- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

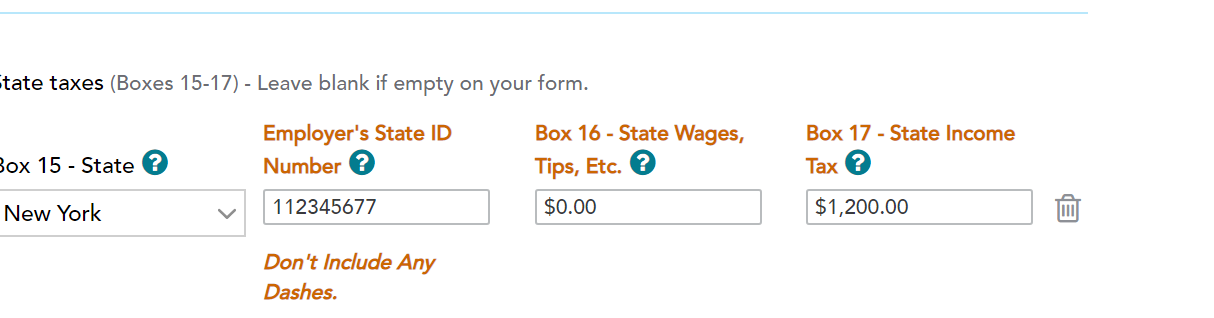

Simply go back to the federal input, and put a 0.00 in the State Wages input. like this

Don't adjust anything for NYS. Leave everything the way it is.

This is the way it showed up for me without any error messages.

What you may want to do is enter the whole W2 input from scratch exactly in the format that I just showed you.

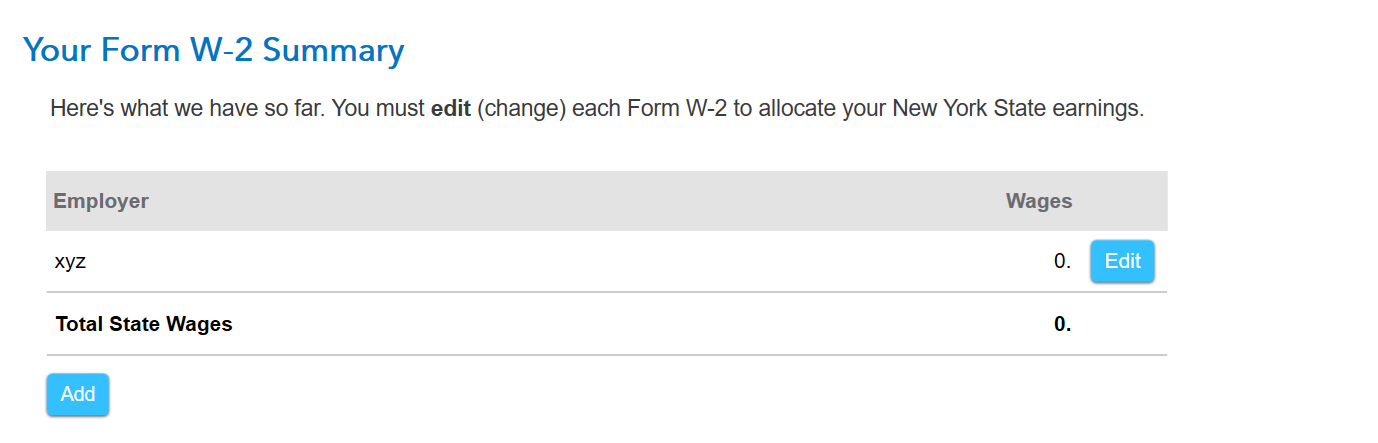

Then go into NYS, hit continue, continue till you get to this screen

Don't edit or do anything with it. On the right, hit Done.

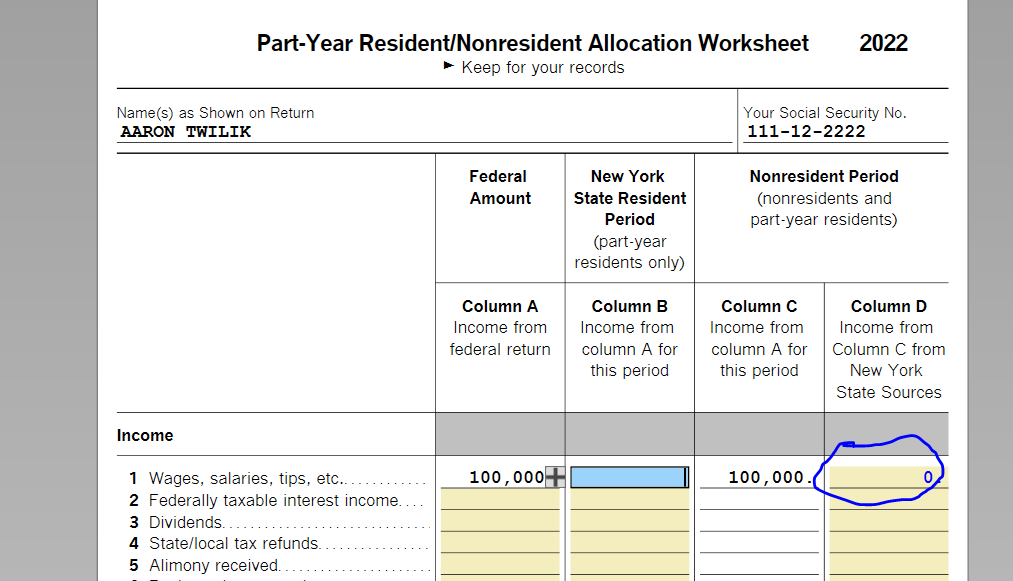

The "0 "allocation for NYS nonresident seamlessly flows through to the worksheet without any error like this.

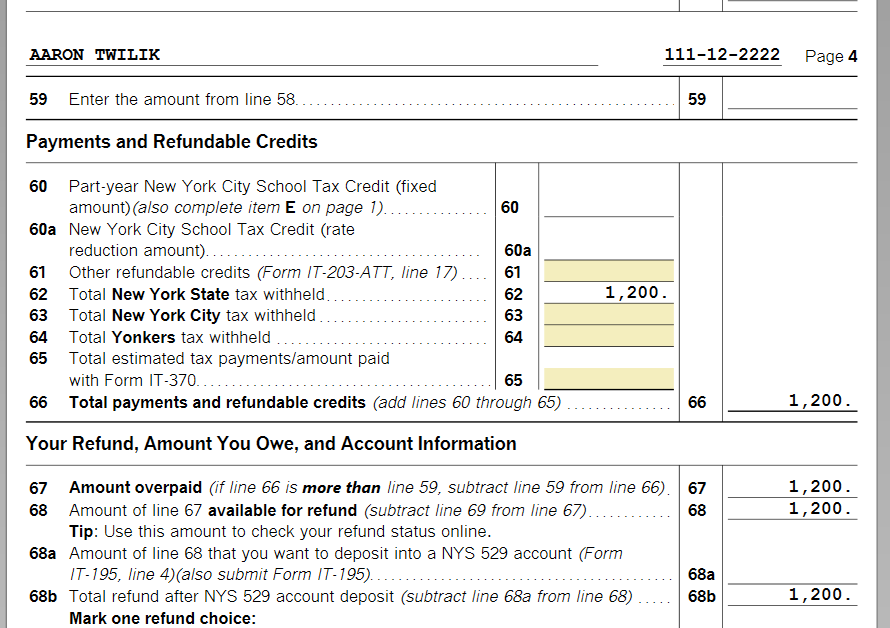

And the state tax withheld on pg.4 like this

I invite you to try us back and tell us if this worked for you. Good luck!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 28, 2023

9:50 AM