- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Reject Code IND-031-04

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

Thank you very much for your quick and clear responses. Greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

Yes, I was right! TT should not have let this situation even attempting an e-file!

VA is Like NY if Fed is efiled then State must be e-filed. I demanded and received a refund of my e-filing fee for a state. (took an hour on the phone).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

Was this ever resolve? I'm having the exact same issue. I have the AIG from 2018 taxes. Could it be an issue with the PIN number not be submitted. Previous years TT would ask for both information, this year it just asked for my PIN. I have submitted it 2x.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

Time-saving Tip: If what you originally entered is correct, you won't be able to e-file. There's probably a data mismatch at the government, a dependent that's already been claimed, or some other situation beyond your control that prevents your return from being e-filed. In this case, your only option would be to print and mail in your return. This article will give you instruction on how to print and mail your return.

Additional reject instruction here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

I am preparing and filing on behalf of my widowed mother-in-law. Her husband passed in 2019. Like others, I just answered the questions and everything worked until the IRS rejected the filing. I also paid the $24.99 filing fee for Minnesota only to find they rejected the filing also. If I understand correctly, I need to do the following:

-Print and file the Federal Return

-Print and file the Minnesota Return

-Fight with TurboTax to get the refund of the Minnesota filing fee (or tell the credit card company to halt payment.)

Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

@DZ16 wrote:

I am preparing and filing on behalf of my widowed mother-in-law. Her husband passed in 2019. Like others, I just answered the questions and everything worked until the IRS rejected the filing. I also paid the $24.99 filing fee for Minnesota only to find they rejected the filing also. If I understand correctly, I need to do the following:

-Print and file the Federal Return

-Print and file the Minnesota Return

-Fight with TurboTax to get the refund of the Minnesota filing fee (or tell the credit card company to halt payment.)

Is that correct?

You are correct.

To contact TurboTax customer service/support use their contact website during business hours. If the problem concerns any type of refund for fees, use the key words billing issues and do Not use the word Refund or you will get a phone number for tax refunds.

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

Thanks! Missy was able to secure the credit card refund. Appreciate her and your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

I can definitely relate to everyone’s responses. Unfortunately, I entered our tax information online too many times, the system’s response was that I had to mail our 2019 tax return.

I have been in contact with Tax Slayer, Turbo Tax, and the IRS. After two and half weeks, I was informed that our refund was sent to my financial institution on February 26, well unfortunately it is now March 18, no refund.

A very concern taxpayer as well as citizen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

What dose the above rejection code mean and how do I correct it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

@Fishertina34 wrote:

What dose the above rejection code mean and how do I correct it

See this TurboTax support FAQ for the IRS rejection code - https://ttlc.intuit.com/community/rejections/help/e-file-reject-ind-031-04-or-ind-032-04-the-agi-or-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

I'm filing MFJ so shouldn't require individual AGI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

If you’re married filing jointly this year and were married filing jointly last year, it’s looking for last year’s married filing joint AGI.

Please see the TurboTax Help articles How do we handle our AGI if we used Married Filing Separately in 2018 but are filing jointly in 2019... and Whose AGI should newlyweds use? for different scenarios.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

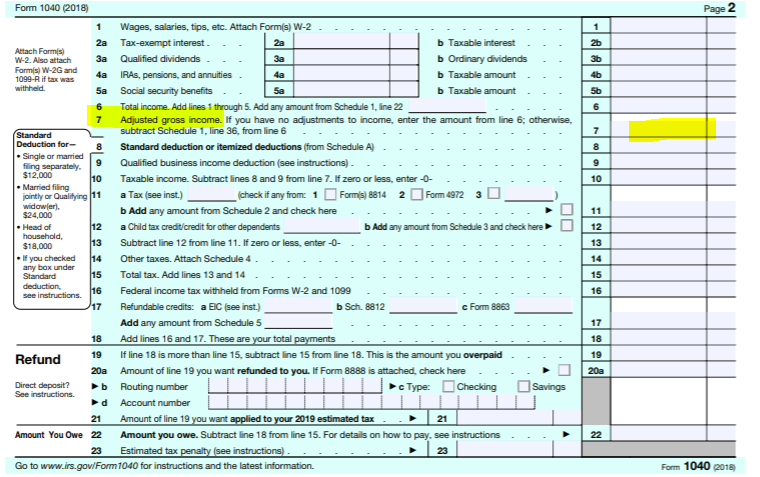

You need your 2018 AGI to efile 2019. The AGI is on 2018 1040 line 7. If you filed a Joint return you use the same AGI for each spouse How to find the AGI.

https://ttlc.intuit.com/community/agi/help/how-do-i-find-last-year-s-agi/01/25947

Sorry to ask but did your spouse die in 2019? There is a problem with Efiling when one spouse died during the year. You have print and mail your return this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

the same thing happened to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code IND-031-04

Rejection Code IND-031-04 means that your 2018 adjusted gross income (AGI) you entered for yourself and/or your spouse doesn't match the numbers in the IRS database.

Your can find your correct 2018 AGI, If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

If you have a copy of your 2018 tax return, your AGI is located on line 7.

To correct your 2018 AGI is accurately reflected to file your 2019 data, follow these steps while in TurboTax:

- Select File from the left hand side of your screen,

- Complete Step 1 and 2 if you haven’t already done so, then go to Step 3.

- When getting to the Let’s get ready to e-file screen after selecting Step 3, select I want to e-file before you continue.

- Follow the online instructions. When prompted, put in your exact 2018 AGI.

- Continue through the screens until you’ve re-transmitted your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fredbiven

New Member

h2o-color

New Member

paige-muskopf

New Member

obviouslyitsyanna7

New Member

jckanderson

New Member