- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If my taxes got rejected will I still get my stimulus check

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

if my 2019 taxes got rejected or you filled your taxes but got a paper says you have to prove your identity then still says its being procces

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

If the 2019 return was rejected then your only option now is to print, ink sign and mail in the return.

If the return was accepted but stopped for ID verification and you did the verification and the IRS site says it is still in processing ... then all you can do is call to see where you are in the system now ...

Try calling to check the status of your refund at the IRS website.

800-829-1040

First choose your language.

Then 2

Then 1

Then 3

Then 2

When asked for SSN do nothing it will ask twice

Then 2

Then 4

You should then be transferred to an agent, but there is likely to be a long wait.

If they can't assist you can try the Tax Advocate in your state. most are working remotely and have a backlog.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

I’ve tried to request the IP pin online but it won’t provide it. I’ve tried to call but they say it can only be done in person. I’ve trued to schedule an appointment but it tells me there’s no appointments for this reason right now. What am I to do if I can’t get in to retrieve my IP pin to submit my taxes in order to receive my stimulus. This is literally holding hostage both stimulate payments now. Help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

The IRS is continuing to issue stimulus payments until February 5. If you filed in 2018 or 2019, you may still get a payment without filing your taxes.

In order to get stimulus payments based on your 2020 tax filing, your taxes do need to get accepted. The IRS issues a new PIN each year and mails the PIN to the taxpayer between November and January to all taxpayers that are required to file with an IP PIN.

If your current pin is being rejected, you can call the IRS directly and they can mail you a new pin. 1-800-908-4490 Ext 245.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

I don't think that is true. We have not received our check or deposit (its 2/12/21 right now). Our 2019 was rejected but we filed our 2018. Nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

The stimulus was based on 2019. If you did not file an accepted return, you would not have gotten the stimulus until you filed your 2020 to claim the missing amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

@pghkathy Use the recovery rebate credit on your 2020 to get the stimulus money as part of your 2020 tax refund.

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check in 2020, you can get it when you file your 2020 return in early 2021

The Recovery Rebate Credit will be found in the FEDERAL REVIEW section. ( you should see "Let's make sure you got the right stimulus amount”) If you are eligible it will end up on line 30 of your 2020 Form 1040.

Make sure that you enter ALL of the stimulus money received for the 1st ad 2nd stimulus for yourself, your spouse and your children.

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Even if you are not “prompted” to enter the stimulus information, you can access to the section directly by following these steps:

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "stimulus" and Enter

- Select Jump to stimulus

- Follow prompts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

Each time I inquired of my agi on my 2018 taxes I filed with TurboTax I was told I could not have my information unless I filed with premium payment being deducted. Because of this my taxes were rejected twice and I have not gotten my second stimulus. I still need my 2018 taxes AGI in order to file my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

Because you did not file 2018 taxes, your AGI on file with IRS would be zero. But you can no longer use TurboTax to efile your 2018 taxes. You will need to print and mail the 2018 tax return.

If you file the 2019 return, you will also need to print and mail that return and will not need AGI.

If you filed a 2019 return then use the AGI from 2019 to efile your 2020 tax return. If you did not file 2019, then use zero for the 2020 AGI.

To check if you are receiving a stimulus check go the IRS Get My Payment website. It will tell you if you have a payment coming and when you can expect to receive that payment.

If you do not have a payment processed, then you can claim any unpaid stimulus amounts on your 2020 income tax return.

If you qualify, you can file for free at the TurboTax Free File site.

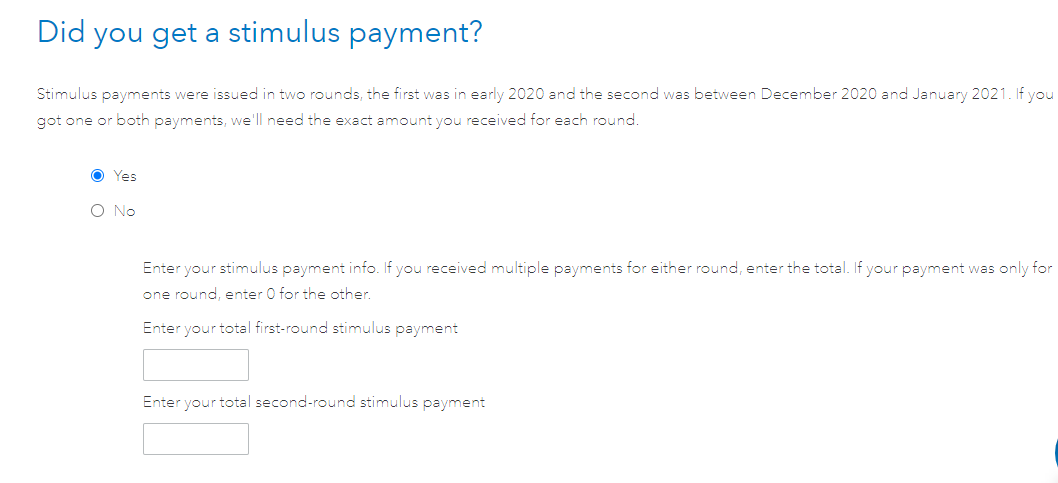

At the top of your tax return select Federal Review

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information.

When that page is correct, you refund will be adjusted correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

My taxes got rejected but I want to recover my stimulus check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

Can you clarify?

If your return was rejected, you will need to fix the errors and resubmit it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

My 2nd stimulus is stating rejected in my turbo acct. .I filed for free this year.did not use turbo..and I have already received my tax refunds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

- no it just says rejected..what number should I call to speak with someone about this issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

Your stimulus payment typically does not show up with a rejected status.

Please see the links below for additional guidance from the IRS in regards to how the stimulus payments are being issued and how to track them.

Link to check your third stimulus payment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my taxes got rejected will I still get my stimulus check

Bc my ex husband stole my last to stimulus with out my knowledge and i filed a 2020 taxe return but was denied will i still receive my 3rd and 4th one

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

roybnikkih

New Member

drbdvm81

New Member

mikedwards406

New Member

hickmond38

New Member

janaly304

New Member