in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Are you married and you each have W2s? You probably ente...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

Sure but it won't make a difference. You still owe the excess back to the IRS. They only need to see your actual W2s if they show they are all for the same person like all for you or all for her.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

Where do I see what the amount is I have not received a refund I was supposed to receive one. I also call my tax lady but she’s not returning calls. Also tried calling the IRS but Cant through. So it’s best to just send in what they ask for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

What year is it for? For 2020 check schedule 3 line 10 for excess ss. For 2019 Schedule 3 line 11.

If you have an amount for excess ss the IRS will deduct it from your refund and will ask for it back.

How many W2s do you both have? What amounts are in boxes 3 & 4 for each person? Then I can explain it more for you. And you need to tell your tax person what happened so she doesn't do it wrong again or wrong for other people too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

It's for the year 2020. We filed together and are married. It shows $2701 for line 10 for my ss. We still have not received our return. So I should just send them the w2's for me and my wife. Then just wait for them to respond? We have one w2 for each person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

That's what i think she is saying but in a round about way. It won't make a difference, instead of the 4500 i thought i was going to get i will get about 1800 less in my case. Im just gonna send it anyways since i dont want to delay my small refund any further. In ny case it was turbo tax that did this....pulled from my adp electronically but put my w2 under my wife for some god forsaken reason and i did not catch it before filing....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

Okay, so it sounds like ill just mail them what they are requesting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

Yea and next year when my turbo tax software asks if i want to pull my w2 from the adp website that they partner with i am going to say thats a big fat no....unreliable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

And don't transfer from 2020 or they will transfer wrong. If you do transfer then delete the W2s and enter them manually as new.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

I can't believe the ADP / TT link broke like this, must be thousands of errors reported through TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

Once again the user is responsible for verifying everything on the return before filing and reading all of the information on the screen is key ... this excess SS issue is 100% a user entry error that the program tries to warn you of in advance. No matter which DIY program you use the rules are the same ... you must verify everything before you file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

This is incorrect. Both of my W-2's are under my name, and I got the same error letter. No way I could have known TT messed up the ADP pull.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

Same here. Both W-2's under my name. Got the error letter. My spouse hasn't had a W-2 in years, so can't imagine why her name would be associated with my W-2(s). This can't be an ADP issue - has to be a bug with TurboTax. I filed early so perhaps it was fixed through a bug fix release after the fact. Not impressed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

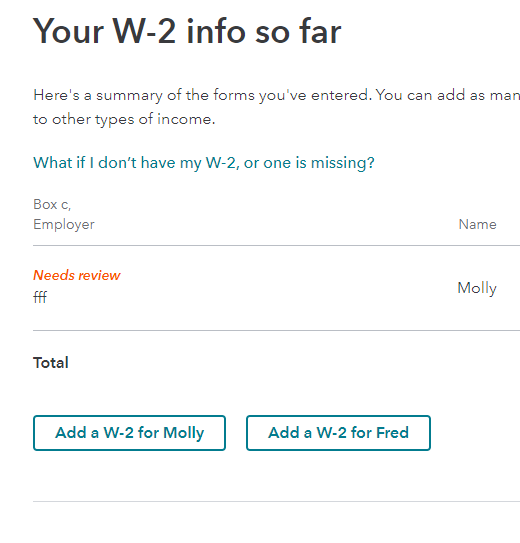

When you go to the W2 section, there is a question that asks who's W2 is this before you start. The default is usually the first person on the account in the desktop version. If you click through without reading, you can miss this. The online version, you must select who the W2 belongs to before you can start.

When using the online version, you must select who you will add the W2 for. You also can verify the name of the person on the W2 on the next screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

My situation: I filed on March 10th and received this letter from the IRS today on April 4th.

I'm Single with no spouse but have switched jobs twice in 2021 (so I've worked for 3 different companies and had 3 different W-2s.) The total of my Social Security Tax withheld across all 3 employers was over $10k so I had an excess of about $2k after subtracting the $8,854 maximum Social Security withholding per individual.

The letter from the IRS says, "The Forms W-2, submitted with your tax return, are insufficient to support the amount claimed for excess social security and tier 1 RRTA tax withheld on your Form 1040". Does TurboTax include our W-2s with our tax filings? This wordage from the IRS would suggest that it does so why is the IRS requesting that I send my W-2s again?

And how do I avoid this so my tax refund isn't delayed again in the future?

Thanks,

Vincent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS letter regarding excess SST/RRTA

TurboTax – and any other tax program – does not send your W-2s to the IRS @vinni3c. It sends the numbers.

The issue is on the IRS end. If you are reporting something like a W-2 that is also being reported by your employer, the IRS will verify that they both match.

It takes months for the IRS to put all the W-2s submitted by employers into their system. Your letter means the IRS was not able to match your info with anything that’s now in the IRS system so they need a copy of the W-2s from you to verify that you reported your info correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RCarlos

New Member

user17558933183

New Member

sacap

Level 2

user17557017943

New Member

kruthika

Level 3