- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to enter into TurboTax an IRS Direct Pay payment already made?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

will this show as an estiamted payment becuase others said not to change the 1040 - not to put in as estiamted payments as it was not - i paid with extnsion thru direct pay...i also am hacing trouble following driections.. and if i figure out directions - does it pass through to the nj state as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

It doesn't matter HOW you paid it. When you did direct pay did you say it was for an extension?

It goes here,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

It really doesn't matter if you enter it on your tax return or not. You can file it showing the balance due and the IRS will match it up to your payment. So file it and say you will mail a check. Then you don't need to mail a check since you already paid it online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

thanks

Yes when I did Irs direct pay I selected extension - so do I put in extension amt I paid in TurboTax? What about state?

so put it in the 1040 form because one of your other responses was to leave the 1040 with the amount due and say I sent a check in but the IRS will match up the payment that I used to direct pay but since I did direct pay with extension are you saying now that I should go in and put that amount in the 1040 and show no taxes owed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

If you used the TurboTax Easy Extension to electronically file the extension request, Form 4868, and make the tax payment with the request, the payment should already entered on your tax return. Provided you used the same user ID for the 2017 online tax return as was used to use Easy Extension. You can check to see if the amount is on your tax return by clicking on Tax Tools on the lefts side of the screen. Then click on Tools. Click on View Tax Summary. Then click on Preview my 1040.

To enter, change or delete a payment made with an extension request (Federal, State, Local) -

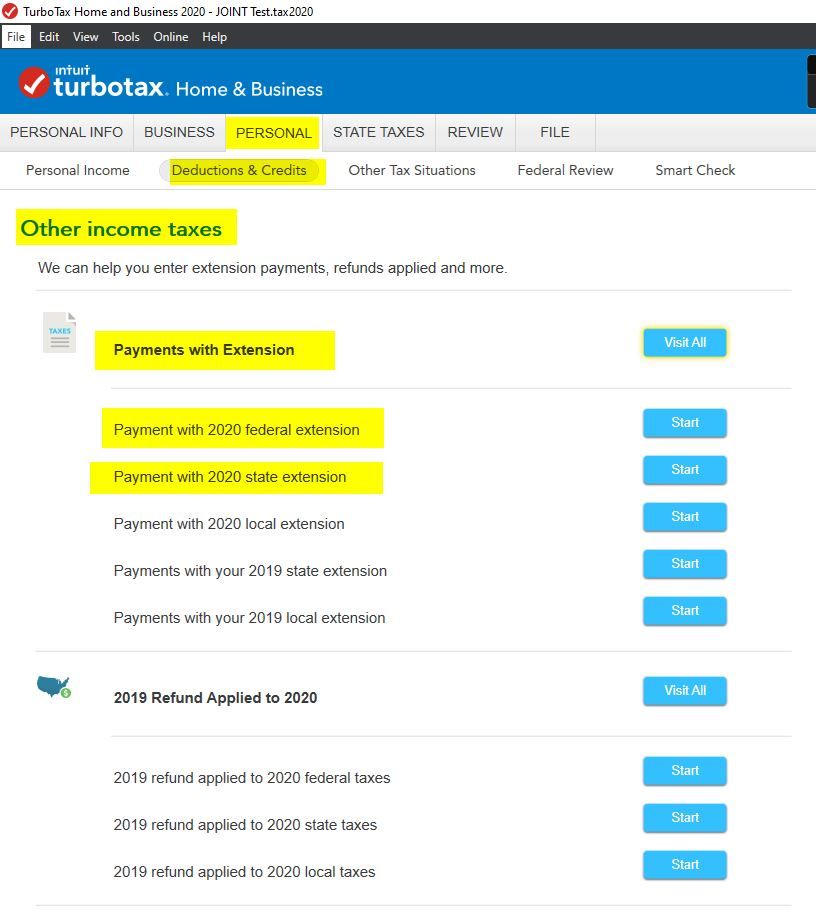

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Estimates and Other Taxes Paid

- On Other Income Taxes, click on the start or update button

On the next screen select the type of extension payment made and click on the start or update button

Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

Whoops, I didn't know we had to put down estimated payments. I thought TT would have done it automatically because i filed extension through them. I assume the IRS will just bill me or refund me the different so i don't need to amend?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

You made an estimated payment OR a payment with an extension to file? They are different and go on different lines on your tax return.

Did you use Turbo Tax to file the extension? Then it should automatically show up on 1040 Schedule

3 line 9. And go to 1040 line 31. See if it's there.

Estimated payments are on 1040 line 26.

If it didn't show up on your tax return the IRS should catch it and add it in for you. Either increasing your refund or decreasing a tax due. They may even send it back to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

@VictoriaD75 @jms206 @VolvoGirl

I’d love to ask if any of you has insight into a very similar question to @jms206 ’s question from August 2021. I’m using TurboTax Desktop for tax year 2018.

I made tax payments in Aug. 2021 through IRS Direct Pay for tax year 2018, and I am just now trying to file 2018 with TurboTax. I’ve tried to follow @VictoriaD75 ’s advice on going to “Federal estimated taxes” to enter my 2021 payment (simply changing the ‘Date paid’ field), but TurboTax is not allowing me to enter any date later than 12/31/2019.

What should I do to ensure my tax filing reflects the payment made in 2021? Or, should I complete the filing and just ignore the payment I made in 2021, and trust that the IRS will see that ‘credit’ on my account?

Many thanks for any help,

Kate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

No, I wouldn't skip entering the amount paid in hopes the IRS will pick up the amount anyway. I think the best option is to use the latest date you can, which is 12/31/2019.

The IRS will adjust the dates paid automatically and the amount will show as already paid. You may get a letter assessing an additional late payment penalty, but I think this approach is better than leaving it off and hoping they put it all together at the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

Thanks so much Julie! Good advice - I’ll do as you suggest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

Hi everyone,

I could really use some help here with a similar problem and I want to thank you in advance.

Here is my situation:

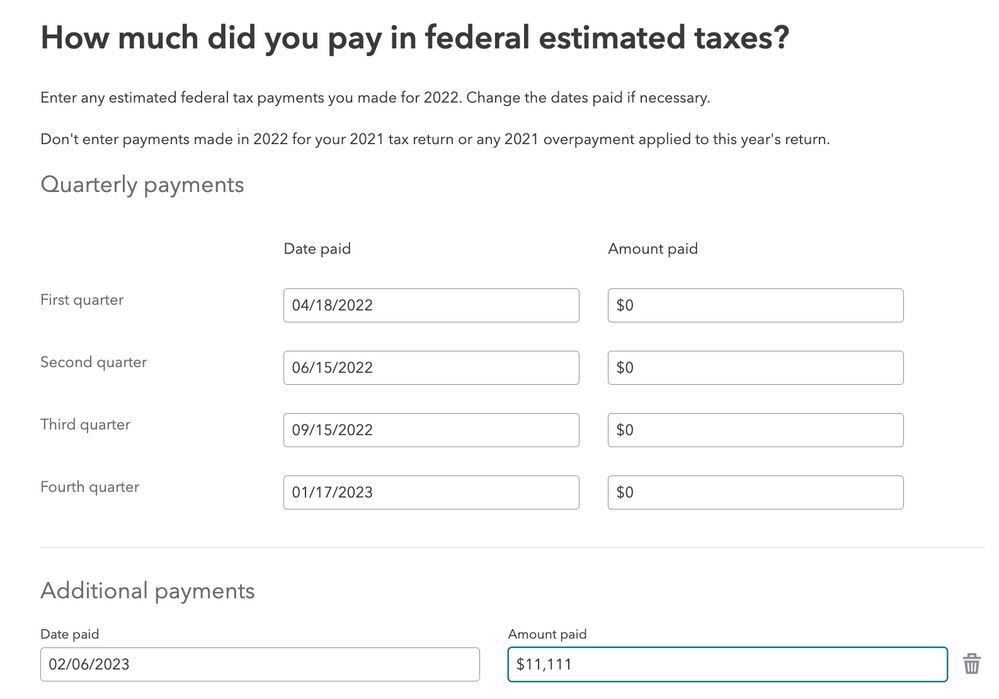

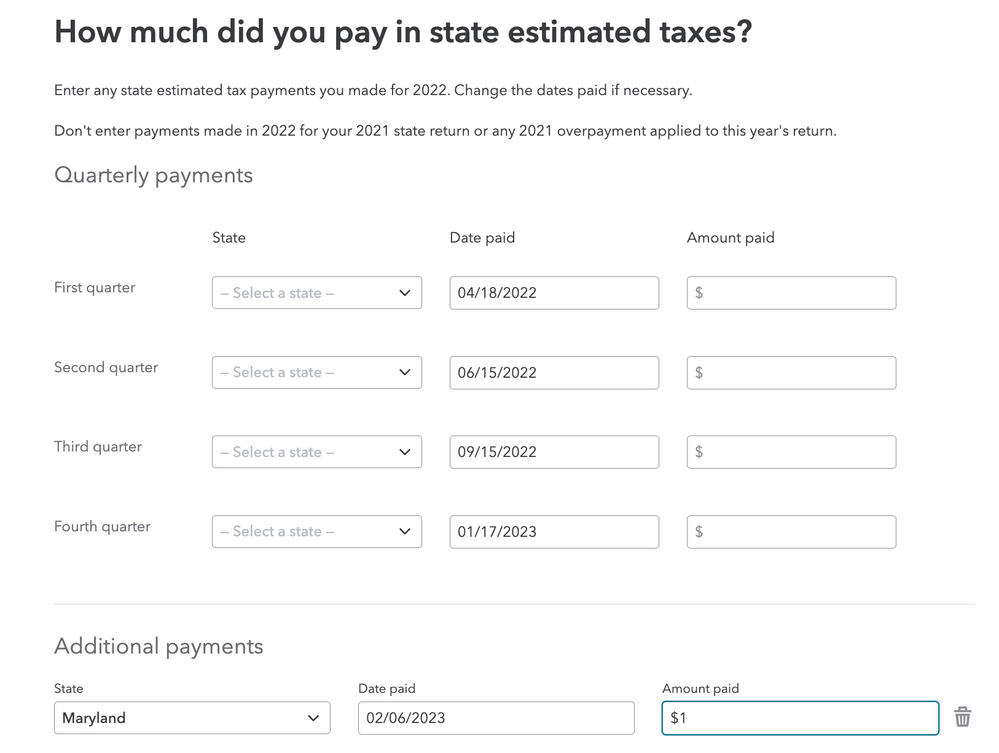

1. Due to a couple of reasons, I owe both federal and state taxes and penalties for 2022.

2. I e-filed on 1/31/23 but all returns got rejected with an error code Reject Code F8960-019-04. This is an ongoing problem that prevents me from e-filing now. I want to wait until this is fixed by IRS and e-file.

3. In the meantime, I want to use direct pay through my ID.me account to pay the taxes and penalties I owed on Monday 2/6/23 to avoid more penalties for both federal and my state Maryland.

4. My question is if I pay now before I e-file, which one of the following should I do?

a. make NO change to my current return and select pay by check when I e-file (probably by end of Feb. 2023)

b. enter the amount I paid in estimated tax as additional payment with the date of 02/06/2023 for both federal and state like the pictures below (amounts just for demonstration).

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

The answer is 4a. Select you will pay by check and your online payment will match up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

@Critter-3 Thank you for linking both posts. However, I was confused by your answer and would very much appreciate getting them cleared up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter into TurboTax an IRS Direct Pay payment already made?

The answer is 4a. In the TT program, FILE tab step 2 ... choose to pay the balance due on the return by check and then DON'T send a check since you already paid the balance due online.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

steve-knoll

New Member

bees_knees254

New Member

barbaramays333

New Member

arti-kwatra

New Member

andrii16

New Member