- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax saying a W-2c is on the way?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

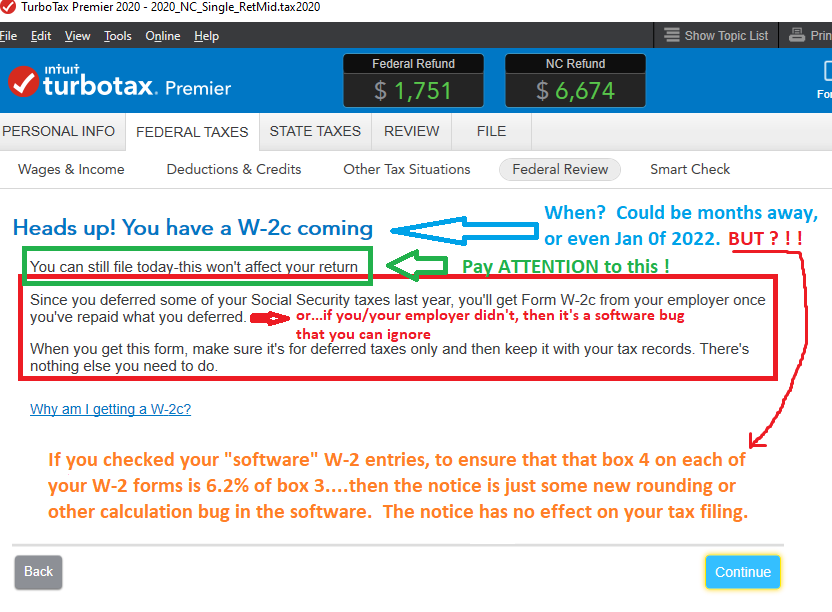

Today (2/18/2021) it says as I get done with Federal review - Heads Up! - A W-2c is on the way. It goes on to say due to deferring social security tax. Neither myself or my wife did any social security tax deferring. Why would it say this? Has anyone else today or recently got this same message? Should I file now or wait to see if I am getting a new W-2 (called W-2c) when again, I did not defer any social security tax and manually see on the W2s that we paid 6.2%. Thoughts?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

1) Did you re-edit each W-2 (in the software itself) and make sure box 4 was not less than 6.2% of box 3? Need to make sure you didn't fumble-finger a value first.

or

2) Was box 4 at the maximum of 8537.40 ??

OR

3) ...might help to read this...if you also had a 1099-NEC reported:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

We paid the full 6.2% all all W2's. Thanks for sending the link. We do have a1099G (unemployment income) but SS tax isn't due on that income. Seems like a bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

maybe...but could be a simple rounding difference in box 4. Try adding 50cents to box 4 on any W2 that has nearly 50cents on the final digits and see if the Warning/Notice (and that's all it is) still occurs.

IF it does, then that is what's going on...i.e. just a rounding difference between what your employer did, and what TTX did.

Then return box 4 to it's former # and ignore that notice/warning.

__________________________

I tested my desktop software.....and for my test, in a situation where the 6.2% was close to $$$$.50..... a value of $$$$.49 in box 4 gave me the warning, and $$$$.50 did not....and that's all a rounding issue.

__________________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Rounding up didn't help. What's strange is i could have filed last week and had gone through this process and the W-2c on the way never came up all last week....and now today it does? Just seems like it's a bug or something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I too believe this is a bug. This saw this for the first time tonight (2/18) after the latest Desktop TT (Win10) updates and I haven't changed any of my W-2 info since I originally imported it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I had the same message pop up and I have quadruple checked my W-2s, had my business office look into it and I am still getting this message. Thank you for posting this because I thought I was the only one!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I'm getting it too....has anyone escalated to Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

NO...it's a brand new notice the was "supposed" to be helpful...but isn't, and also appears to have a calculation a bug in it.

IT doesn't stop your e-filing in any way.....and as long as you confirm that box 4 in any W-2 you have is 6.2% of box 4 (in the software itself)...then you ignore it and just move on.

__________________________

IF you happen to also have a 1099-NEC, or other cash self-employment income in your file, that W-2c notice may also show up. Apparently there is something in that section that needs a NO answer...but I'm unfamiliar with that situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

@SteamTrain FWIW this has been reported to the Moderators.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

thanks...it's quite a barrage.

Hope they can get an FAQ up fast.

(But fervent Hopes are made to be dashed. So I won't make it "fervent", and I won't hold my breath)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I have the same issue when preparing my son's return. He had the proper amount withheld for both Social Security and Medicare and is unaware of any deferral. These amounts were correctly entered in TurboTax and yet the same advice regarding a corrected W-2 (W-2c) was issued. I can simply attribute this to software error. In any event, it doesn't affect the filing of the 2020 return as was correctly stated by TurboTax.

As an aside, my own State return was rejected twice due to what TurboTax admitted (and apologized for any inconvenience) were errors in its software. The third time was a charm and the State return was accepted without any changes to input on my part.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Wow, thank you so much for this! My social security payments ended in .40 cents and when I went back and added the .50 as you suggested, the W2-c notification went away and it went straight into checking the federal return. Thank you so much for this! I spoke to my payroll provider, Turbotax, even made calls to the IRS. No one had any clue what I was talking about.

Thanks again!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I am seeing this as well and have confirmed with my HR that no corrected w2 is coming. hope turbotax clarifies this message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I am having the same issue. I have used TurboTax for over 10 years now without issue. This year, the program is riddled with bugs. I was on the phone for over 3 hours 2 days ago because the program stopped responding when I got to deductions. Phone support did not help me but I could not give them anymore time that day. I thought I would just input my data directly through the forms and get through this years taxes that way. But once I entered all my info and was about to file, I got this W-2c message.

At this point, unless TurboTax can come up with a quick update to remedy these problems, I want my money back. I am already past the return window with Amazon.

I used the disc version of Premier with Windows 10 on a desktop. Then when I ran into problems, my phone support rep sent a digital download of the same program. Both are useless to me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

v8899

Returning Member

melody99205

New Member

user17558059681

New Member

daupet1

New Member

jsaint23

New Member