California and choose to pay the state efile fee of 24.99 out of the Federal refund, then that requires the addition of Premium Services for 44.99. Premium Services is a bundle of benefits that includes Audit Defense, ID monitoring and restoration, the ability to pay out of the Federal refund, etc. If you are being billed for Premium Services (with Audit Defense), then you were not being billed for standalone optional purchase of Audit Defense. And thus you cannot remove Audit Defense independently by the usual method. You have to either decline or remove Premium Service (and thus Audit Defense) by paying upfront with credit/debit card instead of paying out of the Federal refund.

You may not have actually ended up with Premium Services if you didn't actually select to pay your fee out of your Federal refund. It may just be showing that and offering you that possibility of paying by that method. If you are going to pay upfront with credit/debit card, you can just continue on to pay the 24.99 on subsequent screens, and that will prevent it from adding Premium Services (and Audit Defense.)

i.e., the correct way to remove Audit Defense in California when it is bundled in Premium Services is to choose to simply pay your 24.99 state efile fee by credit/debit card. If you chose to pay the fee out of your Federal refund, go back and change it to credit/debit card instead. Or if you haven't chosen to pay out of your refund, simply proceed forward and pay by credit/debit card. When you review your order, be sure it is only charging you the 24.99 plus possible sales tax.

For those filers NOT in California who want to remove add-on Audit Defense chosen in error, one can go to the REVIEW tab, select the subtab "Audit Protection", navigate past the Audit Risk meter, and then scroll way down on the Audit Defense screen and decline Audit Defense.

Again, that method will not work in California where Premium Services is used, unless a California filer did happen to select standalone Audit Defense purchase in error in the same way that another state might select it in error. In California, the usual method to remove or decline Audit Defense (bundled in Premium Services) is to simply choose to pay the state efile fee of 24.99 by credit/debit card. That avoids Premium Service and thus Audit Defense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

It looks like lots of your clients are upset with tax audit there no good it's going to bring your ratings down

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

I've had this problem 3 years in a row. It's classic bait and switch fraud. For the previous 2 years it has taken an actual phone call to the Support department to get instructions to opt out. Every year they promise me it's a known issue and it'll never happen again, but it does. And this year the support department is even harder to reach. This is my last year with Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

This solution only works for the online version. It doesn't work with the download version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

@ cyneswith

You are correct. Unfortunately, the original answer provided by TurboTax in this thread is only for the Online version. Someone marked it as a solution so it appears first.

Scroll up and see the long detailed answer I left recently (Sunday, 3/29/2020) about how to remove it in desktop software. The method depends on whether one is in California (which has an unusual method) or a non-California state.

Are you in California or a non-California state? My long answer addressed both situations. Read it carefully.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I opt out of Audit Defense?

I am in CA and it was totally bonkers! Your solution worked, but i didn't read it until after I'd spent 90 minutes on the phone with Intuit support. Not once in that 90 minutes did this solution come up... they obviously need more training around this.

Anyway, thanks --you solved it when they couldn't

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vermillionnnnn

Returning Member

ip20

Level 1

DANETTE ELLIS

New Member

wandawww262

New Member

sandys17

New Member