- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi everyone,

I could really use some help here with a similar problem and I want to thank you in advance.

Here is my situation:

1. Due to a couple of reasons, I owe both federal and state taxes and penalties for 2022.

2. I e-filed on 1/31/23 but all returns got rejected with an error code Reject Code F8960-019-04. This is an ongoing problem that prevents me from e-filing now. I want to wait until this is fixed by IRS and e-file.

3. In the meantime, I want to use direct pay through my ID.me account to pay the taxes and penalties I owed on Monday 2/6/23 to avoid more penalties for both federal and my state Maryland.

4. My question is if I pay now before I e-file, which one of the following should I do?

a. make NO change to my current return and select pay by check when I e-file (probably by end of Feb. 2023)

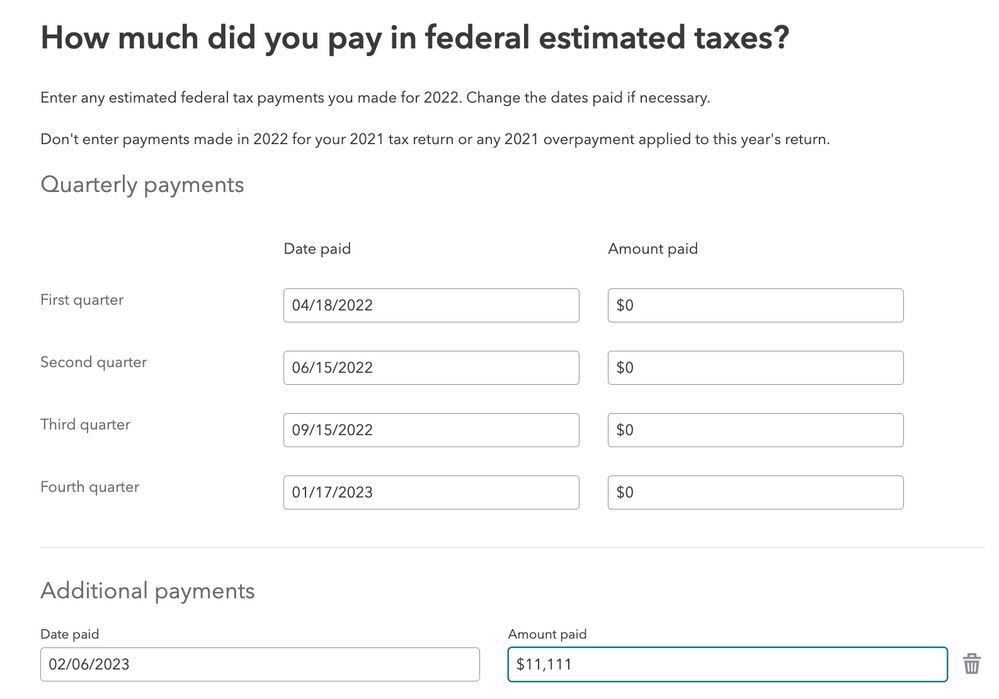

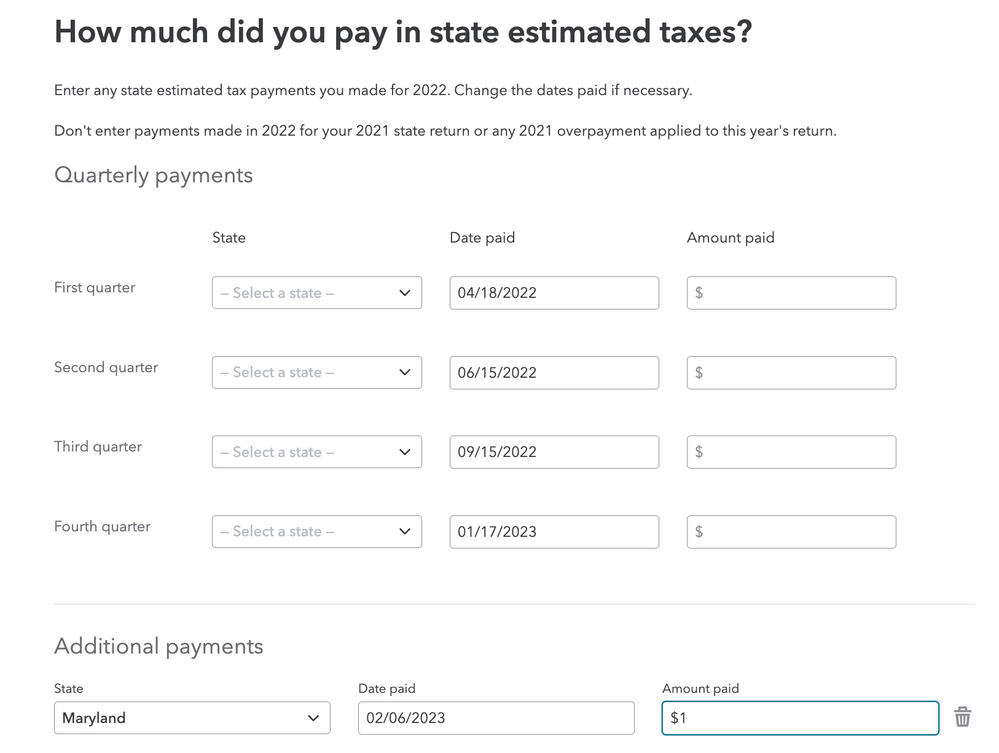

b. enter the amount I paid in estimated tax as additional payment with the date of 02/06/2023 for both federal and state like the pictures below (amounts just for demonstration).

Thank you!