- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Returns Being Rejected Because of PIN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

We have two returns currently being rejected because of PINs. One we called into the IRS who told us it was because we mailed in the 2018 tax return and that the PIN was nullified at that time. The agent told use to use 00000 instead. Turbo Tax will not let us get past that field as it requires anything but this number.

Is there a way to reset the PIN that we have been using since 2007 and set a new one?

The other return we did select a new PIN and it is being rejected. How do we get our returns filed through turbo tax? we have already paid for the state filing and it keeps getting rejects.

In both cases the AGIs have been verified

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

You no longer need a PIN number from last year to electronically file your return as the IRS did away with this method of security validation. Instead you will be required to use your 2018 AGI (Adjusted Gross Income) in order to electronically file your federal tax return.

If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

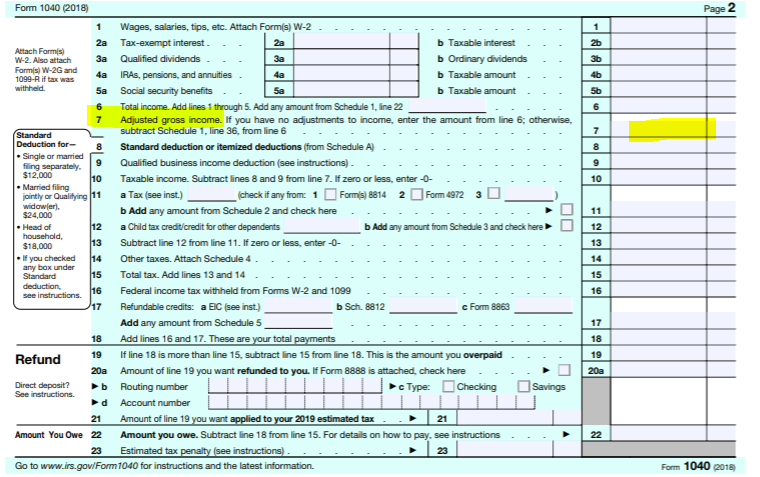

If you have a copy of your 2018 tax return, your AGI is located on line 7.

If your return is rejected because of your AGI, you will have no choice but to file a paper return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

"You no longer need a PIN number from last year to electronically file your return as the IRS did away with this method of security validation. Instead you will be required to use your 2018 AGI (Adjusted Gross Income) in order to electronically file your federal tax return."

Not a true statement.

Use of the self-select PIN Is optional, and not done away with.

What was done away with was the ability to have IRS give you a PIN at the time of filing.

that happened several years ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

Thank you I understand that we no longer need the PIN, however, the Turbo Tax software continues to return an error when its not filled in. Filling in zeros as the IRS agent suggested returns an error with the software.

Selecting a new PIN is returned a rejected file by the IRS. We have checked the AGI and confirmed it with the IRS.

How do we get the tax return electronically filed?

Why is there no Technical Support from Turbo Tax after we have paid for the software and paid for the state filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

Both of our returns are being rejected because of this.

How do I get my money back for the state filing that will not flow through because of this?

We are using the AGI from the program from last year. We have confirmed this number with the IRS

The software is not working the way it is supposed to.

Where do I go to end this with Turbo Tax? What a complete waste of time

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

Filed tax by mail last year and Turbo Tax e-filing this year but rejected for either incorrect AGI and/or pin number. I used the same pin number as 2018 electronic filing but rejected. Any help appreciated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

Are you referring to the Self Select 5 digit pin number?

If you don't remember the one you chose last year you can create a new one to use.

Please see the TurboTax FAQ: What is the difference between the five-digit Self-Select PIN I created last year and my Self-Select... for more information.

Also, if you filed your 2019 later in the year, see What if I entered the correct AGI and I’m still getting an e-file reject? for solutions to fix your AGI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

Please see the information in this TurboTax FAQ here for assistance with your rejected AGI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

Sorry to be snarky, but I clearly said I had already verified that the AGI matched what the IRS had on file, which is all the unfinished paged you linked to says. Honestly I expected TurboTax to have a better guide than one that says: "If you're still having trouble, we suggest that you check with the IRS to make sure that the copy of your return is the same as what they have in their records. To do this, you can order a variable goes here."

If any one hits thread from google like I did, the real answer is that if you can stomach the biometrics collection of ID.me, you need to request an Identity Protection PIN from the IRS (for both you and your spouse if filing jointly) and enter the PIN's on the return under Personal->Other Tax Situations->Other Return Info. While IP PINs can be requested for dependents, I did not need to do so in order for my return to be accepted.

https://www.irs.gov/iden[product key removed]-scams/get-an-identity-protection-pin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

I am not sure why the forum is breaking the link, take the spaces out of this and its the right page.

https://www.irs.gov/ identity- theft -fraud-scams/ get-an-identity-protection-pin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returns Being Rejected Because of PIN

I have submitted a form for a new pass code for my taxes but it has not arrived yet. I have submitted my taxes several times but they still keep getting rejected...... What do I need to do?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alikw1020

New Member

partydude182

New Member

20tprtax

New Member

steve-knoll

New Member

bees_knees254

New Member