- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I took standard deduction last year, my wife itemized

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

Hello,

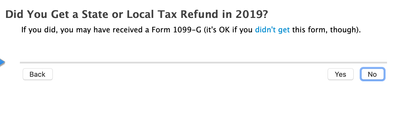

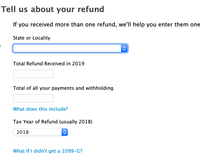

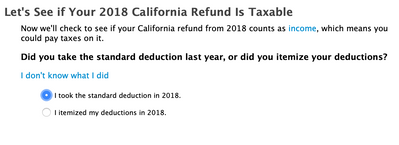

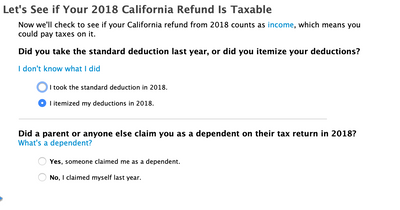

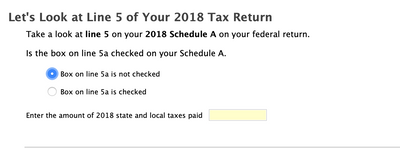

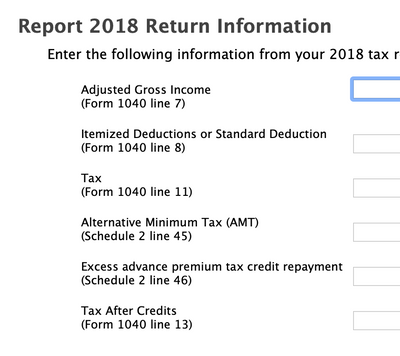

I am having a bit of a challenge with this question - see screenshots.

1) turbotax already had my info.

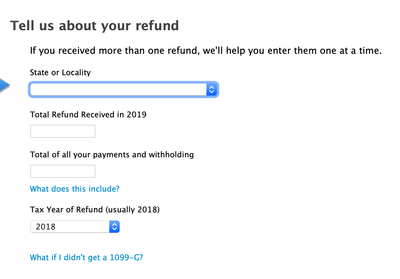

2) we have my wife's 2019 1099-G and there is an amount in box2. So i plan to add this amount to what I see on mine to make an entry per the instructions in the screenshot.

3) how would if find out my wife's total of all payments and withholdings?

4) once I find answer to (3), do i add that amount to what it currently appears on turbotax?

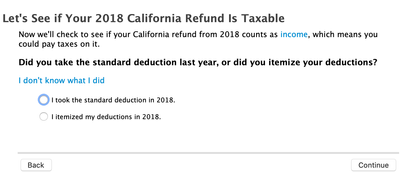

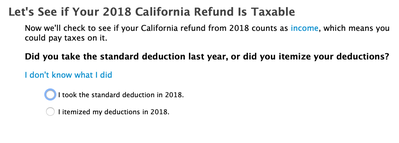

5) once the section is complete it asks lets see if your 2018 tax refund is taxable? I would have to answer it, but in my case m wife itemized and i took the standard deduction. Since we are filling jointly how would i answer this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

Only enter her 1099G state refund since she itemized. Your refund is not taxable or reported.

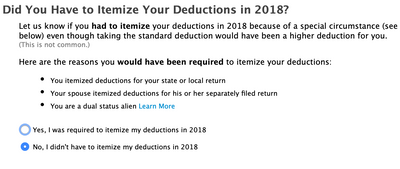

TurboTax does not handle this. If you enter more than one state refund, it just adds them together. It does not ask separately for each refund whether you itemized last year. It just asks once after all the refunds have been entered. There is only one State and Local Income Tax Refund Worksheet, so there is no way to do the calculation separately for the taxpayer and spouse. The help for the worksheet even says that a change in marital status from last year is one of the situations it does not handle.

So either.....

If you both itemized deductions last year then add them together and enter it.

If you both took the standard deduction last year add them together and enter it.

If one person took itemized deductions and the other one took the standard deduction then only enter the one that itemized deductions.

And answer the follow up questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

were you married in 2018 and used the Married Filing Separate tax status -then one itemizing and one taking a standard deduction is a no-no. the law is both must use the same method.

assuming you got married in 2019 then her refund may be taxable. don't enter your refund because since you took the standard deduction (again assuming marriage in 2019) it is not taxable. see PUB 525 and carefully read the instructions and footnotes for each line that has them if her total tax deduction for 2019 was limited due to the cap.

For an individual who paid no more than $10,000 of state and local taxes (income or sales) during 2018, a taxable state tax refund of the year 2019 is the smaller of:

1) The refund amount (normally shown on 2019 Form 1099-G).

2) The excess of itemized deductions over the standard deduction for 2018.

3) The excess of state and local taxes actually deducted during 2018 over the sales taxes that could have been deducted during 2018.

4) if she paid the alternative minimum tax then the answer is more complex because of the way the tax deduction is treated for AMT purposes. The way we handle state income tax refunds was to go back to the prior year and reduce the amount of state income taxes by the refund. then we would see if the total income taxes (regular tax + amt tax) changed. if not that means the state tax deduction produced no tax benefit so the refund was not taxable. if there was a change we worked back and forth on the amount used for state income taxes to arrive at a result that produced no change in the income taxes. the excess of the original state income tax amount over the revised state income tax amount was the amount that produced a tax benefit.

even when there is no AMT issue because of the limitation in 2018 of the deduction for state taxes a refund pf state income taxes could produce no tax benefit and thus not be taxable. example taxpayer pays $8000 in real estate taxes and $5,000 in state income taxes. total taxes for schedule A $13,000 limit on deduction is $10,000. in 2019 got a refund of $1,500 in state income taxes. , that refund produced no tax benefit because had only the net amount had been deducted ($3500 = $5000 less $1500 refund) the deduction would still be limited to $10,000 so there was no benefit from the $1500 refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

Hello,

We got married end of 2019. But I took the standard deduction last year and she itemized last year. So in these screenshots.

1) i answered yes to we both received state or local tax refund in 2019.

2) in the section tell us about your refund. I did not get a 1099G, but my wife did. Since I took the standard deduction, and my wife itemized, how would i go about filling out this info (do i just include her info and not mine?)

** Total refund received in 2019 ====> how do i find in our previous year tax returns?

** Total of all your payments and withholding ==> how do I find it in our previous year tax returns?

** Tax Year Refund (Usually 2019)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

Hello,

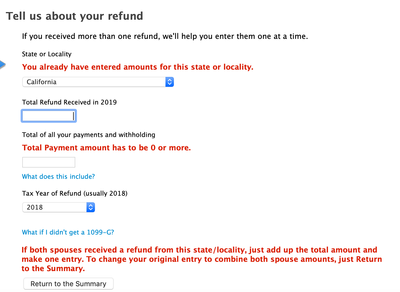

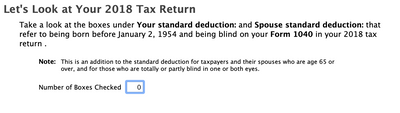

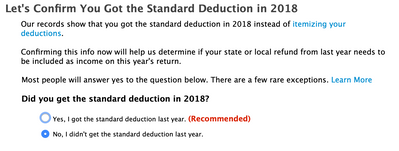

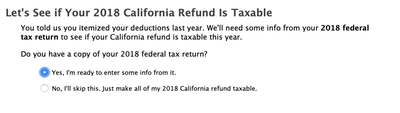

This is what I decided to do. But it looks like if I enter only her info, since TurboTax had imported all my info from last year's tax, now

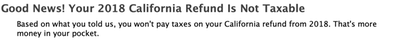

So it asks let's see if your 2018 California Refund is tax deductable: At this point it asks if I took the standard deduction. But here is where it gets tricky because I itemized and my wife did not itemize.

====> But if I select "I itemized", then TurboTax will get confused because based on the info it imported.

===> at this point, what should i do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

On the other Hand if I just answer the question to apply only for my situation, which means I did not itemize, but using my wife's info for her 2018 Tax Refund, then it tells me good news is not taxable.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ninaya1

New Member

MADELYNNCAROL

New Member

Omar80

Level 3

jwicklin

Level 1

user17550205713

Returning Member