- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TT reports "A Link to Schedule C should not be linked"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

After updating the program this morning (Feb 23, 2023), I received an error message involving MISC-1099 that says "Schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked". This error didn't exist yesterday. It looks like there's a bug in the program update released today. Please advise on how to resolve this issue.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

Was your intent to report the 1099-MISC as income into a Schedule C?

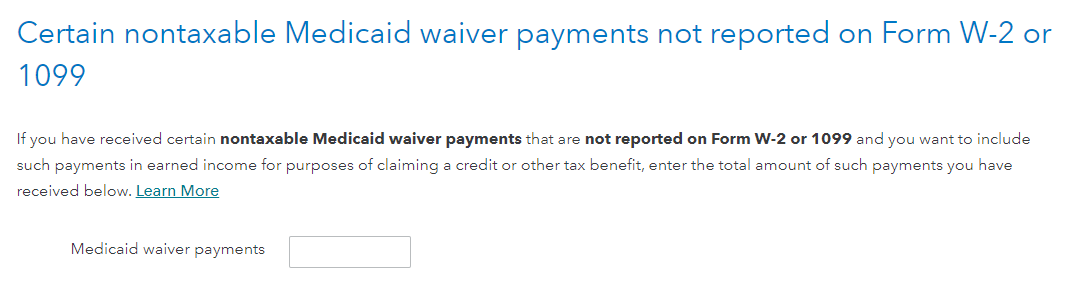

Or did you intend to report the 1099-MISC income as Medicaid Waiver Payments and did you intend to include such payments in earned income for purposes of claiming a credit or other tax benefit?

Was the 1099-MISC reported at the screen Certain nontaxable Medicaid waiver payments... here.

This screen is accessed at:

- Federal

- Wages & Income

- Less Common Income

- Miscellaneous Income, 1099-A, 1099-C

- Other income not already reported on a Form W-2 or Form 1099. Continue through several screens.

If you were intending to report the Medicaid Waiver Payments, I would remove the entry, Review, then re-enter and see if the message returns.

If the income is intended to be reported on a Schedule C, was this the only income for the Schedule C? Were there any expenses reported against the income?

If you were not intending to report either of these incomes, what were you wanting to report?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

The income is intended to be reported on Schedule C. This is the only income for Schedule C. There are not any expenses reported against this income.

Linking the 1099-MISC income on Schedule C was working fine yesterday (Feb 22, 2023) and I was ready to file today. However, after today's (Feb 23, 2023) Turbotax program update, the error referenced above suddenly appeared.

To be clear, this income has nothing to do with Medicaid Waiver Payments. I had no idea what "MWP" referred to until several Google searches.

I would appreciate your thoughts on how to resolve this issue, including checking if a bug worked its way into the Turbotax program after today's program update. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

The 1099-MISC is intended to be Schedule C income. And you have the Schedule C already created.

So I would delete the 1099-MISC, then run Review.

Then I would re-enter the 1099-MISC but I would enter the 1099-MISC within the Schedule C.

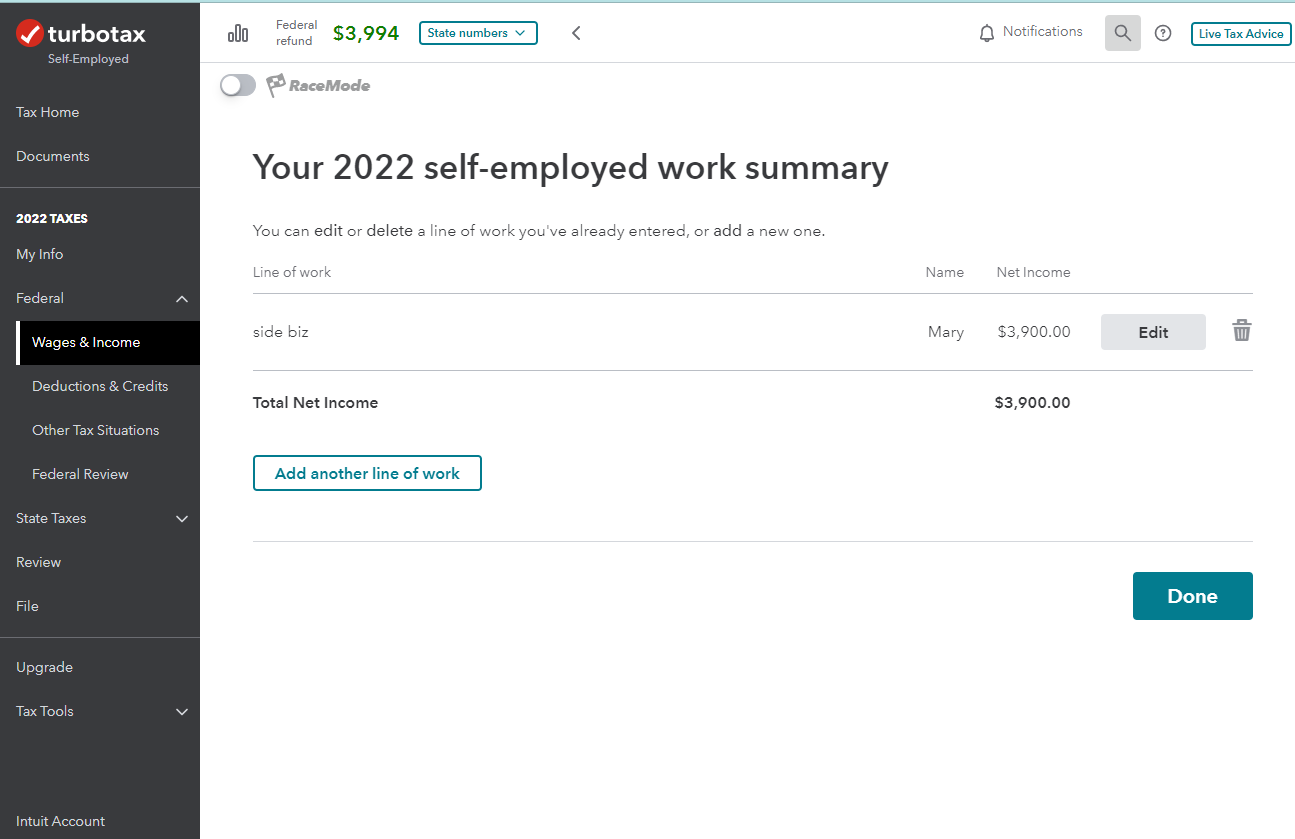

- Click Edit to the right of the self-employment activity at the screen Your 2022 self-employed work summary.

- Click Add income for this work.

- Select Form 1099-MISC. Continue.

I am not sure why the income is on a 1099-MISC instead of a 1099-NEC.

Hope that helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

I am getting the same error, and I don't see a "Your 2022 self-employed work summary." in my schedule c.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

As advised by @JamesG1, delete the 1099-Misc. Here's How to Delete a Form in TurboTax Online. If you're using TurboTax Desktop, click on FORMS in the upper right corner, then under 'Forms in My Return' scroll to the 1099-Misc and click on 'Delete Form' at the bottom of the form.

Type 'Schedule C' in the Search area, then click on 'Jump to schedule c'.

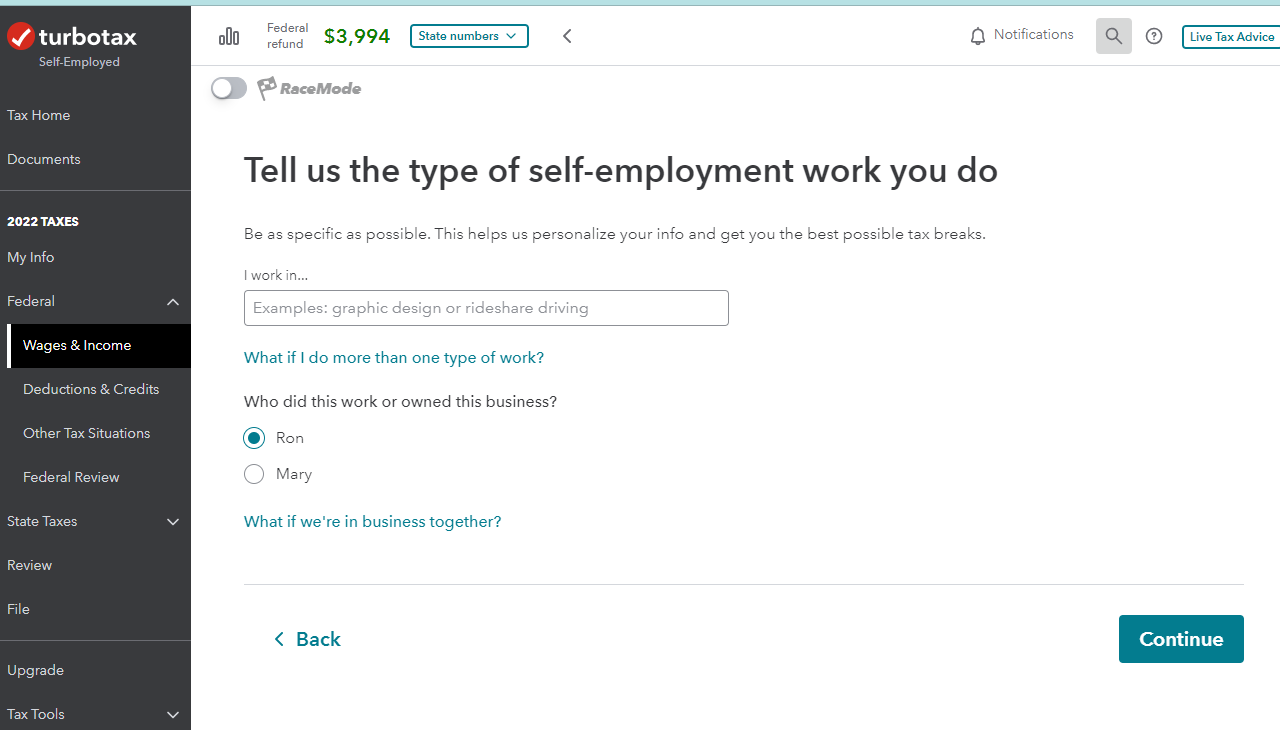

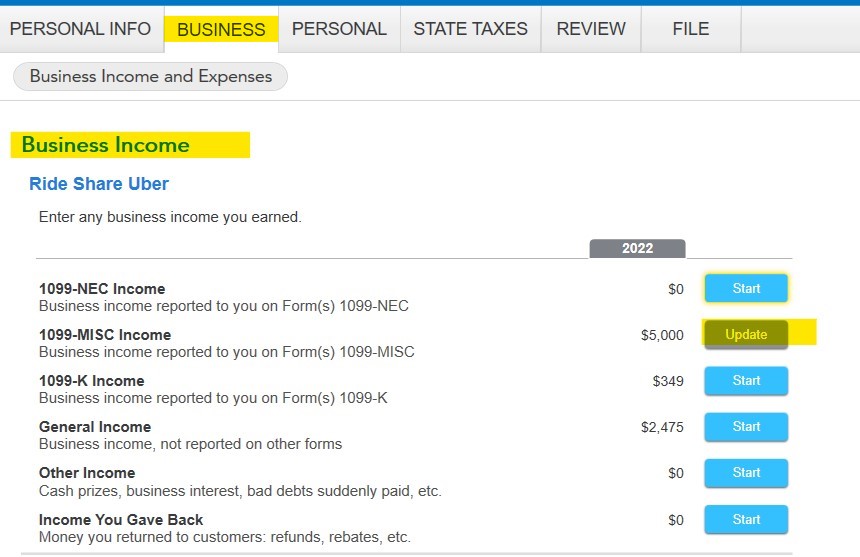

If you have already set up your Business, you should see the 'Self Employed Summary' page (screenshot). If you haven't set up your Business, TurboTax will ask questions about your Business to set it up for you (screenshot).

You will then be asked to report your Business Income. Choose '1099-Misc' and enter the form info.

Most business have some expenses, and it may be questioned if you don't enter any.

Here's some info on Business Expenses you may want to consider reporting.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

What are the steps if using Turbotax Desktop?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

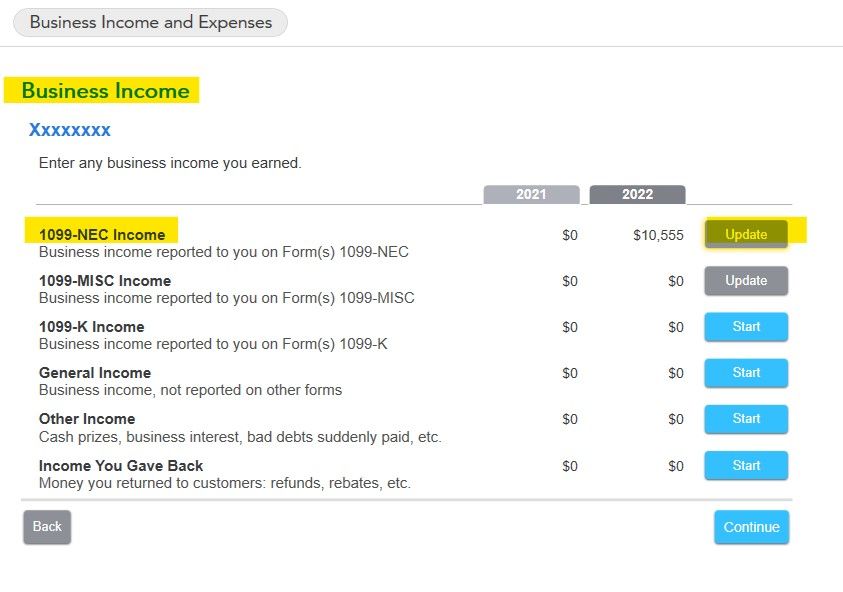

In TurboTax Desktop - go to the Business Tab, then choose I'll Select what I work on. Then,

Click Update next to Profit or Loss from Business (if your business is not already set up, you will need to do that first)

Click on Edit next to your business

Click Update next to Business Income

Click Start/Update next to 1099-MISC Income

Enter the form details

It will be linked to, and the income added to your Schedule C. In the desktop version, you can click on Forms in the upper right-hand corner to get to all of your forms. Find the problematic 1099 in the list and delete it. You should probably do that first before you add the new one so you don't delete the wrong one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

I use turbotax premier desktop and I don't see those screens. I see personal info, federal taxes, state taxes. No business tab.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

I followed the steps. However, the program still generates the same error described in the original post. There appears to be a bug in the latest update. Please let us know when it will be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

We are looking into this (schedule c not linking correctly - Medicaid waiver payments).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

As a workaround, until we can get the error removed, try

- Deleting the 1099-MISC with amounts in Box 3 and

- Enter the form as a 1099-NEC with the amount in Box 1

The results will be the same on Schedule C. And the 1099-NEC will link to Schedule C without an error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17725498558

New Member

rogensg1

New Member

jduong715

New Member

joannewit59

New Member

larslanian

Level 3