- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

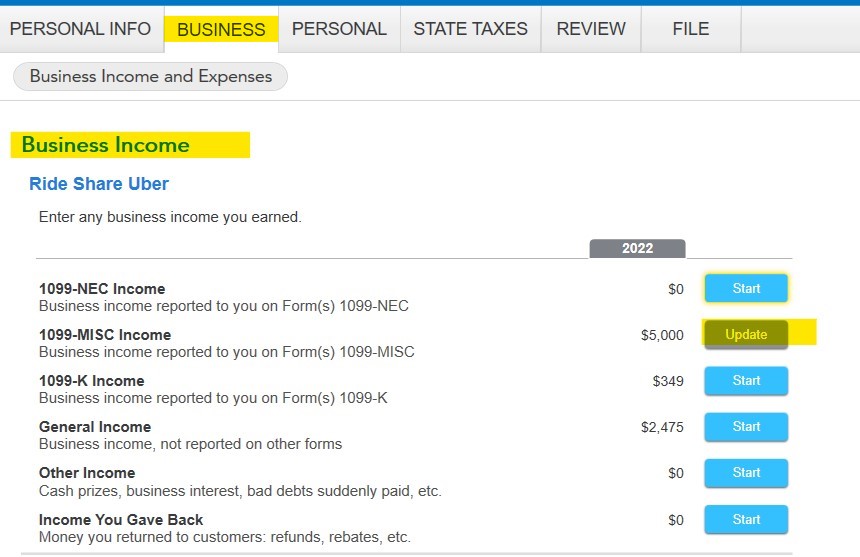

In TurboTax Desktop - go to the Business Tab, then choose I'll Select what I work on. Then,

Click Update next to Profit or Loss from Business (if your business is not already set up, you will need to do that first)

Click on Edit next to your business

Click Update next to Business Income

Click Start/Update next to 1099-MISC Income

Enter the form details

It will be linked to, and the income added to your Schedule C. In the desktop version, you can click on Forms in the upper right-hand corner to get to all of your forms. Find the problematic 1099 in the list and delete it. You should probably do that first before you add the new one so you don't delete the wrong one.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 23, 2023

6:54 PM