- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Because you did not file 2018 taxes, your AGI on file with IRS would be zero. But you can no longer use TurboTax to efile your 2018 taxes. You will need to print and mail the 2018 tax return.

If you file the 2019 return, you will also need to print and mail that return and will not need AGI.

If you filed a 2019 return then use the AGI from 2019 to efile your 2020 tax return. If you did not file 2019, then use zero for the 2020 AGI.

To check if you are receiving a stimulus check go the IRS Get My Payment website. It will tell you if you have a payment coming and when you can expect to receive that payment.

If you do not have a payment processed, then you can claim any unpaid stimulus amounts on your 2020 income tax return.

If you qualify, you can file for free at the TurboTax Free File site.

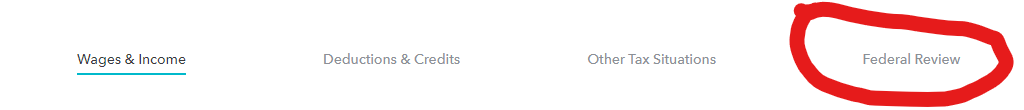

At the top of your tax return select Federal Review

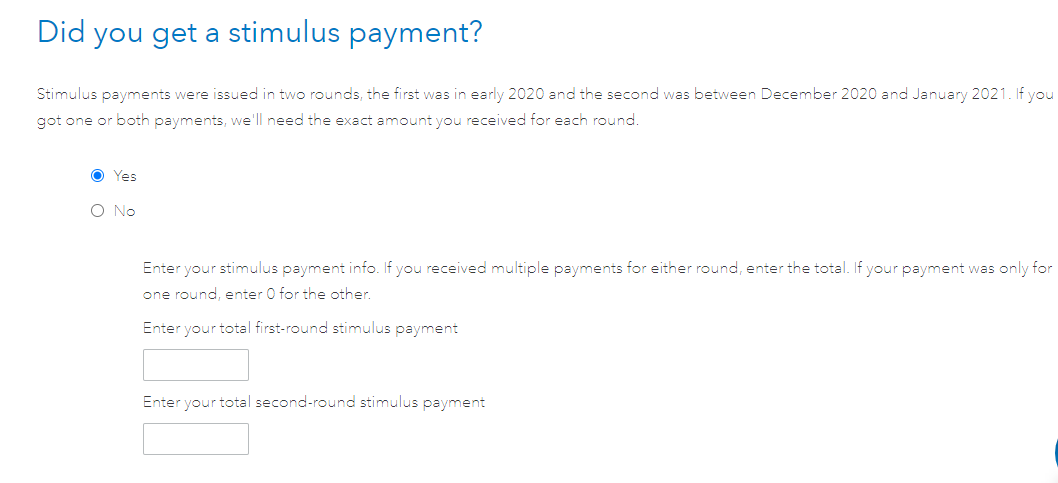

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information.

When that page is correct, you refund will be adjusted correctly.