- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Yes.

How to prepare 1099Misc & W2

https://ttlc.intuit.com/community/forms/help/how-do-i-create-w-2-and-1099-forms-in-turbotax/00/25869

To prepare W2s and 1099s in the Online Self Employed version you have to first start your personal return. Then when you log in you select Take me to my Return. Then the next screen should be the Welcome Back screen. At the bottom under Manage your Return it says Create W2s and 1099s. This will take you to the QEF Quick Employer Forms.

If you are already in your return you can log out and back in again to get to the beginning screen.

Or in your return, Anywhere on any screen you see

Help me prepare and file W-2s and 1099s

Click on it and the side box will open, Then click on Quick Employer Forms in the side box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Yes, you can use Quick Employer Forms using the TurboTax Self-Employed online edition.

See this TurboTax support FAQ for QEF - https://ttlc.intuit.com/community/forms/help/how-do-i-create-w-2-and-1099-forms-in-turbotax/01/25869

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

I'm not sure I trust what TurboTax says about their Quick Employer Forms. If you enter data, it might disappear instead of being saved (as promised).

On about January 10, 2020, I (eventually) figured out how to enter payee data at the TurboTax web pages for eventual printing and eFiling of IRS Forms 1099-MISC (block 7, NEC Compensation) due tomorrow, January 31, 2020. [For my 2019 returns, I upgraded to TTax Home & Business -- specifically because I wanted the advertised ability to eFile my 1099-MISC forms and know that my current 2019 data would be saved online for quick & easy transfer to next year.]

(1) It turned into a time-wasting hassle to (eventually) discover that the ability to enter 1099-MISC info via the online web pages could NOT be accessed from my freshly-created and therefore existing 2019 TTax file in my desktop computer. Instead, when first opening TTax I had to click the "Start a new return" button and from there choose to enter 1099-MISC (or W2, etc.) data. That worked and I manually entered data for about 30 payees. I chose not to eFile at that time (TTax FAQs explain that my data would be saved online for later eFiling and for transfer to next year). Instead of immediately eFiling, I opted to wait until the end of January (i.e., today, 01/30/2020) in case errors needed to be corrected before eFiling. [NOTE -- There was NO "sign out" link or button available on any of the screens that appeared for me, so I simply closed the browser window. Chrome browser.]

(2) Today, 01/30/2020, I am trying to get back to my previously-entered 1099-MISC data that is supposed to be stored someplace within my online account at TTax ... ... ... and, after successfully logging in with my username and password, I cannot find any of my previously-entered data. The option to enter brand new data appears, but NO saved data from a couple of weeks ago. AARRGGH! A link to previously-saved data does NOT appear when I use the "Start a new return" button when TTax first loads. I cannot find a link to my already-entered data when I go back into my already-started 2019 tax file that's stored in my desktop computer. AARRGGH!

Now I wonder why I wasted my time and money upgrading my TTax product so that I could (supposedly) enter and eFile 1099-MISC forms via TTax to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Yes, you can use Quick employer forms in Turbo Tax Self-Employed. Since you are my 100th response today, I shall tell you how to get there because i am in a good mood.

1) log into Turbo Tax Online.Self -Employed

2) Select Federal>wages and income

3) Scroll to all income>Self Employment>self employment and expenses Select Start

4) Select yes when it asks Did you have any self-employment income or expenses?

5) Then it will ask you what type of business you are in. indicate your type of business.

6) Make the selection when you started your business

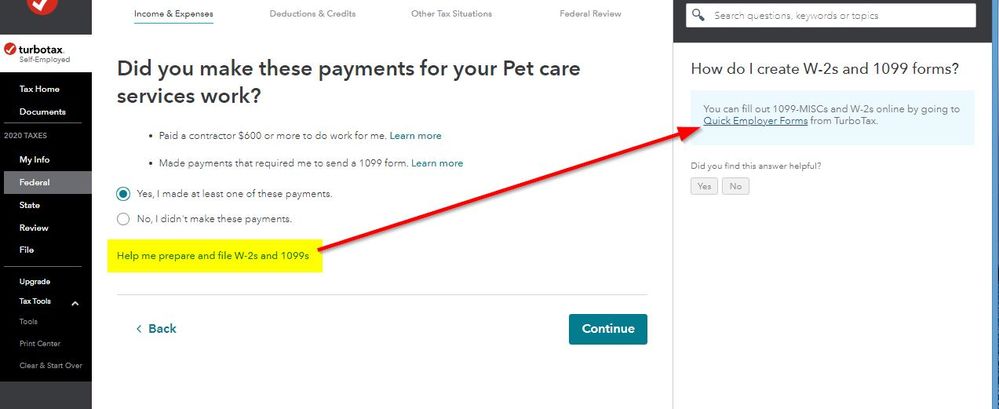

7) You will eventually arrive to a screes that asks Did you pay any employees in 2019 say yes here you will select the link that says Help me prepare W2 and 1099. When you select this link, there will be a screen open on the right side program that says;

How do I create W-2s and 1099 forms? When you select this link. there will be screen that will open up in the right navigational pane that says "You can fill out 1099-MISCs and W-2s online by going to Quick Employer Forms from TurboTax.

Click on Quick Employer Forms link and this will guide you in preparing a W2 for your employee.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Yes you may. here are the navigational steps to get there.

1) Log into Turbo Tax Online.Self -Employed

2) Select Federal>wages and income

3) Scroll to all income>Self Employment>self employment and expenses Select Start

4) Select yes when it asks Did you have any self-employment income or expenses?

5) Then it will ask you what type of business you are in. indicate your type of business.

6) Make the selection when you started your business

7) You will eventually arrive to a screes that asks Did you pay any employees in 2019 say yes here you will select the link that says Help me prepare W2 and 1099. When you select this link, there will be a screen open on the right side program that says;

How do I create W-2s and 1099 forms? When you select this link. there will be screen that will open up in the right navigational pane that says "You can fill out 1099-MISCs and W-2s online by going to Quick Employer Forms from TurboTax.

Click on Quick Employer Forms link and this will guide you in preparing a W2 for your employee.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

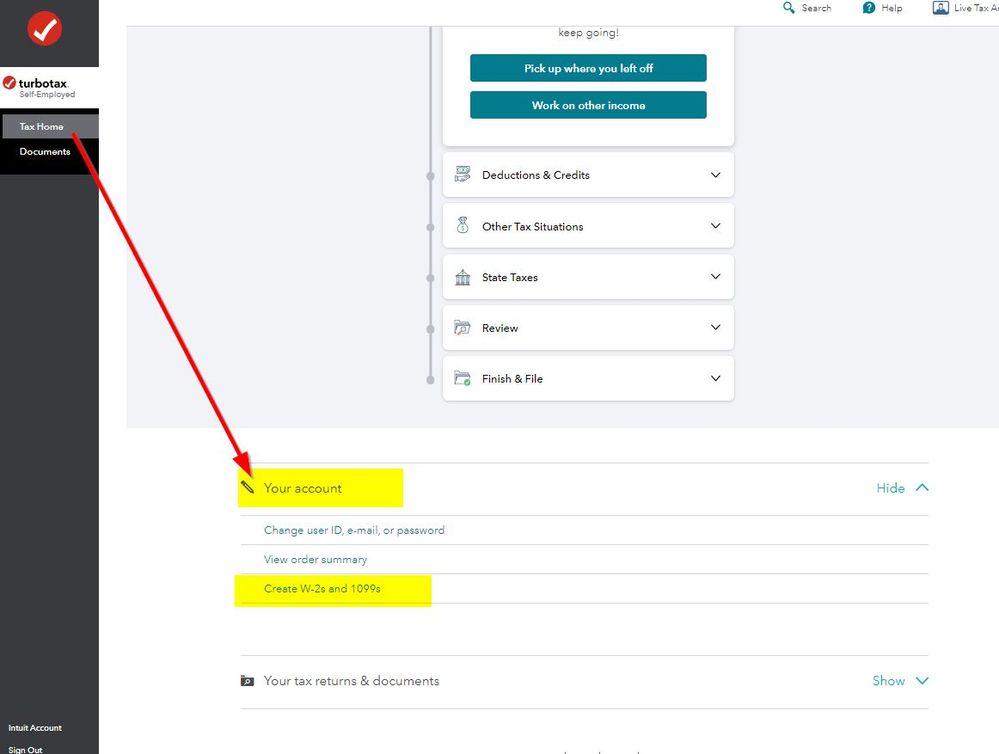

This is incorrect. Directly after logging in, OR if oyu are already logged in, click "tax home" at left. Then scroll to the bottom of the page. Click "SHOW" next to "your Account", then "Create W-2s and 1099s"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Yes - you can use Quick Employer Forms with TurboTax Self-Employed. When you are in your return, please follow these steps:

- Click on Income and Expenses and then click the Start/Revisit box in the Self-Employment section.

- On the Your 2020 self-employed work summary screen, click on Edit next to your business.

- On the Here's your [business] info screen, click on the box Add expenses for this work.

- On the Tell us about any expenses screen, scroll down to Less Common Expenses, mark the radio button for Contract Labor and click Continue at the bottom of the screen.

- On the screen, Let's enter the contract labor expenses for your [business], click the link Help me prepare and file W-2s and 1099s. [See screenshot #1 below.]

- A screen will pop up on the right. Click the Quick Employer Forms link. [See screenshot #2 below.]

SCREENSHOT #1:

SCREENSHOT #2:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Yes there are several ways to find Quick Employer Forms. The beginning of this thread was from 1 year ago last Jan 2020 for 2019 returns. So it may have changed since then.

In your return, Anywhere on any screen you see....

Help me prepare and file W-2s and 1099s

Click on it and the side box will open, Then click on Quick Employer Forms in the side box.

Or from the Account Screen it will take you directly to Quick Employer Forms

2 screen shots:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

No - when I get into the Quick Employer Forms it says I must be using 2020 TurboTax Business and trys to make me download or buy the CD. I was able to do it the past several years - why now requiring more advanced program and I can't even access the previous?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

@NPS What version do you have? The online Self Employed version? Did you see my post above with a screen shot? Or are you in the Desktop Home & Business program? And Windows or Mac?

For Online Self Employed version,

Log into your account

Scroll down to Your Account and click on Show

Click on Create W-2s and 1099s

In your return, Anywhere on any screen you see....

Help me prepare and file W-2s and 1099s

Click on it and the side box will open, Then click on Quick Employer Formsin the side box.

Or from the Account Screen it will take you directly to Quick Employer Forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Thank You so much - your a green shots worked - only way I could get to previous ones. You’ve been so helpful! Have a great weekend!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

THIS! This is the only reply that worked for me. All the other replies have directed me to the right panel with the link and to follow the link, or to use the "help me..." link in the expenses workflow. With all of those I hit a paywall. For me, this direction was the solution.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I use Quick Employer Forms with Turbotax Self-Employed? The Quick Employer Forms website says I need Turbotax Business or Home&Business.

Turbotax is broken! This solution is the only way I could get Quick Employer Forms to work from the Self Employed edition. All the official "help" links to Quick Employer Forms in a way that says you need to upgrade to a Business edition.

SUMMARY FOR OTHERS HAVING THIS PROBLEM:

(left nav bar) Tax Home > (scroll down to) Your account > (click) Create W2s and 1099s

😀

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amyonghwee

Level 5

Hesoukieh

New Member

Hesoukieh

New Member

hjw77

Level 2

HollyP

Employee Tax Expert