- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Was your intent to report the 1099-MISC as income into a Schedule C?

Or did you intend to report the 1099-MISC income as Medicaid Waiver Payments and did you intend to include such payments in earned income for purposes of claiming a credit or other tax benefit?

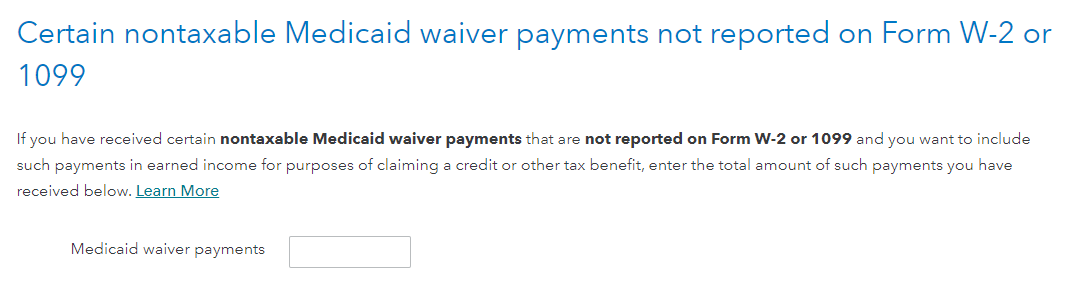

Was the 1099-MISC reported at the screen Certain nontaxable Medicaid waiver payments... here.

This screen is accessed at:

- Federal

- Wages & Income

- Less Common Income

- Miscellaneous Income, 1099-A, 1099-C

- Other income not already reported on a Form W-2 or Form 1099. Continue through several screens.

If you were intending to report the Medicaid Waiver Payments, I would remove the entry, Review, then re-enter and see if the message returns.

If the income is intended to be reported on a Schedule C, was this the only income for the Schedule C? Were there any expenses reported against the income?

If you were not intending to report either of these incomes, what were you wanting to report?

**Mark the post that answers your question by clicking on "Mark as Best Answer"