- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

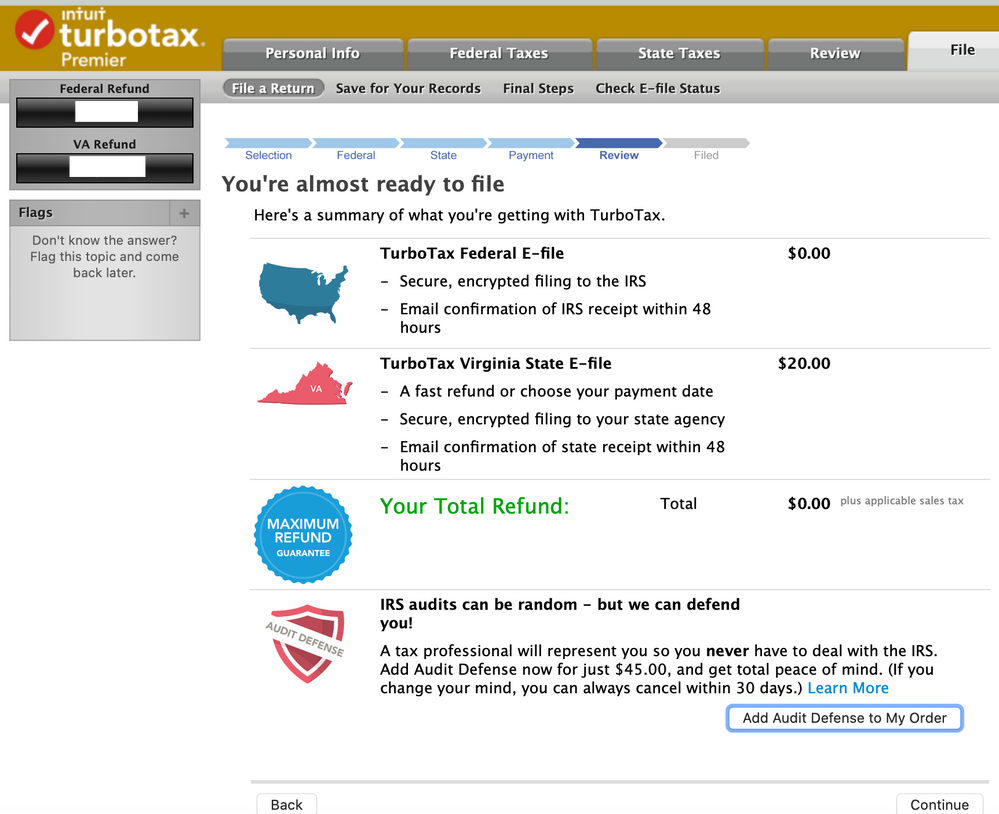

I used TurboTax Premier version to file Federal and State (VA) taxes. When I was filing, the software showed the e-filing fees for State is $20.

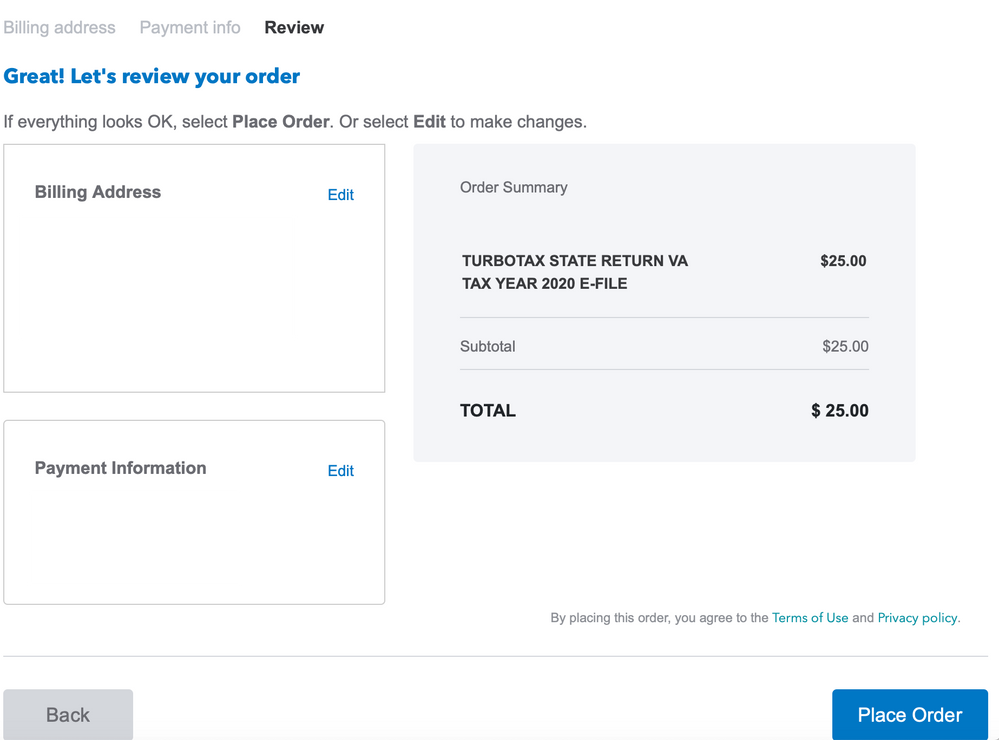

When I went ahead and ordered e-filing for State, I get to a billing web page and the fees was $25.

I was really mad, not because of that $5 but because of the low level unethical, bait and switch scheme employed by the nationally known software and company.

If anybody starts a class action lawsuit, just let me know.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

Fees increase in March.. If you read the fine print on your packaging for the software you will see that it tells you the fees are subject to change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

The "Regular State filing fee (i.e., $25)" AND "limited time offer's DEADLINE" should be on the software's "You're almost ready to file" page. Not just the temporarily reduced "TurboTax State E-file $20".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

Prices are listed on our website and states that prices are subject to change without notice. The discount expired on 2/28/21. Currently, everything is regular price.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

I’ve always wondered who gets the $25 for filing state taxes. Is it a “convenience fee” that TurboTax charges? Does the state charge it? I can’t imagine the state charging it because e-filing saves them so much labor vs having to have to pay people to input a mailed in paper return. You’d think they wouldn’t do anything to discourage people from e-filing. Can you shed any light onto where the $25 is going?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

It goes to TurboTax.

You don't have to pay it you live in NY (NY basically has a law making TT file it for free).

There's not e-filing fee using TT online. It just the desktop users who pay it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

I agree with you on the fee and think it is wrong...regardless of subject to change, etc...

This is not a small company and they have smart tech people handling the software.

I used the downloaded version and the software has downloaded multiple updates since I started working on my return, even two nights ago. If the prices change after a certain date, that should be part of the updates that are downloaded.

What is more frustrating is when your return says you owe $20, in my case $40 because I have two states, but when you click to pay, the amount being charged is $50, not the $40 that the system was saying that you owed. That is like going to the Wal-mart and the tag of the item says $40, but when you go ring up, it rings up as $50. Wal-mart is going to to check the tag and if it said $40, they are going to charge you $40 and fix it for the next person. I have a screen shot showing I owe $40, but TurboTax wants $50 when I put in my card information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

If there is a discrepancy on what your fees show in TurboTax as due and what you are being prompted to pay, please follow the instructions in this TurboTax FAQ to contact customer support for assistance: What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

I found it to be bait and switch as well. I purchased the software in time to save money on the State return, but filed on April 13th (not even a Friday 13th) and after everything was ready then asked to make the payment. A better, more transparent approach, would have been a countdown feature showing how many days remaining before being charged. Even better, if there is a discount at time of purchase, that discount should apply during use regardless of date. I'm sure the legal phrases were disclosed to keep them from being sued, but it harms intuit's reputation to have a bait-and-switch policy executed like this. Customers will remember how they felt after experiencing this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

I agree. The $20 reference was in the program itself as I wrapped up taxes. A few minutes later when I went to e-file, it was $25. ... Not right to do! ... This coupled, with Intuit now always pushing new product, will make me look for a new vendor next year. Their download software is feeling “old” and in need of refresh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

Thanks for the comment. I called customer service about it and they said they didn't know why the software showed $20 but it should be $25 and I needed to pay $25. They didn't care that I had a screenshot showing the $20. Miraculous thing is when I logged in the next time, my screen at that step now said I owed $25 for each state instead of the $20 the night before. Wrong, just wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

What pi***ed me off was not the $5 or the $20 but the $25 because I have ALWAYS filed the state by mail. I chose to "just simply" do the e-file because everything was loaded in with driver's licence, all the other info, bank crap, everything I had spent time on for the Fed. And WHOOOOOOOOP. At the very end, after TT relentlessly pushed the e-file, I get this $25 charge at the last minute. Where was the Big, bold copy that states, YOU WILL NOT BE CHARGED A FEE FOR STATE IF YOU PRINT OUT AND MAIL IN. TurboTax will charge you $25" instead of the "most people do efile with both" and "safe and simple" and "we make it easy" Just so weaselly. I've used TT for about 15 years and I've always "just simply" printed out my returns and mailed in my check when I had taxes due. So, this 'just because we can' efiling charge was egregious.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

Every time I log in TurboTax updates the program. I WOULD NOT be difficult to change the $20 to a $25 in the code...IF INTUIT WANTED TO DO SO... AND BE HONEST WITH BUYERS!! Classic bait and switch. Maybe they will choke on my 5 bucks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

Agree with the bait & switch! Clearly shows it will be $20, then they charge $25. It's only $5 (well $10, for 2 returns). It's not the money - it's the principle. Disgusting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax e-filing fees for State is misleading, $25 instead of $20 as mentioned in software

It is bad that I paid $25 for a state efiling instead of the said $20 on Turbotax popup screen. Not trusted. Feel bad. I expect Turbotax to honor $20/state efiling for everyone.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AMERICANFLAGMAN

Level 2

jasondspencer

Level 2

CTinHI

Level 1

pennyshu08

New Member

rapscallion83

Level 3