- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Charitable contributions error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

In my program, during the federal review, I see that no charity deduction is allowed. Yet, when I go into the forms, I can see the charity deduction is there. Please check your actual tax form and see if it is picking up the charity. See How do I preview my TurboTax Online return before filing? If the forms are correct, you can file. If the forms are not correct, we need to get you help. You can fill this form out for someone to call you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

I did that but I still got the error message, even though Turbo Tax entered the $300 automatically. The only way I could see the forms was to print and that kicked me out of e-filing, even though the final summary and filing instruction page states that you can still file electronically, there was no way to do it. The steps printed on the page were not available. So-o-o annoying!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

You can still e-file. To change back to e-filing, you can open your program again from Tax Home. Then, follow these steps:

- Scroll down to Your tax returns & documents. Under 2020, and select Add a State.

- Next, adjust your Charitable Contributions following the troubleshooting steps below.

- Last, run the Review and then File. On the Just one more step screen, when you are at Step 3, select the Start button to the right of Step 3.

- At the Let's get ready to e-file screen, select I want to e-file.

For more information, see: How do I change from mail to e-file in TurboTax Online?

Some additional troubleshooting tips to resolve the charitable contributions above-the-line deduction issue:

- Be sure that you have closed the program and the browser.

- Re-open using Chrome incognito on a PC, not a Chromebook or iPad.

- You may want to quickly check the review to see if the error has cleared if you have been trying to follow some of the resolution steps already.

The best way to re-set the program is to use the Tax Tools area and follow the preferred sequence for entering the donation details.

Try doing this in TurboTax:

Step 1: Delete the Charitable Organization donation sheet

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to Charitable Organization and select Delete, Delete Selected Form, and Continue.

- Select Federal from the left menu to return to your program.

Step 2: Re-add the Charitable Organization cash donation entered.

- Enter Charitable contributions in the search box.

- Select the Jump to link in the search results.

- Answer the questions in the interview.

- Only Money donations count toward the above-the-line deduction when taking the standard deduction.

- Complete the interview process by answering all donation questions and scrolling to the end of Deductions & Credits to select Wrap up tax breaks.

- Select Continue at Based on what you just told us, the Standard Deduction is best for you.

- At Charitable Cash Contributions under Cares Act, you will see your full cash contributions already input in the box. Do nothing to this cell. Select Continue and Continue.

This process will allow you to claim up to $300 for all taxpayers except married filing separate, who would each have a maximum of $150 without itemizing deductions in 2020.

For more information, see IRS Charitable Contributions Deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

When I go to the Tax Home Documents page and click on Documents, it asks me to upload 2019. If the steps you outline below require that I go to "Chrome Incognito" (whatever that is) something is wrong with the Turbo Tax program. I never found where I could look at the forms before having to elect to file by mail. I still can't find the forms. This is not what I paid for. It's ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

The Forms mode is only available in the Desktop program. To see the forms you have to pay the fees and download the pdf file from online. If you selected to file by mail you can change it to Efile. To get back into your return do not click on Documents. You should see 2020 listed. Click on Add A State (you are not really adding a state, that just lets you back in.) Try the steps Kathryn listed above again.

Where are you seeing anything about using Chrome Incognito?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

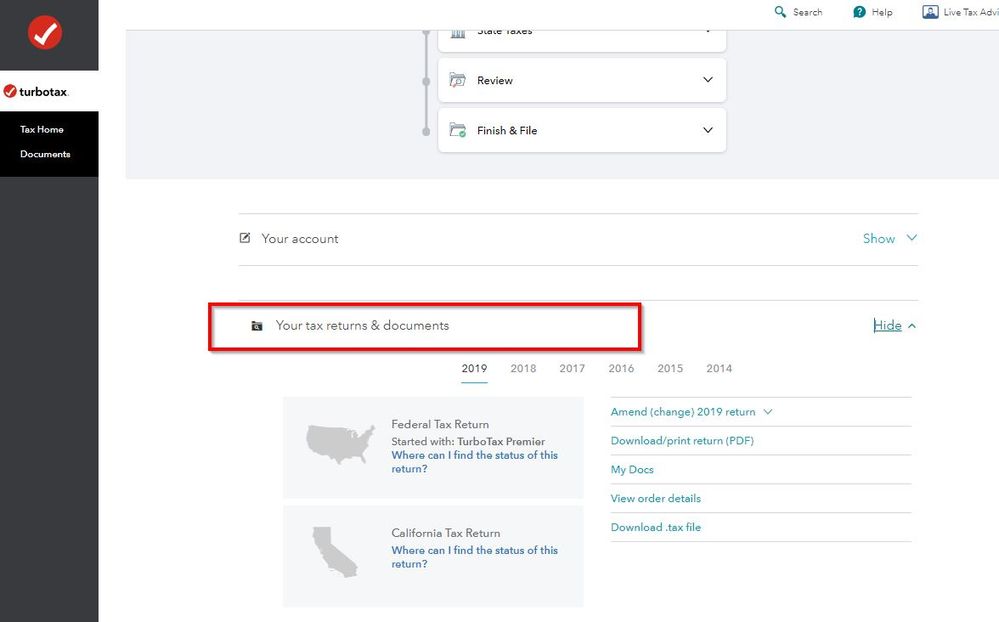

OK When you are on the screen that just says Tax Home and Documents. Click on Tax Home if you aren't already there. THEN scroll down and see YOUR TAX RETURNS AND DOCUMENTS on the right side in the main screen. Click on SHOW on the right and you should see the years listed across. Click on 2020 and then on Add A State. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

2020 Premier Desktop

Itemized Deductions

Charitable Deductions entered

1040 Worksheet line 10b = $0 (TT generated amount)

Federal Tax error check says this is incorrect.

--------------

Isn't the standard deduction amount irrelevant for itemized deductions?

Why is TT marking this as an error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

Yes. There is an issue with the contributions deduction and TurboTax is working to fix it. We do not have an estimated date of correction, at this time. I suggest you check back often to see if the correction has been made.

There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. Last update was January 13th where everything is still in draft. Once IRS finalizes the forms, we will be able to update TurboTax to accurately reflect your Contributions deduction.

Here are some of the changes due to the CARES ACT

The new legislation allows tax deductions on two types of charitable gifts. First, it allows up to $300 given to a qualified charity to be claimed as an above-the-line deduction. After the Tax Cuts and Jobs Act, which went into effect in 2018, increased the standard deduction, many taxpayers had less incentive to donate to charities. Instead, they took the standard deduction and stopped itemizing.

For taxpayers who will itemize deductions, the CARES Act effectively suspends the limit on deductions for cash contributions to public charities for 2020. “That allows individuals to completely wipe out their AGI, and their tax liability, with a charitable contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

That’s exactly what I did, there was no number automatically inserted and when I inserted it manually I got the error message no matter what number I inserted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

You might want to clear your cache.

Your browser stores recently visited webpages as temporary files in a cache, which enables the pages to load more quickly when revisited.

However, a full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

Here are the official instructions for the most popular browsers:

- Google Chrome

- Mozilla Firefox

- Microsoft Internet Explorer 11 (use the drop-down on the upper right corner of that page for earlier versions)

- Microsoft Edge

Apple's official support site doesn't appear to contain instructions for clearing the cache in Safari. Your best bet is to search the Internet for clear Safari cache or similar search terms.

If your cache isn't the issue, it might be best to delete it and start again.

Next, sign back into TurboTax and try the following:

- Go to the Deductions and Credits tab

- Select Review/Edit

- To the right of Standard Deduction, click Edit

- Click OK, Sounds Good when you see it.

- Click Wrap Up Tax Breaks

- Click Continue

The Charitable Donations question should either not appear at all, or the amount should be zero.

If this didn't work, and you still experience the same error, try deleting a charitable donation form floating in the background:

- Go to Tax Tools on the left panel of the screen

- Click on Tools

- Click on Delete a form

- If you see a form with a charitable donation on it, delete it and take steps 1-5 again.

Next, enter the charitable contributions:

To enter the information about the charity that you donated to, follow these steps:

- Open (continue) your return in TurboTax.

- In the search box, search for donations and then select the "Jump to" link in the search results.

- Answer Yes to Did you make any donations to charity?

- Answer No to Do you have an account with ItsDeductible Online?

- On the next screen, answer Yes to enter your donations for 2020.

- Continue with the onscreen instructions.

You can also use our mobile app, It's Deductible.

Here is a TurboTax article about charitable donations.

To enter the information about the charity that you donated to, follow these steps:

- Open (continue) your return in TurboTax.

- In the search box, search for donations and then select the "Jump to" link in the search results.

- Answer Yes to Did you make any donations to charity?

- Answer No to Do you have an account with ItsDeductible Online?

- On the next screen, answer Yes to enter your donations for 2020.

- Continue with the onscreen instructions.

You can also use our mobile app, It's Deductible.

Here is a TurboTax article about charitable donations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

I don’t understand how any of your tech suggestions are relevant; I’m using the desktop version.

Also, your colleague says (if I understand correctly) that the IRS has to decide how to implement the legislative changes to charitable contributions before TT can fix this problem.

I’m confused. Were you responding to someone else, or am I misunderstanding your suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

Since you are itemizing deductions, your total charitable contributions are still shown on line 10a for reference, but line 10b should be blank (with no error message).

Check to make sure you are itemizing deductions. To do this:

- Click on Federal Taxes > Deductions & Credits > I'll choose what I work on

- Scroll to the bottom of the screen, Your 2020 Deductions & Credits and click Done with Deductions.

- You may see screens asking about other deductions, but you'll eventually see a screen telling you what method of deduction is best--standard or itemized.

- If you want to change the selection, mark the box Change my deduction.

If you are itemizing deductions, your program is up to date, and you are still getting the error message, delete any entries in line 10b. If you are still getting an error, then type 0 in box 10b to get rid of the error. [I am not getting an error for line 10b and TurboTax leaves the field blank.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

Confirmed itemized deduction selected

Line 10b: blank

Ran error check -> error line 10b

Entered 0, ran error check -> error line 10b

Deleted entry in line 10b

Ran error check-> error line 10b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

I am having the same issue and not able to go further in order to file my taxes. I am itemizing deductions and line 10a is less than $300. Line 10b is blank (as it should be) and that is where I am getting the error message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable contributions error

To get past the charitable contributions error, delete the $300 in the error check. Then go back to Deductions & Credits and enter the contribution there, in the Donations to Charity topic. Then click Done with Donations and proceed through the screens until you get to the screen that tells you that TurboTax has added in the contribution.

The contribution will be back on Form 1040 line 10b, but it should not be flagged as an error if you enter it in Donations to Charity.

Here is a TurboTax article about charitable donations.

Here's an IRS article explaining how the CARES act changes charitable deductions in 2020.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17729212199

New Member

Fun_with_Taxes

Returning Member

lookto0411

New Member

kjp3070

New Member

mkhalbert

New Member