- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: It keeps asking the date I sold my car and I did not sell it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

Follow the steps below to let TurboTax know you did not sell your vehicle:

1. Search "Form 2106" in the upper right corner

2. Choose "Jump to Form 2106"

3. Select "Edit" next to your occupation

4. Continue until you arrive to the "Vehicle Summary" page

5. Select "Edit" next to your vehicle

6. Continue until your arrive to the screen that says, "Are You Still Using Your Car for Business?" in blue

7. Answer "Yes, I am still using my car for business"

8. Proceed to select "Continue" until finished with the section if you don't need to change anything else

NOTE:

If you are not using your car for job use anymore then

select, "No, I stopped using my car for business" and

proceed to enter the date that you stopped using it. Continue to answer the questions, leaving questions regarding a sale blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

This does not work! I have the same problem with Home and Business 2020 CD. TT keeps saying I sold the car, I followed the instructions in this thread but there was no "I still own this vehicle" option at the vehicle summary page. I cannot file my return with this open issue. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

Please contact support via phone for assistance with this; contact details can be found here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

@jan1666 are you an employee or self-employed? You mention TurboTax Home & Business CD/Download so I assume you are using the desktop version.

Self-employed

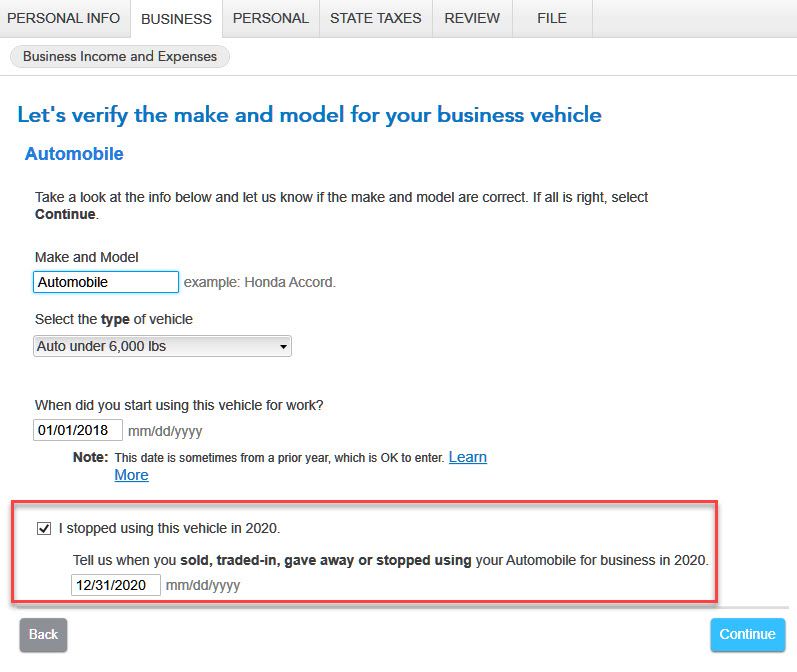

If you are self-employed:

- Select the Business tab

- UPDATE Profit or Loss from Business

- EDIT (Your Business name)

- Find Business Vehicle Expenses and UPDATE

- EDIT (Your Vehicle) in Vehicle Summary

- Clear the box “Tell us when you sold, traded-in, gave away or stopped using your (Vehicle) for business in 2020"

- Uncheck “I stopped using this vehicle in 2020”

Employee

If you are claiming job-related expenses:

- Select the Personal tab

- Choose Deductions & Credits

- Find Employment Expenses > Job-Related Expenses and UPDATE

- EDIT (Your Occupation)

- Continue to the Vehicle Summary

- EDIT (Your Vehicle)

- Clear the box “Tell us when you sold, traded-in, gave away or stopped using your (Vehicle) for business in 2020"

- Uncheck “I stopped using this vehicle in 2020”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

Sometimes just UN-clicking the box will not work ... you may need to remove the date first or continue to the next screen and delete any sale info there first before going back and unclicking that box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

Hi SundayinSalem- yes, I am self employed. I have never checked the box "I stopped using this vehicle in 2020." Never. This is why this is so vexing. The Schedule E keeps asking for the sale date. This is very vexing! thanks for any additional tips. Jan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

@jan1666 Hi Jan, there are also vehicle expense sections in rental property and in Schedule K-1 for S-Corps or Partnerships for taxpayers who not not reimbursed. These flow to Schedule E. The vehicle sections will look the same as ones for self-employment or job-related expenses.

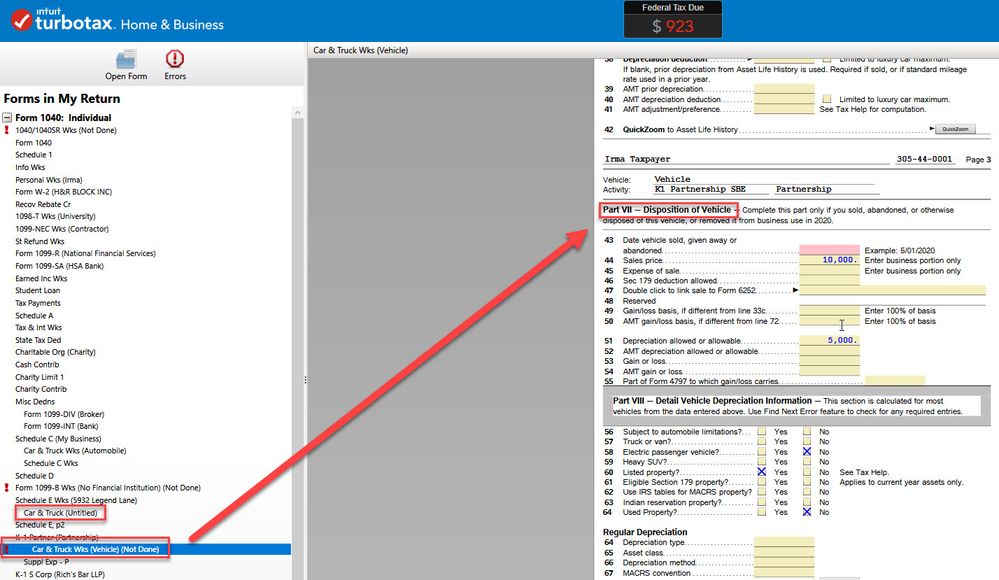

You can go through those sections. However, it's probably easiest to use the Forms Mode.

- Click on Forms in the upper right next to Flags and Notifications

- Scroll down the left column to the appropriate Car & Truck Wks. It will probably have a red exclamation point next to it. Double click.

- Go to Part VII — Disposition of Vehicle and clear out any information in the section.

- Then click on Step-by-Step in the upper right where Forms used to be to go back to the interview section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

Just deleting the form will not work.

Bottom line is, you most likely told the program "somewhere" that you sold a business vehicle. Most likely you marked a vehicle as removed from the business for personal use. This could be in the SCH C section for Business Income & Expenses, the SCH E section for Rental Income & Expenses, or the SCH F section for Farm Income & Expenses.

For all three possible sections, the way it works is kinda like this:

- You indicate you "stopped using the vehicle in 2020".

- Then depending on your specific situation, there's a screen that asks "Special Handling Required?". If you click YES on that screen, then you are *forced* to enter a sales price. You must click NO. Read the information on that screen (if presented) to understand why you click YES, and do not click NO. Then click NO and finish working it through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

I was encountering the very same issue. I went back to form 2106 in the forms view over and over with no success. I noticed that there was a "0" on the the sales price and the expense of the sale, I deleted both those fields and the program ceased to give me that error. Thought I'd share it in case someone else had that problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It keeps asking the date I sold my car and I did not sell it

I think the below is backwards, from my previous response.

- Then depending on your specific situation, there's a screen that asks "Special Handling Required?". If you click YES on that screen, then you are *forced* to enter a sales price. You must click NO. Read the information on that screen (if presented) to understand why you click YES, and do not click NO. Then click NO and finish working it through.

Swap the "yes" and the "no" above.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeffr0671

New Member

ddm_25

Level 2

taxuser77

Level 2

lixiang

Level 2

samman2922

New Member