- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Multiple 1098 Mortgage Interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

I sold a home in one state and bought a new home in another state in 2019. I received a 1098 for the sold home which was a loan refinance 12/6/2017, no money taken out. Home originally purchased with mortgage 6/9/2005. Sold the Home 9/17/2019.

I bought a new home on 6/19/2019 before my old home sold. That loan was sold to another bank after 1 mortgage payment so I have 2 1098s from that loan.

Both homes were my primary residence in 2019, moving one to another.

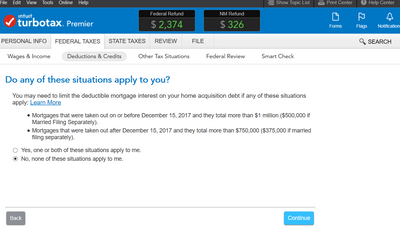

When I put all 3 1098s into turbo tax, initially it says I can deduct all, but on the next section "Do any of these situations apply to you?" Other than maybe the overlap of the loans they do not. When I select "no" it FORCES the selection of "Yes" and I loose all of the Mortgage deduction. Federal Refund goes from $3700 to owing $2000. Schedule A says "0" mortgage deduction.

It doesn't make any sense that I should loose ALL the deductible mortgage interest. Do I need to find an accountant or can you folks give me a work around.

THanks

Scott

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

The most common issue is the amount you have put in Box 2 when adding the information from your 1098 forms to TurboTax.

Box 2 is the amount of the mortgage as of 01/01/2019. For your new loan and your sold loan that amount would $0.

Please review your information and make the correction. By making this change then all of your mortgage interest will become tax deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

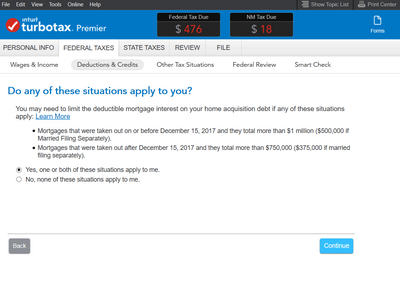

I am also having this issue. My original loan was sold in Jan 19 and in mid year 19 I re-fi'd to a VA IRRL loan. So I have 3 1098's. There is a bug in the Turbo Tax. I check the "No , none of these apply...." and Done and all seems well. TT then reverts this to "Yes,,... " and my taxes go from $2xxxx refund to -$4xx DUE. Pictures are attached. This is very upsetting and needs an immediate fix. I will not continue using TT until/unless it is fixed.

ttached.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

The problems are: 1) That's not what it says on the 1098 for the mortgage I had the first part of the year and 2) TurboTax won't let me enter a $0 value in that field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

What I found I had to do to fix this is open up Schedule A in the Forms View and then override field 8A with putting in the total interest paid that could be deducted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

You will receive a Form 1098 from each financial institution that serviced your mortgage. When your mortgage is transferred to a new financial institution for servicing this is not a refinancing of your mortgage. Your beginning Outstanding Mortgage Box 2 and Mortgage origination date Box 3 do not change when the servicing of your mortgage is transferred to another financial institution.

If you have not refinanced your mortgage and have multiple Form 1098’s to report, follow these steps.

- With TurboTax open enter 1098 in the search box

- Click on Jump to 1098 in the results box

- Follow the prompts to enter your first Form 1098

- When you have completed the first Form 1098 click Add another 1098

- When you have added the last 1098 click on Done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

I am having the same issue (loan refinanced and purchased by another bank so total inappropriately appearing to be more than 750k and TurboTax reverting my input). I appreciate your suggestion about entering zero but this is for the IRS 2019 publication and doesn’t seem to jive with what you’re saying:

”Box 2. Outstanding Mortgage Principal

Enter the amount of outstanding principal on the mortgage as of January 1, 2019. If you originated the mortgage in 2019, enter the mortgage principal as of the date of origination. If you acquired the mortgage in 2019, enter the outstanding mortgage principal as of the date of acquisition.”

Any further suggestions appreciated. You’d think TurboTax could figure out the total mortgage based on the origination and acquisition dates...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

I have the same problem as the other customers.

Sold my old home and bought a new one in 2019. The new house's mortgage was bought out by another institution so I have 3 1098s.

TurboTax is reverting my response to the special situations question (Mortgages taken out after 12/15/17 total more than $750k) to yes, even though it should be no - removing my deduction.

I cannot enter 0 for the Outstanding mortgage principal as suggested by the first TurboTax suggestion. And following the steps suggested by the other TurboTax person results in the same outcome as when I did it the first time on my own.

This seems to be a clear software issue. How do we override or fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

Also, for two 1098 forms due to one lender selling to another in 2019, do I enter points paid on purchase of principal residence twice then or just once on my current lender?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

Hi all,

Here's the solution to the situation where you have TWO 1098s related to ONE mortgage that was serviced by two different lenders during 2019 (i.e., your original loan was sold to a different lender during the year).

TurboTax actually allows you to override its assumption that these two 1098s are for two different loans. Here's how:

Go to the form Tax & Int Wks. Go to the Mortgage Interest Limited Smart Worksheet. Look for the line reading "Does your mortgage interest need to be limited" and click No. TurboTax recalculates WITH interest from both 1098s being added together and entered onto Schedule A.

Hope this helps others! I didn't figure it out till after I filed my return (bad on me) so now I need to amend. Grrr.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

This sucks.....there are NO clear instructions on how to enter 1098s from a home sold and one purchased in the same year. Maybe I'm missing something but its not even easy to find in the help section !!??

I sold my main home in 2020 and bought a new house - which is also my primary residence.

Why does TT not walk me through this? Instead there are multiple side notes about refinancing (which is equally awkward - adding the amounts together with a "hold up" message).

I entered the 1098 from the home I sold (together with the box 2 mortgage value) and then on a new line, the 1098 info from the home I bought (also with the box 2 value from the 1098) and it didn't deduct all the interest...but this is not clear until you spend a lot of time playing with the numbers (I set both box 2 amounts to 300k to be sure I was below the $750k and hey-ho suddenly my 'tax due' dropped.

This is NOT user friendly or clear at all. @Turbotax please improve this function. I spent extra on the Premier version to avoid this kind of confusion ! It shoulkd be simple and idiot-proof but its not....tempted to go to HR Block where a real person will assist me ! Shouldn't be necessary on a simple situation like moving house.

I remember a few years ago TT used to ask "Did you move house this year?" where did that go?

Disappointed and confused....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

If I understand you correctly, you received two 1098's, one for the old home and one for the new. if so, enter an average loan balance between the two 1098's in Box 2 of the 1098 for the house that was sold and then leave Box 2 blank for the second 1098. If you enter an amount in the second 1098, this will combine the balances and will limit your mortgage interest thinking you are over the $750K threshold to claim a mortgage interest.

[Edited 03-01-2021|01:32 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

@suttonm11 Try this; combine the first two 1098's for the first home/refi into one 1098 entry. Combine the second two 1098's for the second home purchase/refi into one 1098 entry.

Click this link for more info on Multiple 1098's.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple 1098 Mortgage Interest

Thanks for the suggestion but if I do this, as soon as I enter the box 2 amount, my CA State tax refund drops....I assume there is a cap on the allowable mortgage amount for CA tax? (since I then have entered 838k for the first (combined) 1098s and 644k for the second (combined) 1098s..... but my first property was sold and I now have a mortgage of only 644k so that does not seem correct...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

djb01720

New Member

lenahooker27

New Member

user17581270646

Level 2

kata123

Level 3

megestrain

Level 1