- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Have you tried either deleting the line items or leaving the fields blank?

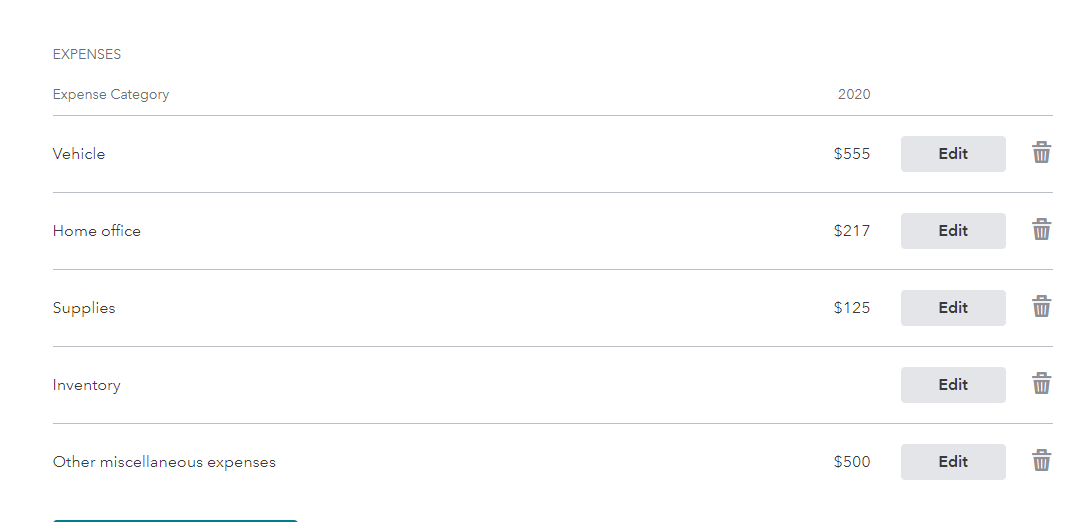

If you do not have any amounts to enter for the current year, you can select the trash can to the right of the input to delete it from your 2020 tax return.

This may clear up the error and allow you to file.

Follow the steps below to get to the input screen in the federal interview section of the program.

- Select Income & Expenses

- Select Self-employment income and expense

- Under the screen titled Your 2020 self-employed work summary, select Edit to the right of your business

- The next screen will say Here's your business name info.

- Scroll down to the expenses and select the trash can to the right of the applicable expenses that have a zero value this year to remove them from your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

I have completed my return. Fed only. Will not accept, error message that my routing and account numbers do not match at _PenFed checkingl Have tried for almost an hour. Unable to reach anyone landline or on the net. Please help,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Please see the link below to assist you with the input for the banking information just in case something is entered incorrectly.

Which number on my check is the routing number?

If that does not work, please use the link below to contact us. Please note, hold times will be longer than normal due to the filing date deadline.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

[phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Sometimes for reasons unknown to TurboTax the IRS can decide to mail you a check instead of making a direct deposit. The IRS does not tell TurboTax anything when they change something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

I would like to learn more about my refund from a live tax specialist.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

You can fill this form out for someone to call you from TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Your company filed electronically my tax stimulus return April 6th have not received yet Would like to talk to one of your agents

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

@GSackenger No one at TurboTax can tell you when you will receive your refund. And no one can call you from the user forum. Only the IRS can tell you when you will receive your money.

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer. “21 days” is not a promise from TurboTax or the IRS. Many refunds are taking longer during the pandemic. The IRS is backlogged —-they are still trying to process millions of 2019 returns; they received millions of e-filed on the day they opened for 2020 returns, and now they are burdened with sending out another round of stimulus checks.

Some delays are resulting from incorrect amounts that folks entered for stimulus checks they received. Many people have been confused by the recovery rebate credit and completed it incorrectly. The IRS may delay your refund while they cross-check to see what you received. Some refunds are delayed because of the tax law changes that went into effect recently. If your return has unemployment or the premium tax credit on it, that may be delaying it.

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 34of your 2020 Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

From this IRS website - https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

As of May 15, 2021, we had 300,000 individual tax returns received prior to 2021 in the processing pipeline. Including current year returns, as of May 15, 2021, we had 16.4 million unprocessed individual returns in the pipeline. Unprocessed returns include those requiring correction to the Recovery Rebate Credit amount or validation of 2019 income used to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). This work does not require us to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund. If, as a result, a correction is made to any RRC, EITC or ACTC claimed on the return, the IRS will send taxpayers an explanation. Taxpayers are encouraged to continue to check Where’s My Refund? for their personalized refund status and can review Tax Season Refund Frequently Asked Questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Need number for turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

@bucktol wrote:

Need number for turbo tax

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or -

Use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

Or -

On every TurboTax web page, including this one, scroll down to the bottom of the page and click on Contact Us

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

I can’t seem to efile my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

@Jaked007 What happens when you try to e-file? Are you getting an error message? Is it rejecting? Or do you mean you do not understand how to e-file? Please give us some specifics so we know how to help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

My turbo tax return, says not in system , federal return in Tennessee for 2049.00, where is my tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I speak to a real person at Turbo Tax , need a number

Where is my tax return

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

latdriklatdrik

New Member

shuli05131999

New Member

rsherry8

Level 3

tianwaifeixian

Level 4

Lindawill56-lw

New Member