- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello,

We got married end of 2019. But I took the standard deduction last year and she itemized last year. So in these screenshots.

1) i answered yes to we both received state or local tax refund in 2019.

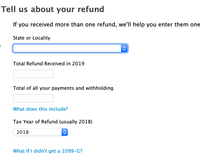

2) in the section tell us about your refund. I did not get a 1099G, but my wife did. Since I took the standard deduction, and my wife itemized, how would i go about filling out this info (do i just include her info and not mine?)

** Total refund received in 2019 ====> how do i find in our previous year tax returns?

** Total of all your payments and withholding ==> how do I find it in our previous year tax returns?

** Tax Year Refund (Usually 2019)

July 7, 2020

10:05 AM