- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to cancel a return that hasn’t been sent yet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

Once you transmit your returns, you are not able to cancel the return. Please see Can I cancel a pending return? for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

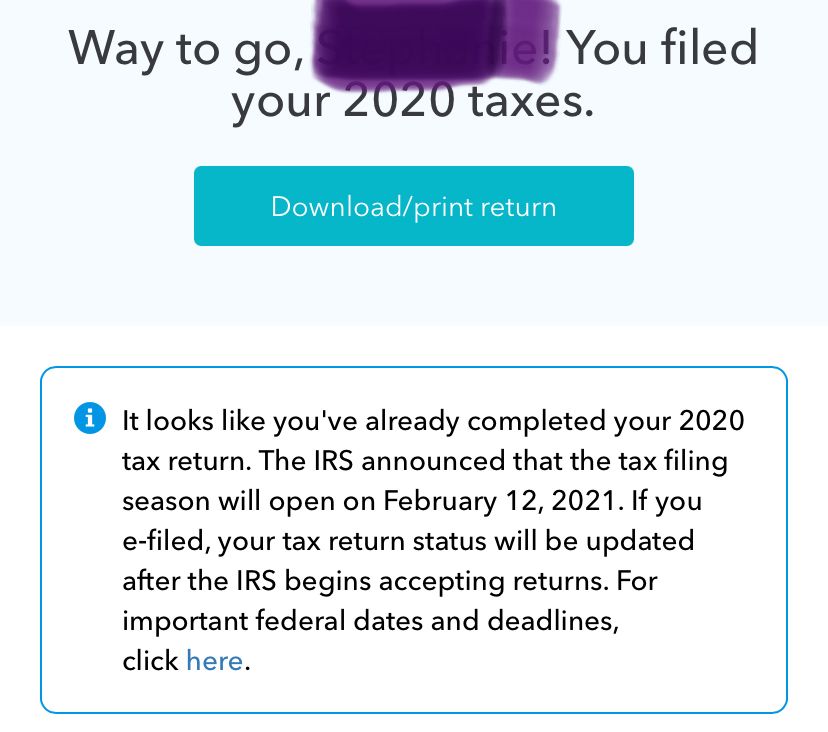

If you want to review and update your 2020 return, please enter your information here by February 6, to have your 2020 tax return sent back to you. You will then receive an email from TurboTax on February 8, letting you know that your return is available and providing you with detailed instructions on how to review, update and re-file your tax return without the Recovery Rebate Credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

@wakannaylz As long as you haven't submitted your return yet, you can use the Clear and Start Over button to clear out any previously entered information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

There is no “clear and start over” button in the tax tools section. Please advise 🙏

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

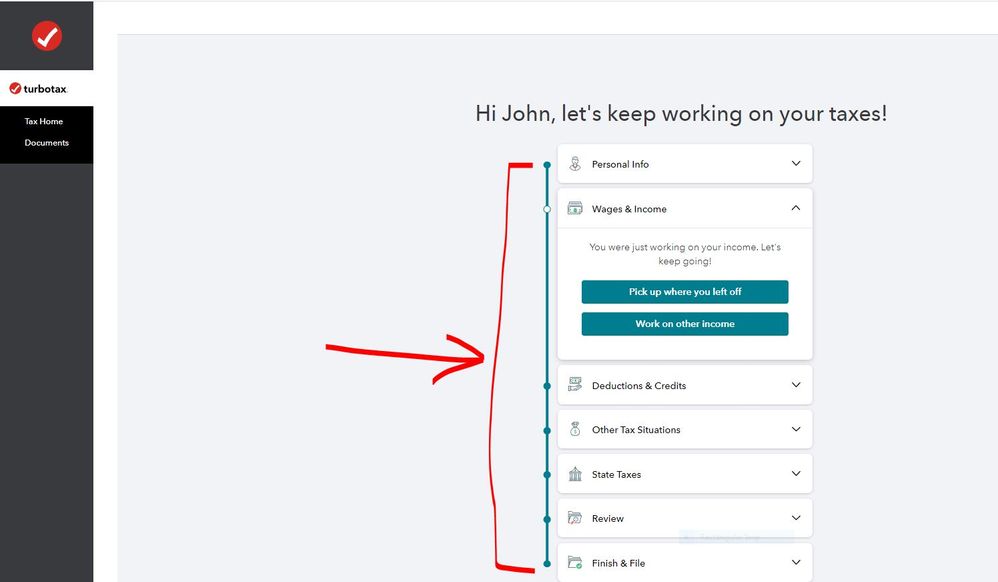

@wakannaylz You have to sign onto your 2020 online tax return - https://myturbotax.intuit.com/

Once you are signed onto your account you have to click on one of the boxes listed to go back to the 2020 online tax return -

Once you are accessing the 2020 online tax return the links on the left side of the online program screen will be available -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

I have submitted it .., but the IRS is not accepting returns until February 12. So, why can’t I amend my return? I just got another W2 from a late sending employer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

I have completed it and submitted to turbo tax but the IRS isn’t even accepting returns until feb 12. So I should be able to amend it, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

Once a tax return has been filed it cannot be changed, canceled or retrieved

You will have to wait for the IRS to start accepting or rejecting 2020 tax returns on February 12, 2021

If the return is rejected you can make the necessary changes and e-file again.

If the return is accepted you will have to amend your original tax return. An amended return, Form 1040X, can only be printed and mailed to the IRS, it cannot be e-filed. The IRS will take up to 16 weeks or longer to process an amended tax return.

Before starting to amend the tax return, wait for the tax refund to be received or the taxes due to be paid and processed by the IRS.

See this TurboTax support FAQ on amending a tax return originally completed and filed using the 2020 TurboTax online editions - https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-turbotax-online-return/01/27577

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

I did not receive my email as of 6 pm on the 8th to correct my tax returns for recieving the stimulus after filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

Here is a link to the IRS's most up to date statements made regarding the Second Stimulus Payment:

IRS Statement on Economic Impact Payments

Should this not provide you with the information you are looking for, I can assure you that the IRS will be performing extensive reconciliations of taxpayers' accounts to ensure the minimal amount of overpayments go out. You do not need to file an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

I did it on turbo tax I'm being charged for self employed but I'm not self employed any longer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to cancel a return that hasn’t been sent yet

Once a TurboTax account is created, it cannot be deleted. You can simply abandon it. If you'd like to clear any data that you may have entered into the program, you can use the "Clear and Start Over" feature, just don't start over.

If you have already paid for a TurboTax product and are wanting to see if you can receive a refund, simply fill out our TurboTax Refund Request form. For more information on refunds, please see the FAQ provided below:

Our TurboTax Satisfaction Guaranteed Refund Policy

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

doingmytaxesagain2019

Returning Member

nitayl44

New Member

jareyliz8

New Member

missjella33

New Member

haleyrhodes57

New Member