in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Issue with NY wage allocation worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Hello,

I am a FL resident since Nov 2021. Previously resided in NY.

The company I worked for was based in TX (indicated on my W2).

That company never changed my state of residence and for a few pay cycles in 2022 I was paying NY state tax.

I can't get past the Smart Check as TurboTax indicates an error on the Allocation Worksheet for PY/NR with this explanation:

"Wages, Salaries, Etc, Col D New York Wages were reported on federal form W-2 but no wage income has been allocated to New York. This will cause the e-file return to be rejected by New York state.

How do I indicate that no wages were sourced from New York and that no NY taxes are due?

Thanks!

FloridaRez

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

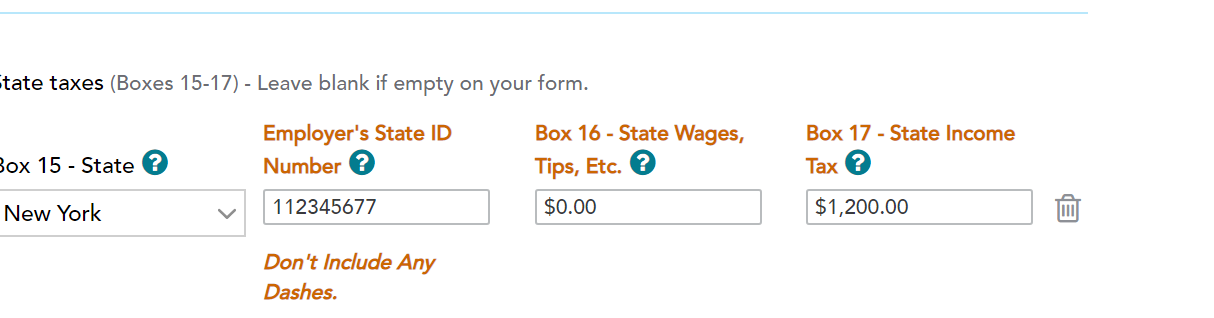

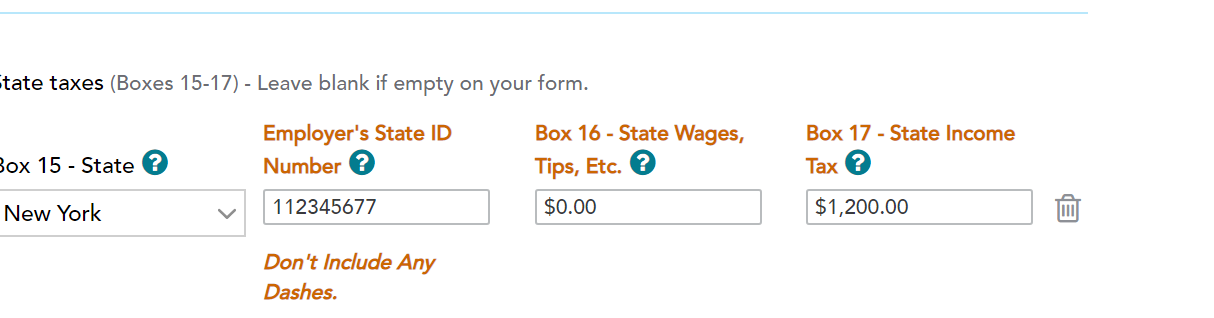

Simply go back to the federal input, and put a 0.00 in the State Wages input. like this

Don't adjust anything for NYS. Leave everything the way it is.

This is the way it showed up for me without any error messages.

What you may want to do is enter the whole W2 input from scratch exactly in the format that I just showed you.

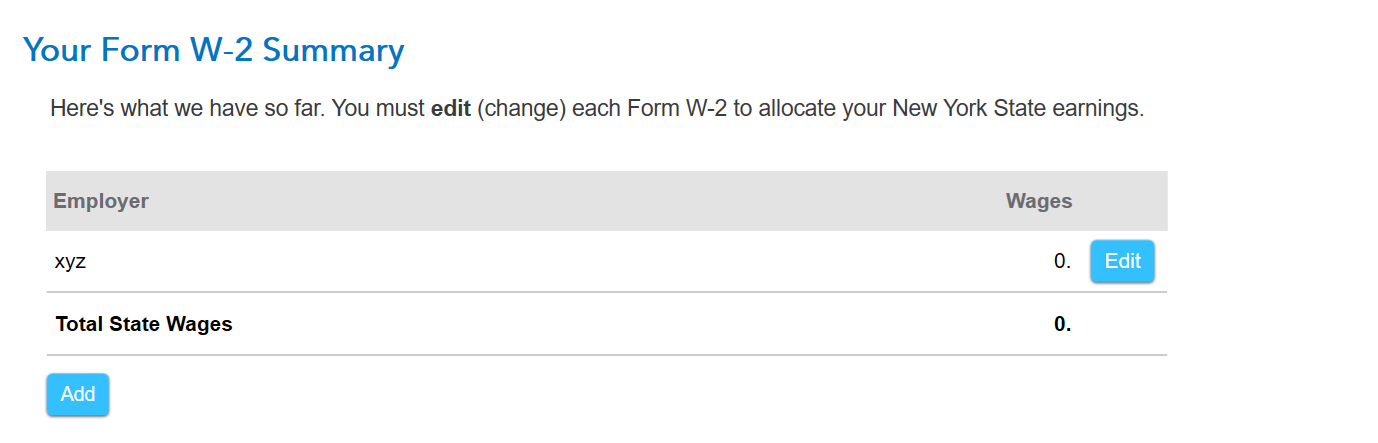

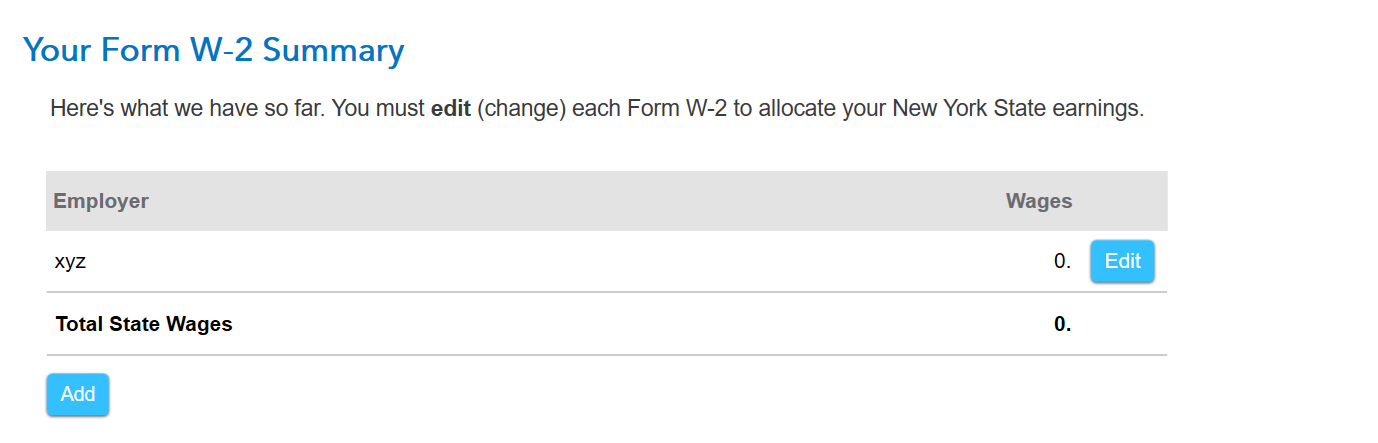

Then go into NYS, hit continue, continue till you get to this screen

Don't edit or do anything with it. On the right, hit Done.

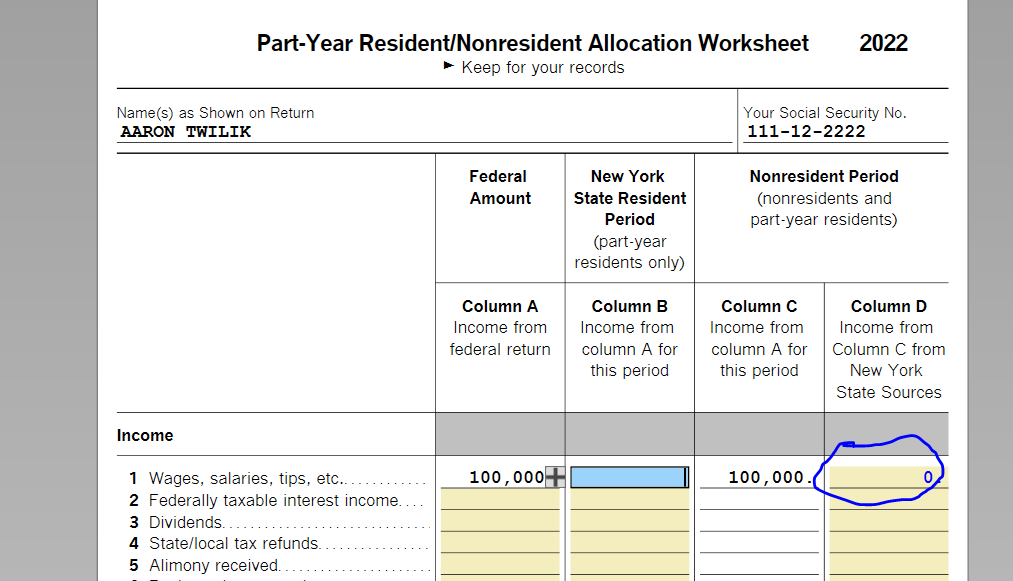

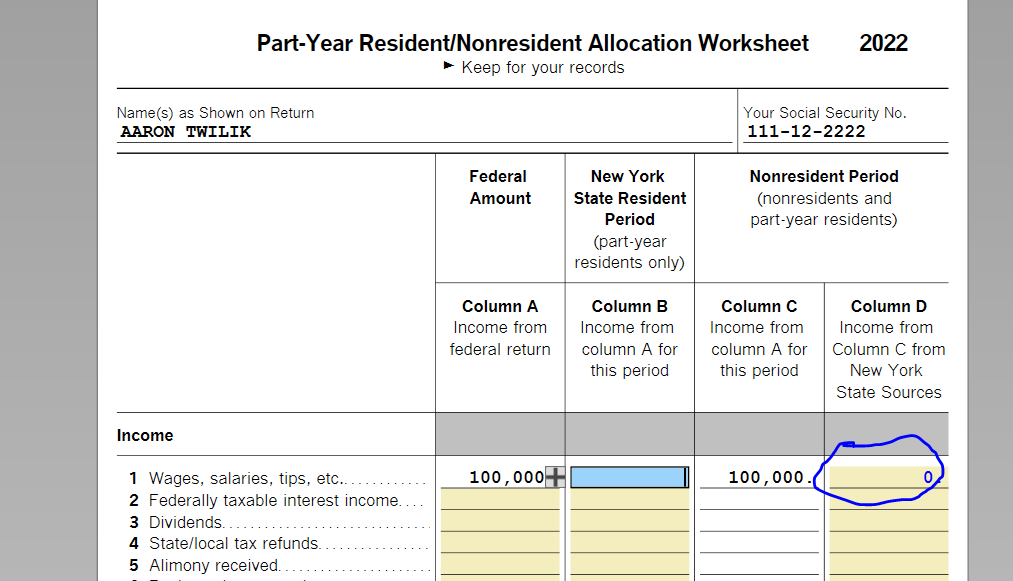

The "0 "allocation for NYS nonresident seamlessly flows through to the worksheet without any error like this.

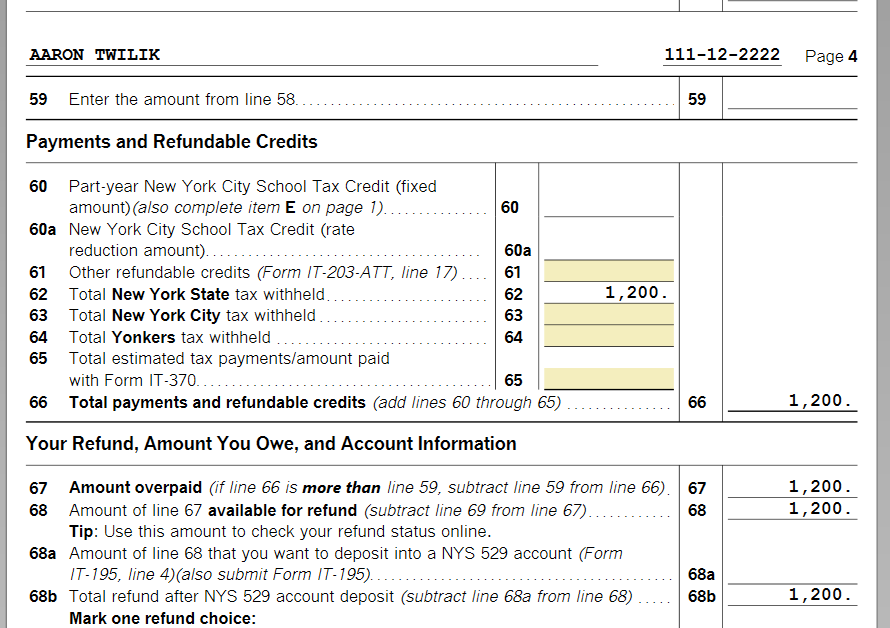

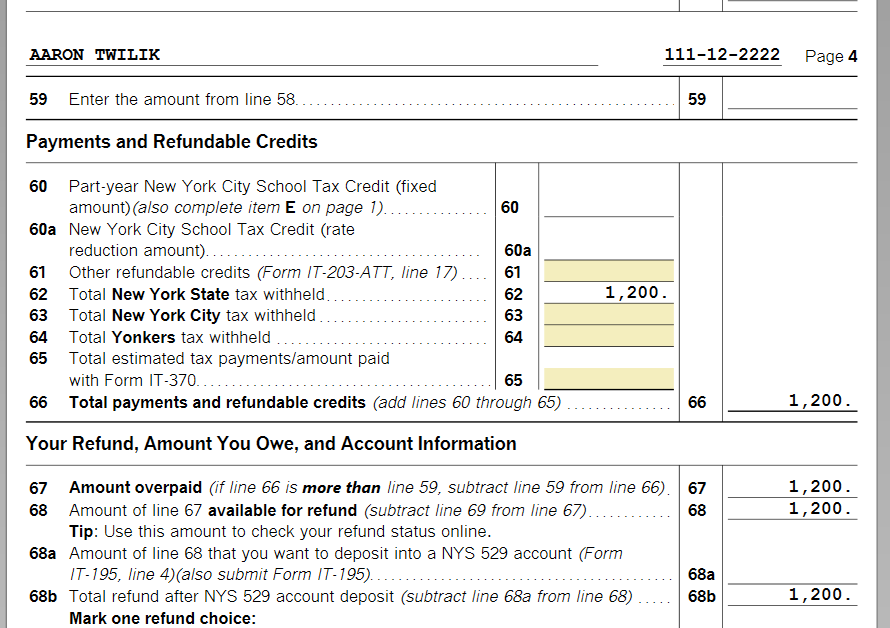

And the state tax withheld on pg.4 like this

I invite you to try us back and tell us if this worked for you. Good luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

The income is definitely not taxable to New York (NY). When you enter your W-2 for this company, be sure to enter the wages for the state of NY for the few pay cycles then review NY for the nonresident questions to remove it.

It sounds like you already performed the following which may have created the error.

- Enter only the withholding amount (Box 17) and nothing in the state wages (Box 16) then try processing the return so that only your NY state withholding is shown and a full refund is received.

Also,you should first clear your cache and cookies. It handles many issues that seem nonsensical on a regular basis.

- Close your TurboTax return first.

Watch to be sure you are selecting 'all time' as example. Do not use selections like 'last hour' for those browsers that give you options.

Next double check you residency is listed as 'Nonresident' when you review the NY return after making this change. The key is to have an accurate tax return so if the employer actually listed NY wages that would be incorrect for two reasons.

- The company is not located in NY.

- You did not physically work there.

Please update here is you have more questions and one of our tax experts can help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Thanks for the help!

I cleared cache and cookies and made the change you requested:

- state wages (box 16) set to zero

- state income tax (box 17) stays as is

I now have 2 errors in TurboTax:

1. You entered New York withholding greater that 25% of New York wages. Please review your W-2 and change the incorrect entry.

2. Same original error: Allocation Worksheet for PY/NR: Wages,Salaries, Etc, Col D New York wages were reported on Federal form W-2 but no wage income has been allocated to New York.

I am set as a Non-Resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Let's see if we can eliminate the error.

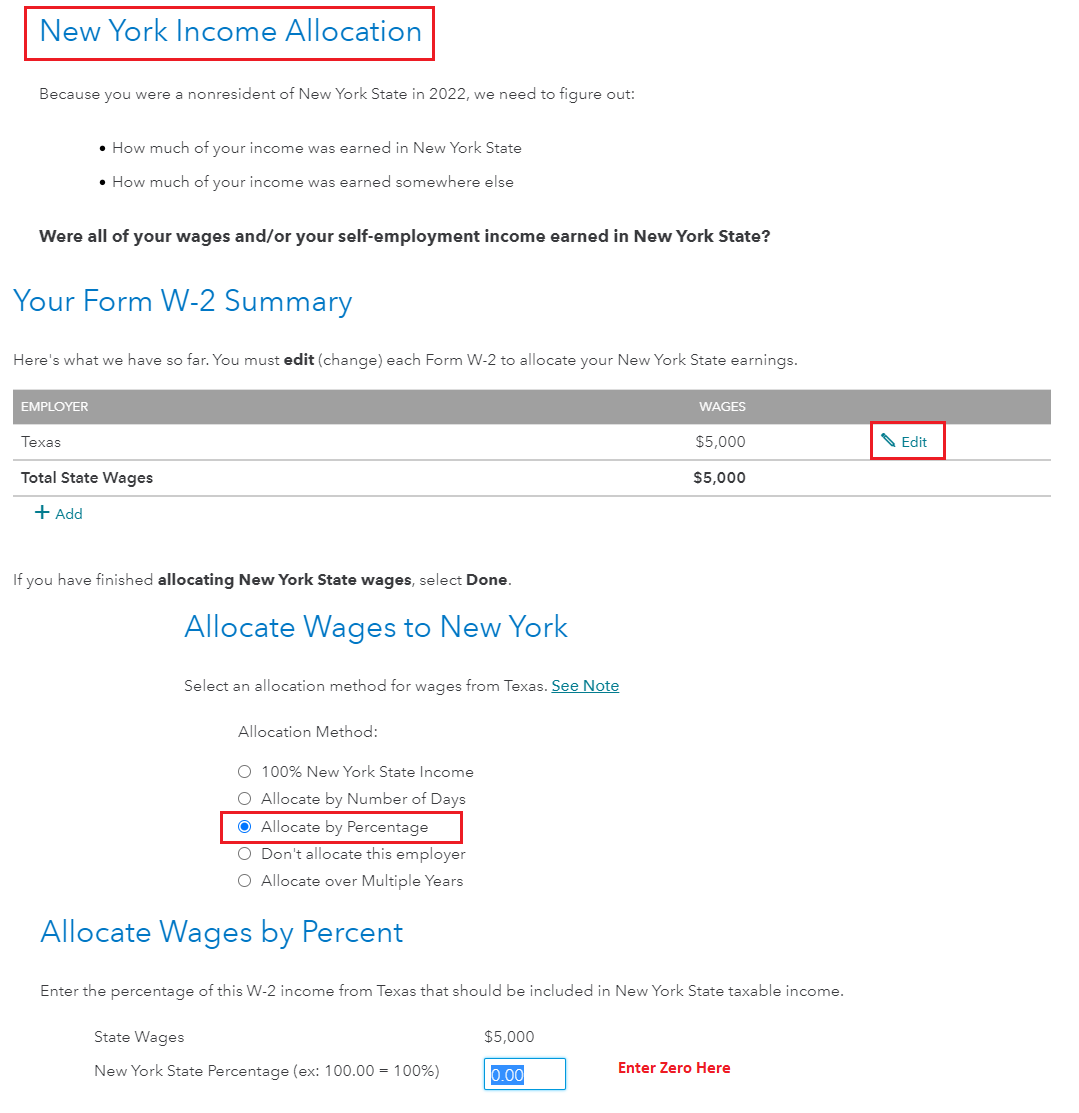

I tested a scenario on my end with good results. Here are the steps I used.

- In the federal section search for w2 and then click the Jump to... link

- Edit beside the W-2 in question

- Make sure the NY state wages are in place in Box 16.

- Finish the W-2 and then income section (Continue)

- Go to the NY return to review. When asked 'Were all of your wages earned in NY? Select No

- Select Edit next to the W-2

- Select Allocate by Percentage

- Enter 0 for the NY Percentage

- Continue and you should see the NY state refund

I had no errors upon review of the NY state return. See the images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Unfortunately, after the changes suggested, I still get the original error.

It wants something in Column D.

Once I put something there, I get taxed on it, even with 0% allocation:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Simply go back to the federal input, and put a 0.00 in the State Wages input. like this

Don't adjust anything for NYS. Leave everything the way it is.

This is the way it showed up for me without any error messages.

What you may want to do is enter the whole W2 input from scratch exactly in the format that I just showed you.

Then go into NYS, hit continue, continue till you get to this screen

Don't edit or do anything with it. On the right, hit Done.

The "0 "allocation for NYS nonresident seamlessly flows through to the worksheet without any error like this.

And the state tax withheld on pg.4 like this

I invite you to try us back and tell us if this worked for you. Good luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

I started a new return and followed your instructions and it worked.

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

An addendum to the post.

Turns out that even though the NYS return had no errors, when I attempted to e-file, it was rejected.

This is the message:

So, it looks like I will have to mail the NY return in.

Should I include a letter to explain the situation?

I know NY requires that I include the Fed return as well. Does that return have to be signed?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Yes. Include an explanation with your New York return as to why you are claiming $0 wages. A letter from your employer would be helpful stating that New York tax was withheld by mistake.

NY may still challenge your position, claiming you are a NY-based employee working in Florida for your own convenience, so specify that you did not work in NY a single day and that you have minimal connection to NY.

You do not have to send a copy of your federal return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with NY wage allocation worksheet

Thank you. I will include a letter of explanation with my return as well as letter from the employer.

It does look like I have to include the fed return as well.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zinj

Level 3

5d456c8d408d

Level 1

user17713554989

New Member

seanshunkwiler

New Member

orcutd

New Member