- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

I am having the same problem.

TT says I can e-file federal and NJ state (nonresident) but not NY (resident). I have filed with TT for years and this is the first time this happens. My tax situation has not changed.

I talked to TT help and they could not find anything wrong. Of course the issue only appeared after I paid $160. What is the point of using turbotax if I cannot e-file? It does not even tell me what the problem is.

Now I have to print my returns and mail them in the middle of a pandemic to get my refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Yes, I worked with another customer service agent for over an hour on Friday and we worked with her boss and we determined the reason I could not e-file my nonresident NY state return is because turbo tax does not support the e-filing of an IT-2 form. This form is required to be filed by New York (it is a summary form of my W-2s). They admitted it is a bug or a problem that has to be fixed for next year.

Also, my husband called New York because we were concerned, since on the New York return to print, there is a page that says "this return needs to be e-filed due to New York law if prepared with online software". Thankfully they said if the software does not allow you to e-file you can mail it with no penalty. But regardless it was such a mess, I went through the software at least 10 times, I have used Turbo tax for over 5 years, guess I will not be using them in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

@DoninGA Seriously, that's your reply??? Why waste everyone's time if you are too lazy to read.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

@DoninGA Well clearly you canot read or understand the basic issue at hand. The program that people pay for can no longer efile because of a TT technical bug. It us not rocket science, people (,myself included) are not impressed about learning this AFTER WE PAID FOR THE CONVENIENCE OF EFILING. If you cannot understand that I suggest you go back to hibernation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

I am not sure I understand your response, when I made my initial comment, I had already paid for the services so I am forced to use Turbo Tax at this point, not throwing away $160. I was sharing my story to hopefully give an explanation to those who did not get any answers from customer service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

@DoninGA Reading or comprehension are clearly your enemies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Replying to DoninGA who cannot grasp the problem that everyone dealing with TT and NYS are experiencing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Same here, have used TT for years, always e-filing both Federal and State, but this year it will not let me e-File NYS, and it does not give any good explanation... ("This return is in a tax situation that does not allow you to e-file").

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

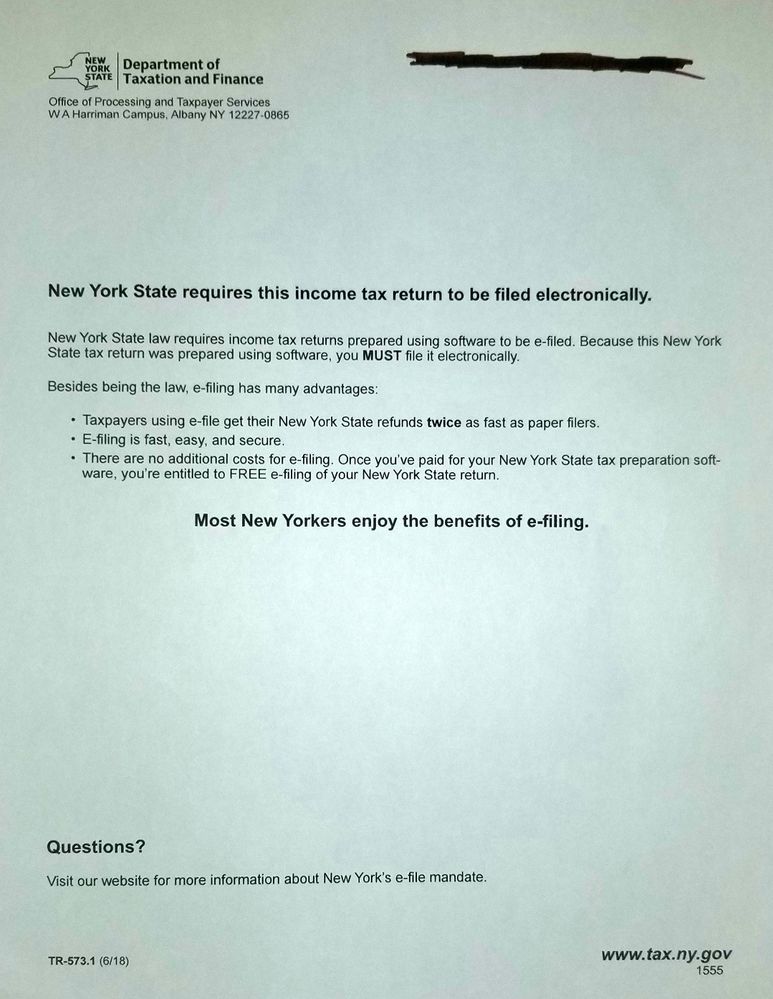

DoninGA is so repetitively wrong that I'm starting to think it's a Russian chatbot. I have the same problem. I was able to file by 2020 federal return. Then I was told, via 2 calls with turbotax CPAs to print it out and send it NYS based on TurboTax instructions. The problem is ... the second page that prints out, which appears to be from NYS Department of Taxation & Finance, says the following (I'll try and use the same BOLD that the form uses:

New York State requires this income tax return to be filed electronically.

New York State law requires income tax returns prepared using software to be e-filed. Because this New York State tax return was prepared using software, you MUST file it electronically.

Besides being the law, e-filing has many advantages:

- Taxpayers using e-file get their New York State refunds twice as fast as paper filers.

- E-filing is fast, easy, and secure.

- There are no additional costs for e-filing. Once you've paid your New York State tax preparation software, you're entitled to FREE e-filing of your New York State return.

Most New Yorkers enjoy the benefits of e-filing.

Questions?

Visit our website for more information about New York's e-file mandate.

TR-573.1 (6/18) www.tax.ny.gov

1555

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

@hankb99 Then your issue is with the New York State Department of Taxation and Finance who maintains this website - https://www.tax.ny.gov/pit/efile/efile_mandate_for_individuals.htm

As stated on the website -

You're required to electronically file your return if you meet all three of the following conditions:

- you use software to prepare your own personal income tax return; and

- your software supports the electronic filing of your return; and

- you have broadband Internet access.

If the TurboTax software is unable to e-file the New York State tax return, then the requirement your software supports the electronic filing of your return is Not met.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Clearly comprehension of the topic eludes you. TURBOTAX IS BROKEN AND DUE TO A SYSTEMS ISSUE CANNOT EFILE NEW YORK RETURNS!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Thousands of New York state tax returns have been e-filed using the TurboTax software. So there is no systemic problem with the software regarding e-filing. On a case by case basis there could be issues on a particular tax return. In those cases TurboTax support needs to be accessed so they can review the tax return for those issues.

Standing down.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

@DoninGA You don't have to stand down, unless you want to stop making a fool of yourself.

After my 4th call with a turbotax expert, they admitted that "turbotax doesn't work for efiling NY returns." Then, after 7 hours of back and forth, they eventually agreed that I cannot submit a PDF of the return that was created by their software, according to NYS law. So, their recommendation was to get an extension from NYS, then do my returns on my own. Finally, they said that they were willing to consider refunding me the $55 I paid to efile my NYS returns. ... honestly, this sounds like a class-action lawsuit in the making.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

Count me in. TurboTax Thieves need to make it right instead of BS'ing everyone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY requires me to e-file tax returns but your software will not let me without e-filing federal returns. My fed returns has been paper filed 2 months ago.

A good friend of mine suggested that I fill out a Consumer Protection Complaint with the NY Attorney General. He said that they are actually pretty good about following up on these complaints. So, if anyone else wants to fill one out, here's the website: https://formsnym.ag.ny.gov/OAGOnlineSubmissionForm/faces/OAGCFCHome;jsessionid=8WJY2RUqRO0-pX7DEHaVW...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

deniseh

Returning Member

ericbeauchesne

New Member

in Education

sburner

New Member

tyjaha

New Member

ttla97-gmai-com

New Member