- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When do I report capital gains and which version of turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

It's hard to tell what your question is without knowing more about your situtation. A capital gain is what the tax law calls the profit you receive when you sell a capital asset, which is property such as stocks, bonds, mutual fund shares and real estate. This does not include your primary residence. Special rules apply to those sales.

You'll use TurboTax Premier to report capital gains and losses as described above.

If you have additional questions or details regarding this, please feel free to post in the comments for further clarification.

https://ttlc.intuit.com/replies/5209280

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

Where in Turbotax Delux do I enter information on the costs (improvements, etc.) tat can reduce the cap gains on the sale of my house? In the income segment the system says this is possible but doesn't provide a way to do this.

Al

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

The input is made under the Federal section of the program as follows:

- Select Income & Expenses

- Scroll down to see All Income

- Select Less Common Income

- Select Sale of Home

- Proceed to enter the info as prompted

- You will see a screen titled Sales Information. You will enter your selling price and sales expenses here.

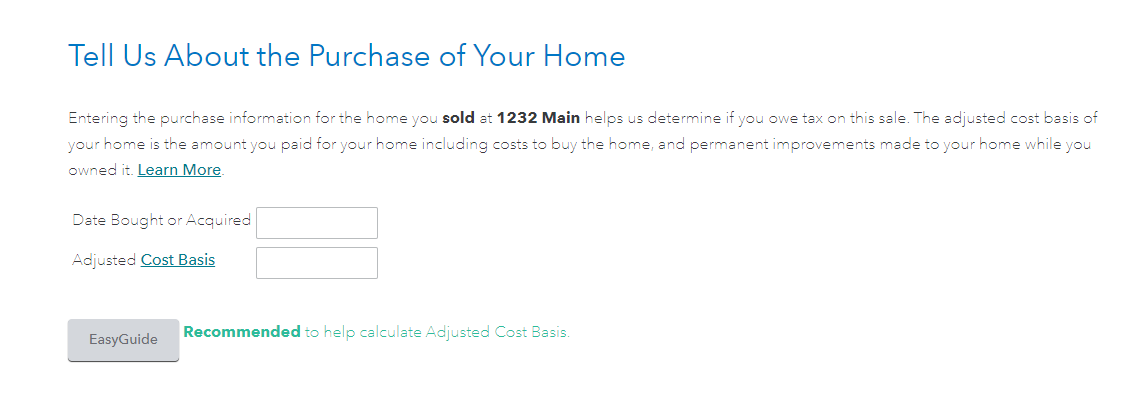

- The next screen will say Tell Us About the Purchase of Your Home. You will enter the improvements in the cost basis input field.

Also be aware you may not have to report anything if your gain is less than $250,000. See the following link for more information on the exclusion and if you would qualify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

I understand what you said but I think it's to broad of a statement because selling of your home residence can incur capital gains if it doesn't fit into the rules that exempt it. The problem I'm having is the property sold was my home for many years prior before converting to a rental property. Realistically, probably better to sell your home outright to get the exemption of capital gains and then invest in a rental property. My situation was a forced one due to 2008 mess but I don't advise doing it just so you don't lose the capital gains exemption on your personal residence if you didn't live in it 2 out of the last 5 years prior to the sale. Now I'm caught with a sale that encompasses deductions during owner occupied periods vs when it was a rental to report the capital gains from the sale. I don't see any Turbo Tax program so far that handles this well and support is telling me to enter things in the rental depreciation that are not properly reported there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

Besides, anything I add to depreciation schedule will cause some depreciation to be taken on the current return that will reduce my normal income taxes at a 15% tax rate but it will cause a recapture at 25% and ultimately increase my basis/capital gains amount; not exactly ideal!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

which version of turbotax is needed to report capital gains on sale of non prmary residence home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

@abryan196 You need Premier if you are using online TurboTax. If you use desktop (CD/download) then you can use any version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

For the Capital Gains answer you gave (with photo)

Sale Date and selling price are easy to answer, but what does the "sales expenses" line mean? Like what qualifies under this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

You are allowed to deduct from the sales price almost any type of selling expenses, provided that they don't physically affect the property. Such expenses may include:

- advertising

- appraisal fees

- attorney fees

- closing fees

- document preparation fees

- escrow fees

- mortgage satisfaction fees

- notary fees

- points paid by seller to obtain financing for buyer

- real estate broker's commission

- recording fees (if paid by the seller)

- costs of removing title clouds

- settlement fees

- title search fees, and

- transfer or stamp taxes charged by city, county, or state governments.

Most of these costs will be listed in the closing statement prepared by the escrow, bank or other financial institution, (or attorney, in some states) when you sell your house.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

Thank you for your kindness and wonderful help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I report capital gains and which version of turbo tax

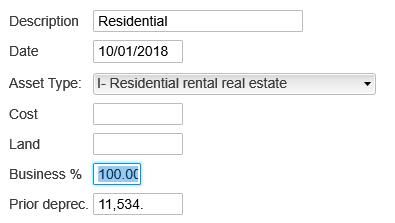

@Texas Roger I bought a rental 4 years ago for $103,000 and that year put $42,000 into fixing it up. I then rented it out and this year I sold the property for $260,000. How do I add the costs basis and where do I enter that number?

Do I put $145,000 in the "Cost" field for Depreciation or do I put $103,000 there and the $42,000 somewhere else?

Do I split that amount between the property & the land?

I'm using laptop Home & Business.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gangleboots

Returning Member

brelaz99

New Member

AKL1

Level 2

eapples

Level 1

mytax26

Level 2