- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Amending 2019 State tax return using TurboTax app on macOS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

I filed Federal and State tax returns at different times.

August 2020: filed 2019 Federal using TurboTax website

December 2020: filed 2019 Indiana State tax using TurboTax macOS app (because the website was updated for 2020 season and wasn't accepting 2019)

Both returns have been accepted and I got both refunds.

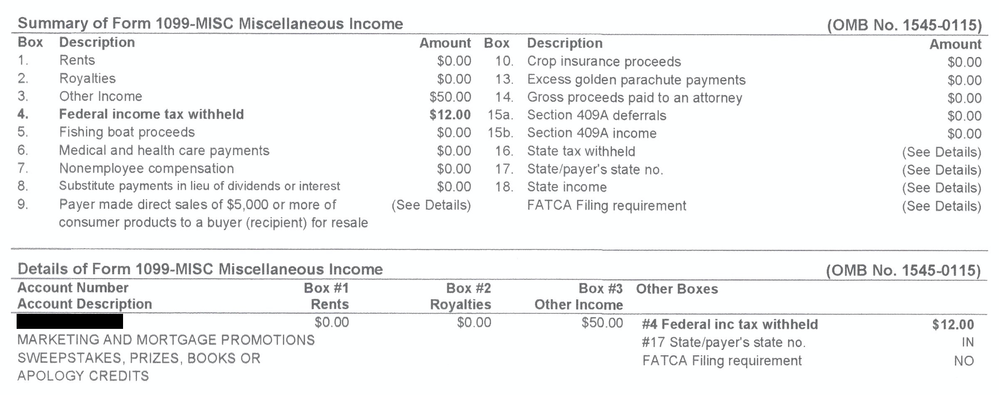

Problem: I forgot to add one 1099-MISC form (photo attached). I can amend federal on the website (using "Amend 2019"), but how do I amend State tax return? I no longer have my macbook. The website doesn't have my 2019 State tax information. I do have the "TurboTaxReturn.tax2019" file.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

2019 and earlier can only be amended with TurboTax using the CD/download version installed on a PC or Mac computer.

2019 amended Federal returns can either be e-filed or mailed. 2018 and earlier amended returns can only be mailed. It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS or state receives it.

See this TurboTax FAQ for detailed amend instructions:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

-- Amended returns can only be mailed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing.

You can check the status of the amended return here, but allow 3 weeks after mailing.

https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

Hi @macuser_22

"2019 and earlier can only be amended with TurboTax using the CD/download version installed on a PC or Mac computer" -- I think that's not true. I can see option to amend my tax return on website. Are you talking specifically for my case? Should I do federal from website and state from CD/download version?

My federal info is in website but state info is not. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

@steofn3 wrote:

Hi @macuser_22

"2019 and earlier can only be amended with TurboTax using the CD/download version installed on a PC or Mac computer" -- I think that's not true. I can see option to amend my tax return on website. Are you talking specifically for my case? Should I do federal from website and state from CD/download version?

My federal info is in website but state info is not. What should I do?

Only *2020* returns can only be amended online. The website is only for 2020 tax returns.

You could NOT file a 2019 state return in 2020 using the website. If you tried to add a state online and entered 2019 data into it then you filed 2020 state return using 2019 information. You will need to amend the 2020 state and remove the 2019 data and include 2020 data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

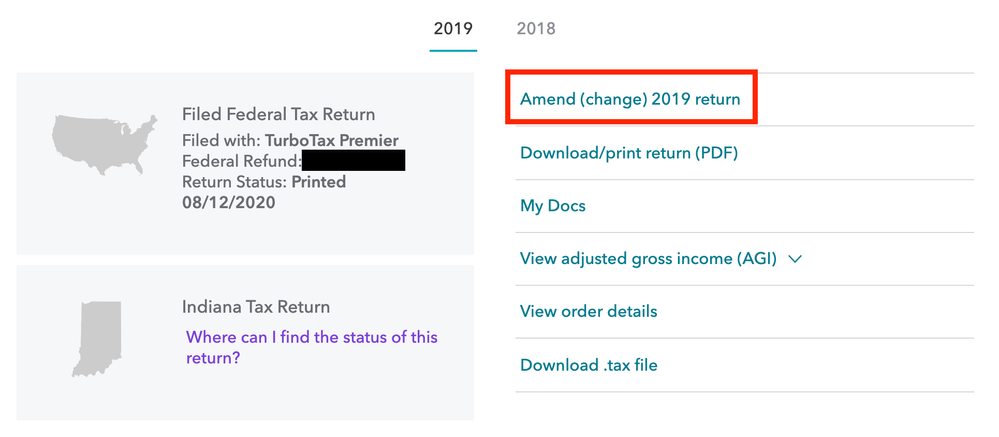

@macuser_22 "Only *2020* returns can only be amended online." -- that's not true. See attached screenshot. I am more confused than before. Why are you saying that only 2020 can be amended online? See attached screenshot.

I want to know: how to amend 2019 federal and 2019 state? I did 2019 federal online and 2019 state using macOS app. Please state it clearly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

That must be something new.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

I cannot find the option "Amend a return (make changes) after it was filed and accepted by the IRS."

I am using Turbotax Home and Business 2019, Mac Download, for tax year 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

To amend a 2019 tax return, see the following instructions:

- Open TurboTax 2019.

- It's important that you open your 2019 return in your 2019 version of TurboTax. It won't work in other year versions.

- Select Amend a return (make changes) after it was filed and accepted by the IRS.

- Select Continue on the We'll help you change (amend) your return screen.

- On the following screen, Did you already file your return? select Yes, I've already filed my return, then select I need to amend my 2019 return and Continue.

- Now, make an "amend" copy your return by selecting Save As (Mac: select Duplicate) from the File menu. This preserves the originally-filed return.

- Name the copy to distinguish it from the original, like 2019 Amended Smith B Form 1040 Return.

- You should now be working inside the copy you'll be amending. Make your changes. Don't worry if your refund meter drops to 0; this is normal. Your calculations will come out correctly in the end.

- Select Done when you're finished, and continue through the screens.

- Follow the instructions to print and mail your amended return.

To track the status of your return, use the IRS's Where's My Amended Return? tracking tool.

Processing times for amended state returns vary from state to state. If it's been more than 12 weeks since you mailed your amended state return, and you haven't heard anything, we suggest you contact your state tax agency.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

Thanks, but I already tried that.

As I wrote - I cannot find "Amend a return..." in any menu on my version. Where do I find it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

If your e-filed return was rejected (you got a specific reject code), go here instead.

Looking for a prior year return? Go here.

You can amend e-filed returns if they've been accepted; paper-filed returns may be amended once they've been mailed.

If your e-file is still pending, you won't be able to make changes until the IRS either accepts or rejects it. Don't know your e-file status? Here's how to look it up.

Select your tax year for amending instructions:

Keep in mind: You have 3 years from the date you filed your return or 2 years after you paid the tax due (whichever is later) to file an amendment.

Related Information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending 2019 State tax return using TurboTax app on macOS

I found the answer, so thanks all. For others equally lost, skip down to my bolded text.

The problem is that the documentation doesn't say "where" to "Select Amend a return...."

So naturally, I looked at the menu bar. Nope, not on any menu. I tried the two help options - nada. I looked at the page on my return, nothing.

Where do they put "Amend a return?" You'd think it would be an option you can reach with the return open.

Nope, you find it by File->New Tax Return - and in fine print under "Manage Your Return" is that text - it looks like a web link. So, even though you are not creating a new tax return, that's where it is. sigh.

Had they put that in the help article, it would be great. If you could find it with "Search" or "Help Center" - that would be good too. If they put it in the File->xxx options, it would be easy to find, and that's the standard Mac and Windows way to do things.

I hope that Intuit is reading this thread. The documentation needs just that one tweak, and it will be useful. Adding the "Amend a return" to someplace more natural would help, too.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Cruzer1943

New Member

user17724918007

New Member

litesjm

New Member

marlattme

New Member

user17724894562

New Member