- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hello,

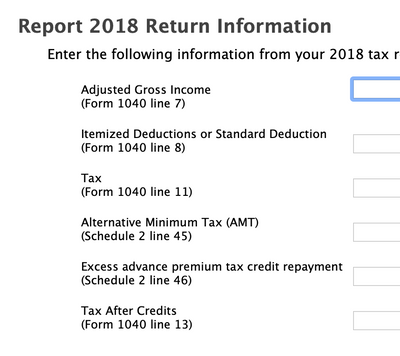

This is what I decided to do. But it looks like if I enter only her info, since TurboTax had imported all my info from last year's tax, now

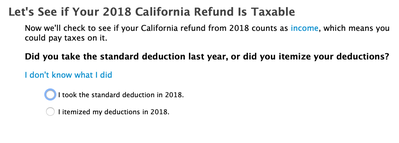

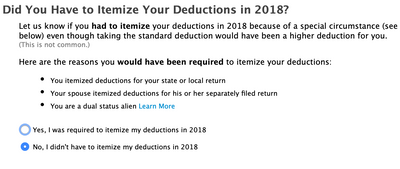

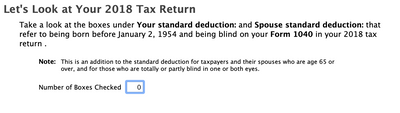

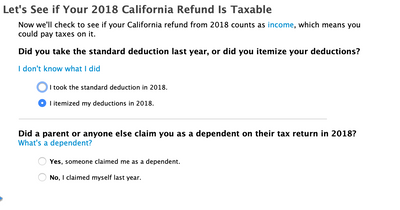

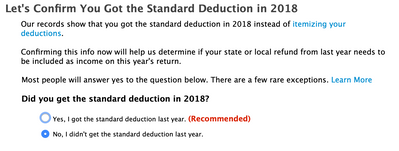

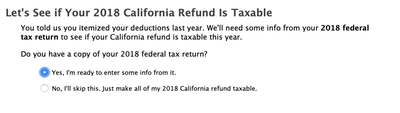

So it asks let's see if your 2018 California Refund is tax deductable: At this point it asks if I took the standard deduction. But here is where it gets tricky because I itemized and my wife did not itemize.

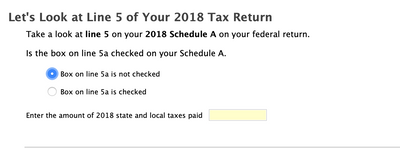

====> But if I select "I itemized", then TurboTax will get confused because based on the info it imported.

===> at this point, what should i do?