- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Let's see if we can eliminate the error.

I tested a scenario on my end with good results. Here are the steps I used.

- In the federal section search for w2 and then click the Jump to... link

- Edit beside the W-2 in question

- Make sure the NY state wages are in place in Box 16.

- Finish the W-2 and then income section (Continue)

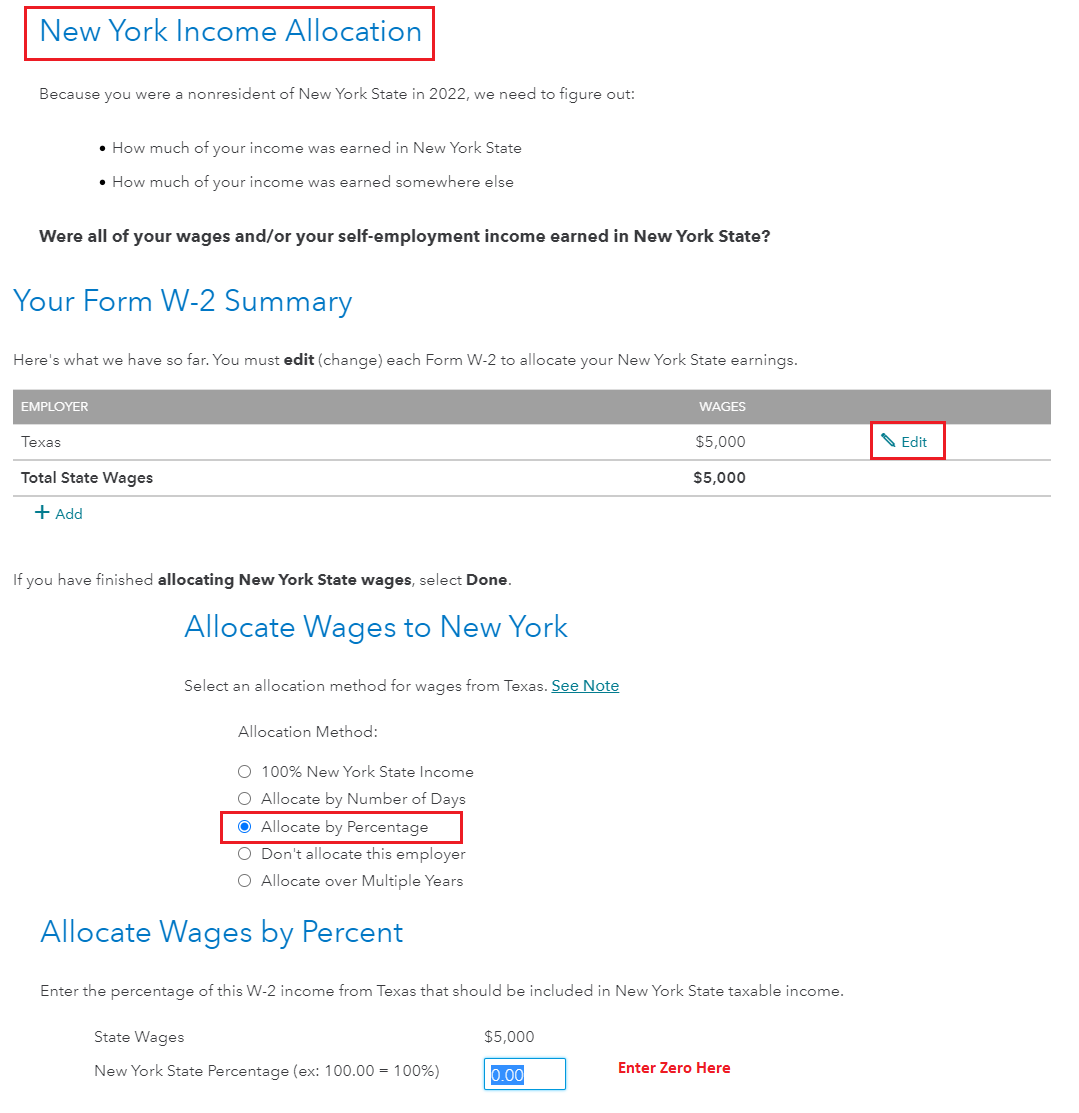

- Go to the NY return to review. When asked 'Were all of your wages earned in NY? Select No

- Select Edit next to the W-2

- Select Allocate by Percentage

- Enter 0 for the NY Percentage

- Continue and you should see the NY state refund

I had no errors upon review of the NY state return. See the images below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 27, 2023

11:05 AM