- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@Texas Roger I bought a rental 4 years ago for $103,000 and that year put $42,000 into fixing it up. I then rented it out and this year I sold the property for $260,000. How do I add the costs basis and where do I enter that number?

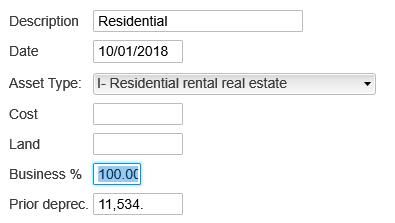

Do I put $145,000 in the "Cost" field for Depreciation or do I put $103,000 there and the $42,000 somewhere else?

Do I split that amount between the property & the land?

I'm using laptop Home & Business.

October 14, 2022

12:56 PM