- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Still getting Error - Deductible Home Mortgage Interest Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

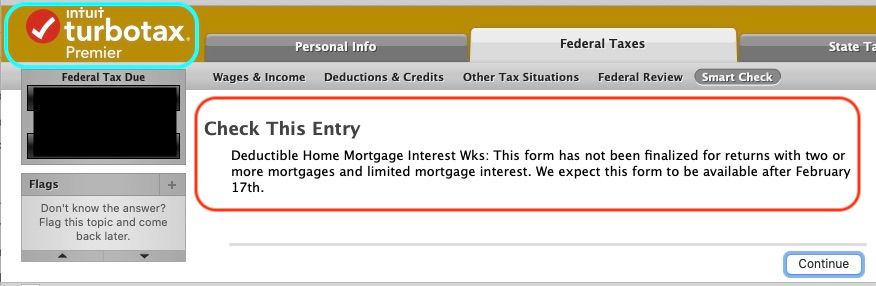

Error Message: Deductible Home Mortgage Interest Wks: This form has not been finalized for returns with two or more mortgages and limited mortgage interest. We expect this form to be available after February 17th.

Adding the screenshot right here. This is 100% a software issue, and we cannot file until TT fixes it.

The problem is that if you have more than two mortgages, the worksheet that is currently loaded by TurboTax in their software cannot handle it. In the other thread, the solution stated that you should combine the two 1098s into one.

The accepted solution does not properly account for mortgage acquisition dates for two new loans.

Scenario: You get two 1098s for Two Mortgages that you picked up in 2021.

Mortgage 1 - Primary Home

- Acquisition Date: April 1, 2021

- Loan Amount: 600K

- Interest Paid: 9500

Mortgage 2 - Second Home (Still deductible)

- Acquisition Date: August 1, 2021

- Loan Amount: 500K

- Interest Paid: 5500

If you combine both of them in one 1098, how will you account for the mortgage acquisition date question?

On Feb 18th - I spent two hours today on the phone with an agent / escalated to another supervisor.

The agent I spoke to confirmed that she escalated with "Tier 2 Support" and confirmed that there is an investigation in place to fix this issue, and that I will receive an email when they fix it.

TT, please help fixing this error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

just got this from support

"Currently there is an investigation in place to fix this issue, and you will receive an email when we fix it."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Thank you for sharing this information. Our team is working to resolve an error message for the form availability of the Deductible Mortgage Interest Worksheet after the original date expected.

Please see this TurboTax Help article which has a link to sign up for updates. Notifications Mortgage Interest Worksheet

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Hey thanks for posting this.

I have been trying to figure this out for a whole week. No luck either.

I saw your post on the other thread as well.

Here is my Case ID: [phone number removed]. Is anyone from the company on these forums. Please help us solve this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Same issue.

I just called TurboTax and they said this is a system error and it has been escalated. They are targeting a fix before February 28th. They said I would get an error when this has been truly resolved. Really frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Thanks for posting this. I have exact same issue. TT Download version. Two 1098's in same year - one home sold, one home bought). TT is not allowing me to file because a form update. I considered doing some of the other "workaround" solutions on other posts, but they seem shady and each one gives me a different refund amount, so that can't be right.

waiting for TT to update and following this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Hey @hound562 , that is encouraging that they give you an ETA.

But your second comment, on getting an error when this is resolved? Not sure if I follow that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

This is ridiculous. Simply refinancing in 2021 triggers this, even if you take the standard deduction and file your federal taxes you will not be able to file your state taxes in a state with a mortgage interest deduction like California or New York.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Hi @sonofsmog1 , yes this has been very frustrating. If you haven't done so already, please call their support, tell them about this issue, ask for an eta and escalation and then please get your Case ID.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

@Max_Tax_Guy The error is the same as you: "Deductible Home Mortgage Interest Wks: This form has not been finalized for returns with two or more mortgages and limited mortgage interest. We expect this form to be available after February 17th."

They said that is a system error and they are working on fixing it. Again really vague. The customer service rep didn't really have much information but it sounds like this is a known issue that has been escalated with their technical team.

You can try giving them a call to see if you have any better luck or clearer answers on the resolution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

@hound562 , ah yes that makes sense.

Sorry I misread your original response.

I have been now on the phone with them twice.

So I pushed the lady who said that there is an ongoing investigation. I asked her what is the investigation number, ticket number etc. She wouldn't give that to me and said that she is talking to a tier 2 support agent on chat about it. I asked her to please give me that agent ID so I can reference it when I call back. She wouldn't give that to me either. So I asked for an escalation to a manager. Then finally after being passed around, the new person who came on the phone confirmed that they have added my specific Case ID to that actual investigation going on with Tier 2, and that if I call back, they have put in the notes all the details.

What I don't understand is that why are they not being clear about it? Shouldn't they be transparent to their user base? It would be so much better if someone from their Support or Operations group got on this thread, and actually gave a meaningful and tactical response, not a vague one like we are working on it.

In the meanwhile everyone here, if you don't have Case ID's, please call and get them, and then ask them to tag your case id to that investigation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Did you get her name?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Still getting this error message as well. I’m shocked that TT hasn’t fixed this problem yet. This is a very simple tax issue and should have been resolved by now. Considering taking my business elsewhere after being with TT for the past 10 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Hi yes, her name was [Removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

Here is the screenshot of the actual error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

@Max_Tax_Guy They probably don't know to be honest. I've worked in call center management and most likely they are all reading from the same knowledge base and notes. They really have little to no sight to what their technical team does or what the status or progress is. They are most likely a third party vendor that TurboTax outsources their customer service to. The best we can do is hope this makes enough noise and continue to escalate this issue further so that it is a top priority.

I would encourage everyone to continue to call TurboTax. The more calls about this, the more pressure this will put on resolving this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Still getting Error - Deductible Home Mortgage Interest Worksheet

@hound562 , yep you are definitely right. They are going by script and or knowledgebase articles.

I'm trying to see on my LinkedIn if I know someone from Intuit, and have them take a look at this thread.

If anyone has any sort of a remote connection with an actual Intuit person, please do forward this thread. That may help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

larko33139

New Member

Sherry B

Returning Member

yysegedin

Returning Member

kudoqs

Returning Member

ron6612

Level 5