- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I submitted my 2020 taxes, federal and 4 states on time made online payment from checking account. All the amounts were deducted, except for Indiana state. Why ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my 2020 taxes, federal and 4 states on time made online payment from checking account. All the amounts were deducted, except for Indiana state. Why ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my 2020 taxes, federal and 4 states on time made online payment from checking account. All the amounts were deducted, except for Indiana state. Why ?

Read the filing instructions that print out with your pdf----what does it say there about how you will pay your IN state tax due? TurboTax does not "pay" your state tax for you. TurboTax only passes the information for debit or credit to the IRS or state for you and then it is up to the IRS or state to take the payment from your account. Some states do not want/allow direct debit for the tax you owe---and want either a check or money order or payment directly on the state's own tax web site.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my 2020 taxes, federal and 4 states on time made online payment from checking account. All the amounts were deducted, except for Indiana state. Why ?

https://www.in.gov/dor/online-services/dorpay-tax-and-bill-payment/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my 2020 taxes, federal and 4 states on time made online payment from checking account. All the amounts were deducted, except for Indiana state. Why ?

I seem to recall from prior years, that Indiana was one of several states that doesn't allow you arrange a Direct Debit from a checking acct at the time you e-file, and you always had to pay them separately. Of course, they can change that in a future year, so you always have to check your printed State Electronic Filing Instructions sheet carefully to see how it is going to be paid.

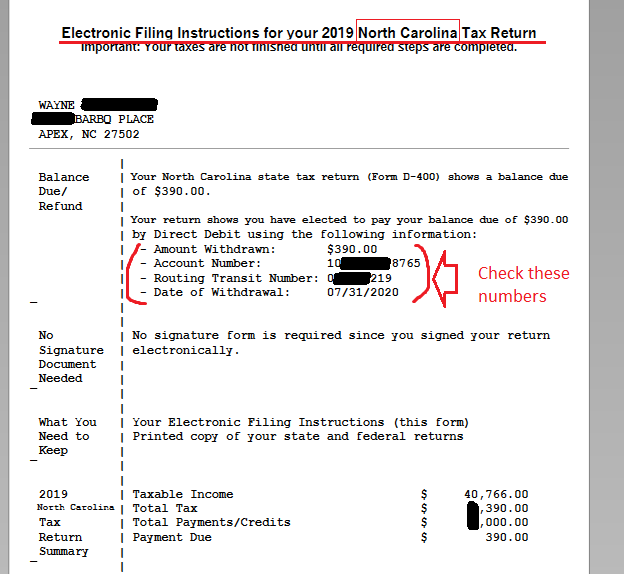

NC didn't start allowing that until 2 or 3 years ago. IF Indiana allows it, your printed State Electronic Filing Instructions would look similar to the following.....with your Routing and Account numbers showing:

____________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I submitted my 2020 taxes, federal and 4 states on time made online payment from checking account. All the amounts were deducted, except for Indiana state. Why ?

Indiana does not allow your taxes to be paid directly from the tax return. Please see this website to pay your Indiana tax due: DOR: DORpay - Tax & Bill Payment - IN.gov

See the instructions for Line 26 on page 11 of the 2020 Indiana tax instruction booklet:

IT-40-Instructions-Complete-Book-Annotated-09-20.pdf

Also see the screenshot provided by @Critter-3 in this previous thread:

Indiana tax payment 2020 (intuit.com)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jwicklin

Level 1

lmunoz101923

New Member

johntheretiree

Level 2

jjalles

New Member

drm5303

New Member