- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took standard deduction last year, my wife itemized

Hello,

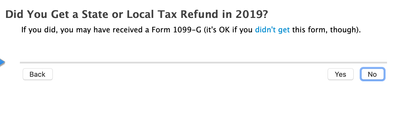

I am having a bit of a challenge with this question - see screenshots.

1) turbotax already had my info.

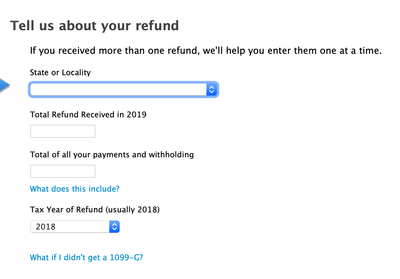

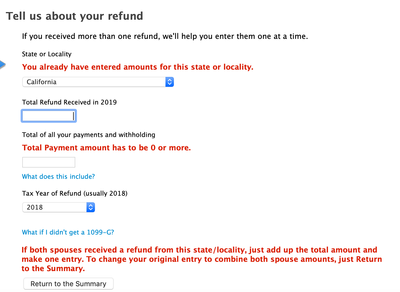

2) we have my wife's 2019 1099-G and there is an amount in box2. So i plan to add this amount to what I see on mine to make an entry per the instructions in the screenshot.

3) how would if find out my wife's total of all payments and withholdings?

4) once I find answer to (3), do i add that amount to what it currently appears on turbotax?

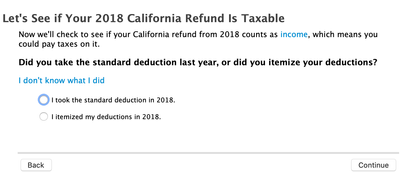

5) once the section is complete it asks lets see if your 2018 tax refund is taxable? I would have to answer it, but in my case m wife itemized and i took the standard deduction. Since we are filling jointly how would i answer this?

Topics:

June 21, 2020

4:45 PM