- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

When I replace Undetermined with long term it decreases refund by $400. I can also change date acquired from n/a to various. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

@Jbradley37931 If it was purchased on various dates, then various is correct. The n/a is not an option allowed. Various, Inherit, or a date are the only choices.

Once you selected a date the program could understand and a holding period, the program was able to enter that transaction into the program. It wasn't about long term, it was about actually entering the transaction on to your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

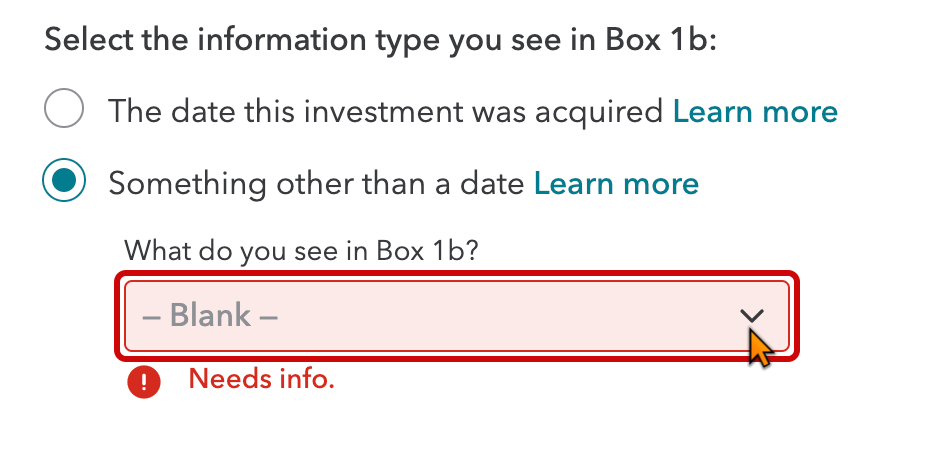

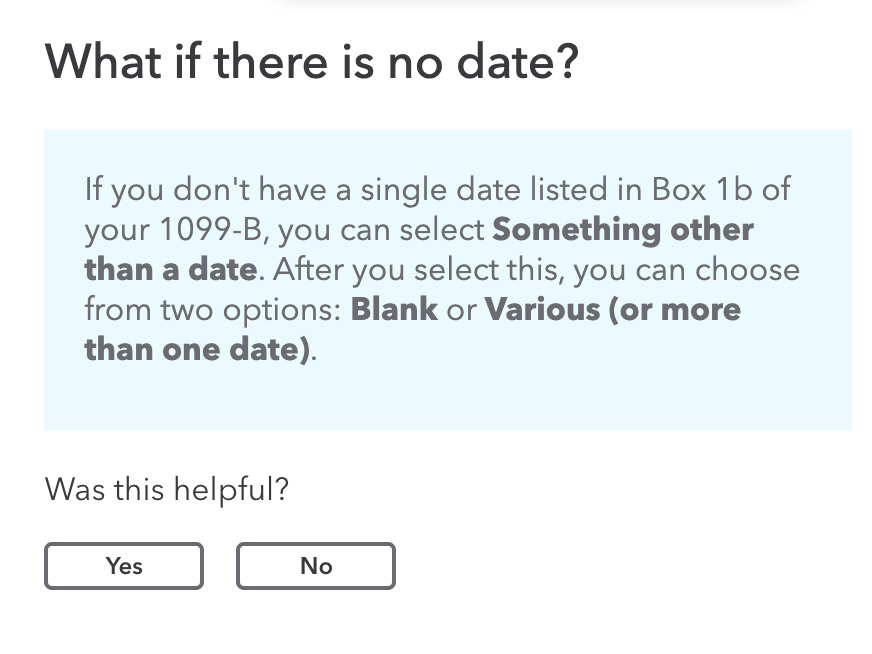

Note this is still an issue as of 2/12/2022. My 1b box is blank on my 1099-B for Long-term gains, and Turbo Tax tells me in the "help" sidebar that I can choose "Something Other than a Date" > "Blank" or "Various", but when I choose "blank," and then go through the steps to finalize my federal submission, it says that 1B Box response of "Blank" is not acceptable and Needs Info.

on the phone with TurboTax support for 30min and they are unable to assist.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

When entering the stock sales if there is no acquisition date that normally means that there are various dates. For the acquisition date only you can enter the word "Various" in the box for the acquisition date. When you use the word "Various" you will need to enter whether it is a long-term or short-term sale. You can usually find this on the 1099-B you have received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

I selected Various Dates Jill, but I was NOT asked if it was short term or long term. Did the system ask you? Can you show a screen shot?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

When you enter a sale with various purchase dates you first have to manually figure which dates are short term and long term. Then split the sale into 2 sales, one for Short term and one for Long term. I think when you start entering sales you pick the term or enter the code like A- E to tell it. Then to do the other term you start over with new sales to pick the term again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

If I did that Volvogirl, my entries would not match my 1099-Bs and that is a red flag for the IRS, been there, done that, got audited!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

then why does TurboTax have the option to select "Blank" - but then won't let us select it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

Please log completely out of the TurboTax website, then clear your browser's cache and delete cookies. A full or corrupted cache can keep TurboTax from functioning properly.

If you continue to have issues please reach out to a TurboTax representative for assistance.

What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

Of course I have cleared my cache, etc. And I spent an hour on the phone with an Intuit rep yesterday, who acknowledged that there is a problem, because she tried it and it didnt work for her either. You can see posts about this problem going back to 2019, with no resolution. I don't understand why Intuit can not simply fix the glitch. People, who have used Turbotax for years are quiting Turbotax because of this issue, and I will probably join them. The Intuit rep suggested I might try the desktop version. Really? No thanks... 🙄

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

If you don't know the date or your form does not have a Date Acquired, You will click "Various or (more than one date) then click continue. This should resolve your issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

Hi @DaveF1006

thanks so much for your reply. its really helpful! But just to make sure I get it correct can you provide examples of acceptable dates for short-term and long-term transactions considering sale date as 02/03/22?

Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

If you don't see the Long-Term sales report to the IRS with Box B checked on your 1099-B. You can determine if the sale is short-term or long-term by calculating the dates purchased and sold.

To be considered Long-Term, you must have made the purchase longer than one year before it was sold. For example, you purchased stock on February 2020 and sold the stock in April 2022.

To be considered Short-Term, you must have made the purchase less than a year before it was sold. For example, you purchased stock on February 2022 and sold the stock in August 2022.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 1099-B, the 1b (date acquire) field is blank. It doesn't have anything in it at all. When I try to leave that space blank n TurboTax, it tells me I must enter date

Select the box below that says "something other than a date" then select "various" This will make your frustrations go way. Hope this helps, have a great one!

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17631449562

Level 1

illinoisian

New Member

Sam123

Level 1

griverax

New Member

tgensheimer

New Member