in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I refinanced and have two 1098 forms

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

This doesn’t work for me. I don’t need any CA adjustments because my loan is below the federal limits.

On the federal form I can override TT by going into forms and changing the answer to whether limits apply to “no.” But on the CA return the worksheet always adds together the original loan and the loan as purchased by another lender. And I can’t change those amounts manually on the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

What is your situation?

How many 1098 and what happened? Any loans made in 2019?

Was the loan sold or refinanced?

If the loan changed hands, you need to have the origination date in Box 3 be the original date prior to 2019.

Could you please provide the numbers from Boxes 1, 2, and 3?

Also, what types of loans are they? Original, Loan sold to new Lender, refinance no cash out, refinance or HELOC with cash out.

On what date was the loan made?

Unfortunately, the 1098 is not providing enough information for the program to make the adjustments in many situations.

Below is a link to IRS Pub 936 is you are interested in reading up on it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

One mortgage that was refinanced 8 years ago. In 2019 it was sold to another mortgage company so I have 2 1098s. But because the mortgage was not refinanced in 2019 they have the same 2012 origination dates.

When I enter the 1098s into TT federal I get an error asking for points/interest limits even though the loan is below the federal maximum. I can override by going into the form and changing the answer to whether I’m subject to limits to “no.”

But on the CA return it’s still adding both loans together, which causes it to think that my federal was limited, which it wasn’t. And I can’t manually change the entries on the CA worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

The following steps should resolve your issue:

- Log into TurboTax and choose Deductions & Credits.

- On the page “Your tax breaks”, select Mortgage Interest and Refinancing (Form 1098) and Start.

- Delete any Forms 1098-MTGE you have already entered in the program. Then choose the button “Add a 1098”.

- Enter the details from your FIRST Form 1098 – the one from your old mortgage company or before the refinance occurred. Be certain to enter all the information, including the amount in Box 2 of your 1098. According to the updated 2019 instructions for Form 1098, Box 2 should show an amount. For a loan prior to 01/01/19, the amount should be the balance of your loan as of 01/01/19. For the loan taken out in 2019 (including refinance loan or when the loan is sold to another mortgage company), the balance should be as of the date of the loan origination.

- Continue through the interview until you reach the screen “Was this loan paid off or refinanced with a different lender in 2019?” If you’re entering the original loan, say No.

- On the screen “Is this loan a home equity line of credit or a loan you’ve ever refinanced”, say No.

- Continue to complete the first 1098.

- Add your next 1098. Be certain to enter all the information, including the amount in Box 2 of your 1098. If there is not an amount in this box, please contact your mortgage lender for the amount. It is required for an accurate calculation.

- When you reach the screen “Is this loan a home equity line of credit or a loan you've ever refinanced?” say Yes. Select the correct radio buttons and Continue to complete the interview.

- Click Done. If presented with a followup question about the interest limitation and your loan balance is under $750,000 then your deduction is not limited - say No. If your loan is over $750,000 then the deduction is limited. Say Yes. You will need to manually calculate the adjustment. Please see Page 12 of IRS Pub. 936 for a worksheet that will help you calculate the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

There is a bug in the CA form and there is no way around it using the Step by step in the federal section. The only way i could fix it is by manually adjusting the amount in the CA state Step by Step when it asks if there is any adjustment for interest and points reported on FORM 1098. The adjustment that TT is calculating is $1,100,000/'total loan(s) amount (incorrectly calculated by TT)l' x total interest minus the federal interest deduction. If you are below the $1,100,000 in mortgage loan amount then just simply take the total mortgage interest minus the adjusted federal mortgage interest and put that number there. It should be a positive number. This brings the full interest being deducted in the CA forms. It's a ridiculous workaround and honestly should be fixed.

On a side note, if you do it manually you can get TT for free since you will get a bigger refund doing it manually over using the software. They guarantee a maximum refund and this artificially lowers your refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I called and reported the bug today. If you click continue after answering NO to is the average mortgage balance over 750K/1mil, etc it will default back to YES and remove your mortgage interest deductions. The work around to this is to simply not click continue and instead go back to another tab. Supposedly they are reporting the glitch today (03/06/20), which will hopefully be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Perhaps I misunderstand.

If you need to adjust the mortgage interest on the California return, why would you think that would be done on the federal screens?

If there is a limit on the interest being claimed on the federal return, enter that amount as an adjustment on the California return, that is what the adjustment screen is for.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Hi, I'm facing the same issue. I cannot file my federal return because it thinks that my mortgage refinance is two different mortgages. I've called and was asked to fill out a containment form, but never received any further contact. Now when I try to use phone support, the system calls me back and hangs up on me. This has happened twice. Please advise. Otherwise, please tell me how to get a refund on my software purchase.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

As an update: I finally got connected to one of your TurboTax CPAs. She literally said to me, "wow, I'm stumped." What are you going to do to fix this, TurboTax? I plan on using FreeTaxUSA's software if there is not a patch for the desktop version within a week. I will also be contacting Costco to see if they might reconsider not selling your software in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Try this:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

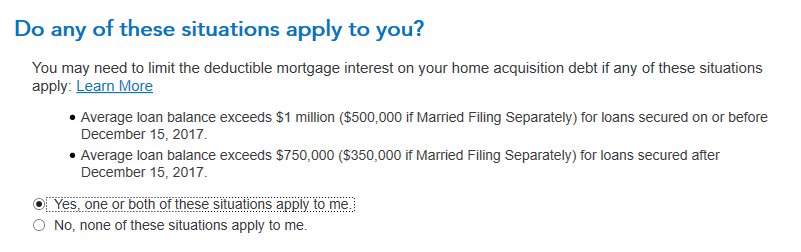

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

This question was previously answered by KrisD15

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

The California state return is not working. I have two 1098: the original one 1.2M and the refinanced one 1.1M. I entered both as it is in the federal and when it gets to CA, it calculates the average loan balance as 1.2M/2 + 1.1M = 1.7M, which makes 1/3 of my mortgage interest not deductible in CA.

Why can not TT fix such a common issue? maybe I should switch to another software next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

So you want me to click "yes" to the question that says that my average loan balance exceeds $750,000, even though it does not (screenshot below)? How can I be sure that my taxes are being filed properly if I have to put false information the TT software? Also, how do I know what amount to put in the adjusted value? I'm almost certain that all my interest paid is deductible, but the whole point of buying your software is to not do these calculations myself.

This is a serious UX issue, if not an outright bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

MFUKing TT software is not doing anything to address this issue, I will never use TT again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

I will also point out that your suggestion directly conflicts with the instructions that your colleauge, @JokitaT2 suggested.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced and have two 1098 forms

Same problem here. The software defaulted to adding together BOTH my loans (the closed out original one AND the existing refinance) as the total mortgage debt balance. Despite answering the Q that one of the loans is a refinance, it sets the outstanding balance as the initial amount. When I manually edit the form, I can change the closed out original loan to "0" as the outstanding balance, and then the total mortgage debt is close to just what the existing balance is on my new loan... HOWEVER... it DOES NOT calculate correctly the average mortgage balance on the original loan because it just takes the full amount and then divides by two -- it should instead ask what the final balance was upon pay-off and then calculate the average off the original.

This software is SERIOUSLY flawed -- like to the point of having me shorted thousands of dollars because it's setting too high my mortgage debt (and thus my refund as a function of AGI).

TURBOTAX SHOULD BE NOTING A PATCH IS COMING OR REFUND PEOPLE AND COVER THE COST OF THEM HAVING TO FILE AN AMENDMENT... We're talking about 30 million people in CA who will have their taxes submitted erroneously when they had a re-fi in 2019. This is unacceptable, and I'm NEVER using TurboTax again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TaxHead

Level 2

Jhatgas

New Member

in Education

Jhatgas

New Member

in Education

ahleanaburton

New Member

in Education

rpope012506

New Member

in Education