- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: State and local taxes greater than $10,000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

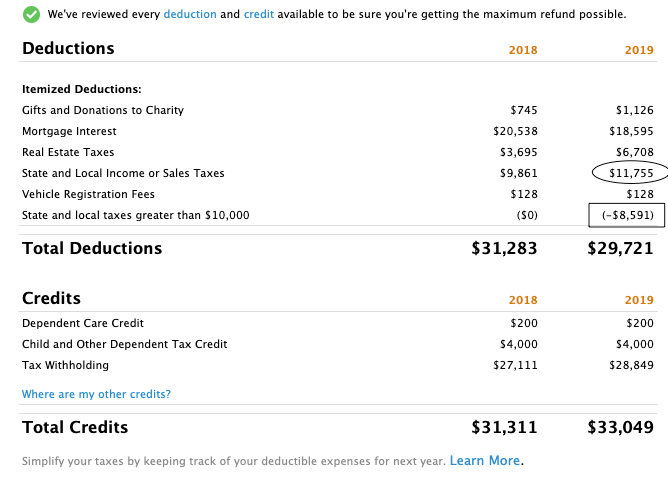

Question on SALT deduction. I know that the law changed in 2019 and it now maxes at 10,000. But looking at the screen our State and local income or sales taxes are $11,755 but then it's deducting from my deductions (-$8,591). Shouldn't it just be duducting the overage of $1,755.

Thanks in advance for the help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

SALT includes state and local income tax paid, state sales tax paid, and property taxes paid

Look again at your amounts---

Real estate taxes 6708

State and Local Income or and Sales tax 11755

Vehicle registration 128

Those add to $18,591 - 10,0000 = 8591

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

SALT includes state and local income tax paid, state sales tax paid, and property taxes paid

Look again at your amounts---

Real estate taxes 6708

State and Local Income or and Sales tax 11755

Vehicle registration 128

Those add to $18,591 - 10,0000 = 8591

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

Thanks. Didn't realize property tax was in there too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

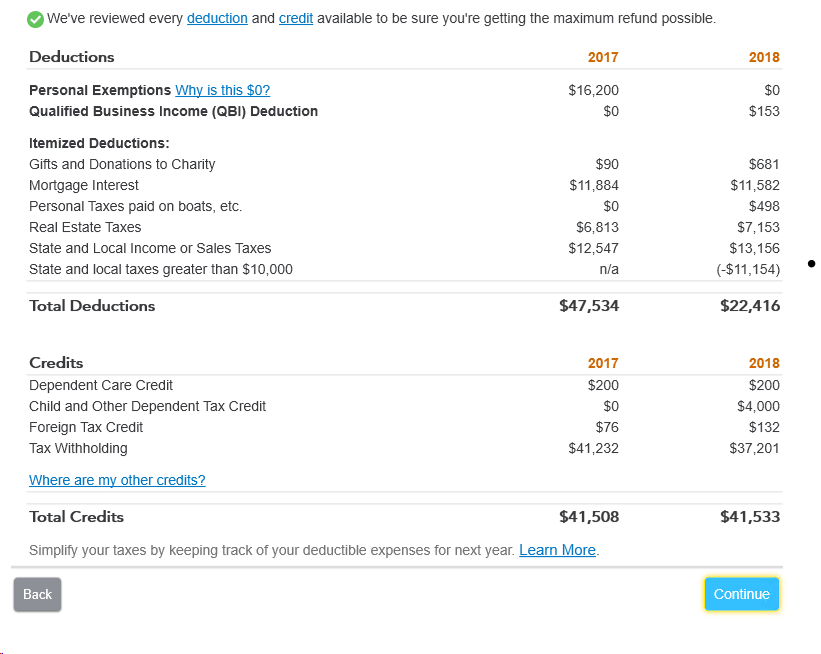

@xmasbaby0, related to your response, can you help me figure out how mine is being calculated?

I can't figure out how they are coming up with $21,154 of SALT deductions and thus subtracting the $11,154.

My math is $13,156 + $7,153 + $498 = $20,807.

Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

The summary screens can be confusing ... sometimes looking at the actual Sch A would be better ... 681 + 11582 +10000 + 153 = 22416 total deductions ( can't forget the QBI on this list even though the QBI is not on the Sch A) this summary list is the total deductions on the return.

498 + 7153 + 13156 = 10000 max

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

Thanks Critter for spotting this one. I missed it. Looks like Critter set you straight-- you forgot that the SALT limit is $10,000 so you were adding up too much for your state and local taxes + real estate taxes. You are capped at $10,000 no matter how much you really paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

@CR and @xmasbaby0 thanks for your reply, however, I'm trying to figure out how TT calculated $11,154 they are disallowing. I don't as I mentioned, 498 + 7153 + 13156 - 11,154 doesn't equal 10,000.

Thanks for your help!

Mark

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

I suggest you look at the actual forms since the summary screens can be very misleading ... save a PDF of the return with the worksheets for the breakdown of those figures.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

@B0555555 Seems like you still do not understand what the SALT limit means. Of course those numbers add up to more than $10,000. But....the tax law says you cannot deduct more than $10,000 for your state and local taxes and real estate taxes. You kiss some of the deduction goodbye under the tax laws that went into effect for 2018 and beyond.

But....your standard deduction is higher than it used to be, so less of your income is taxed from the get-go.

Are you making the common mistake of just adding up all the amounts for your itemized deductions without considering the caps and thresholds that must be met?

STANDARD DEDUCTION

Many taxpayers are surprised because their itemized deductions are not having the same effect as they did on past tax returns. The new higher standard deduction and the elimination of certain deductions, as well as the cap on state and local taxes have had a major impact since the new tax laws went into effect beginning with 2018 returns.

Your itemized deductions have to be more than your standard deduction before you will see a change in your tax owed or tax refund. The deductions you enter do not necessarily count “dollar for dollar;” many of them are subject to meeting tough thresholds—medical expenses, for example, must meet a threshold that is pretty hard to reach. The software program uses all the IRS rules that apply to the expenses you enter, and it tells you if you have enough to use your itemized deductions or if using the standard deduction is more advantageous for you. Under the new tax laws, some deductions have been capped—there is a $10,000 limit to the itemized deductions for state, local, property and sales taxes.

Your standard deduction lowers your taxable income. It is not a refund.

2019 Standard Deduction Amounts

Single $12,200 (+ $1650 65 or older)

Married Filing Separate $12,200 (+ $1300 if 65 or older)

Married Filing Jointly $24,400 (+ $1300 for each spouse 65 or older)

Head of Household $18,350 (+ $1650 for 65 or older)

Look on line 9 of your 2019 Form 1040 to see your itemized/standard deduction amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

Hi,

There is an error in the Turbo Tax calculation on the state and local taxes greater than $0 for me.

Mortgage interest: $10,589

State Income Taxes: $21,129

State and local taxes greater than 0: (-$21,129)

TOTAL DEDUCTION: $10,589.

The above is incorrect because it should be $21,129 - $10,000 = 11,129.

Therefore, the state and local taxes greater than 0 should be (-$11,129).

How do I fix this in Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

To help get you connected to the right person, please click the link below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

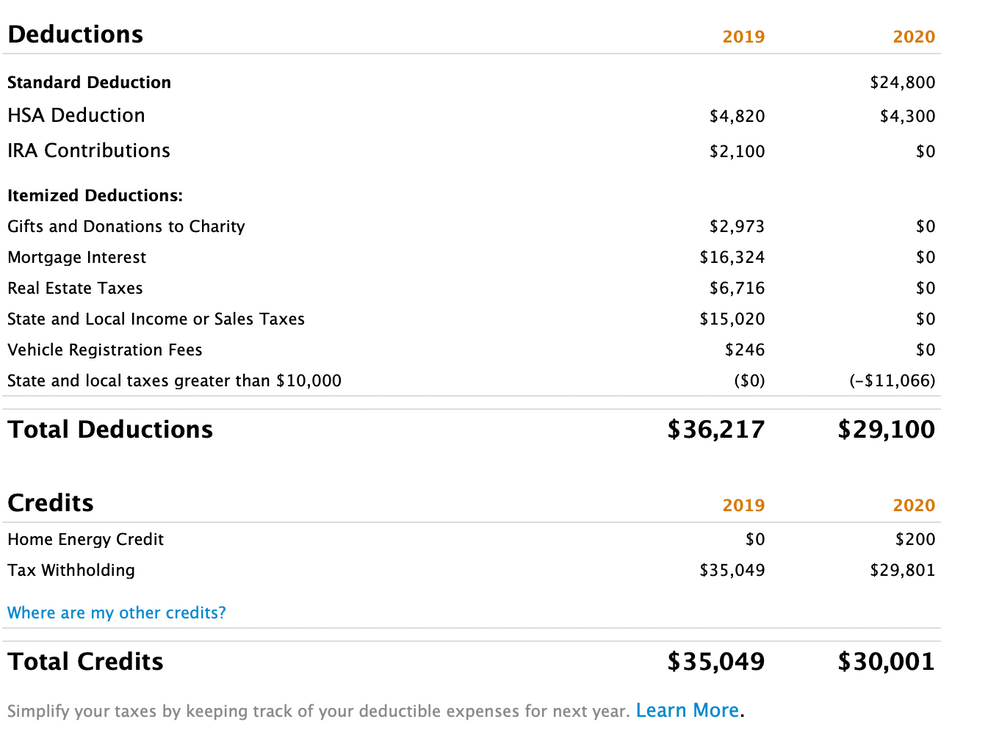

State and local taxes greater than $10,000

My property tax is 6,926.00

Car Registration 209.00

State Income Tax 12,046.00

SDI 1,885.00

Total $21,066.00

It seems it should just show $10,000 deduction for state, but instead it's subtracting $11,066. Because of this it has zeroed out all of my itemized deductions and is applying the standard deduction, when my other deductions would be higher. Look how it calculated last year. My state taxes were higher and it used them.

Can anyone tell me why?

Thank you for any help you can offer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

Have you already entered all of your other itemized deductions? If you manually go in and change your selection to take itemized deductions instead of the standard deduction it is giving you, does that make any difference? See the link below for instructions on how to override the deduction chosen by TurboTax.

I do see an issue that is being addressed regarding itemized deductions, but I am not sure if this is the same issue that will be resolved in a future update or if this is unrelated. And do you have charitable contributions listed on your return?

How do I change from the standard deduction to itemized (or vice-versa)?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

I have put in all of my itemized deductions. When I asked to change deductions, it shows my itemized deductions as $19,817, which is not the case. My other itemized deductions come to $20,030 and if you cap off the state taxes at $10,000, that would give me $30,030 in itemized deductions which would be more than the standard.

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State and local taxes greater than $10,000

If it's giving you the Standard Deduction and not showing you Schedule A you can check the actual amount of itemized deductions by using by going to

Tax Tools on left

Tools - Topic Search (top left box)

Type in itemized deductions, choosing. It should highlight that in the list, click on GO

Then Click on "Change my deduction". That will display the actual amount of itemized deductions vs. the standard deduction. (Be sure to uncheck "Change my deduction" after checking it so you do not lock in the wrong deduction.

How to change between the Standard Deduction and Itemized Deductions

Do you mortgage interest? There is a question or two you have to answer right to get the mortgage interest deduction. Like maybe put in your ending balance. Make sure you answer that the loan is secured by the property. Go back through that section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jrosarius

New Member

AS70

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Waylon182

New Member

BobTT

Level 2

BobTT

Level 2