- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@jan1666 Hi Jan, there are also vehicle expense sections in rental property and in Schedule K-1 for S-Corps or Partnerships for taxpayers who not not reimbursed. These flow to Schedule E. The vehicle sections will look the same as ones for self-employment or job-related expenses.

You can go through those sections. However, it's probably easiest to use the Forms Mode.

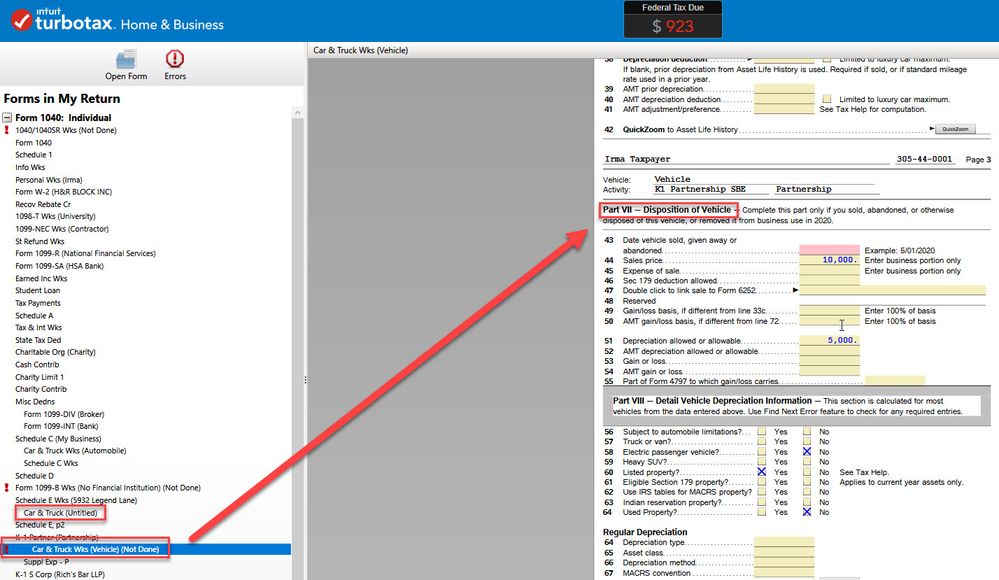

- Click on Forms in the upper right next to Flags and Notifications

- Scroll down the left column to the appropriate Car & Truck Wks. It will probably have a red exclamation point next to it. Double click.

- Go to Part VII — Disposition of Vehicle and clear out any information in the section.

- Then click on Step-by-Step in the upper right where Forms used to be to go back to the interview section.

October 5, 2021

6:58 PM