- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

I need someone to contact me [phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Click the following to enter your 1099-R:

- Federal

- Wages and Income

- Scroll down and click Show More next to Retirement Plans and Social Security

- Start next to IRA, 401K, Pension Plans (1099-R)

As to whether or not you have to enter it, that depends on your income. If you have enough income that you are required to file a return, then yes, you will need to enter the 1099-R. Retirement income is generally taxable by the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

I entered all my info from my 1099R from dept of defense. Not it is wuesyioning me about gains and withdrawal. I get a monthly check from military retirement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Not helping

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

A monthly check means you are on regular pension plan and that RMD is covered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

I am trying to import my 1099-R TIAA $$$ for 2021. I have done it for years, but I can't figure out how to do it today. I purchased TurboTax Deluxe 2021, is that able to do that or should I have purchased a more expensive version? Thanks, Denise Dowell

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

@DeniJaye wrote:

I am trying to import my 1099-R TIAA $$$ for 2021. I have done it for years, but I can't figure out how to do it today. I purchased TurboTax Deluxe 2021, is that able to do that or should I have purchased a more expensive version? Thanks, Denise Dowell

Why can't you do it?

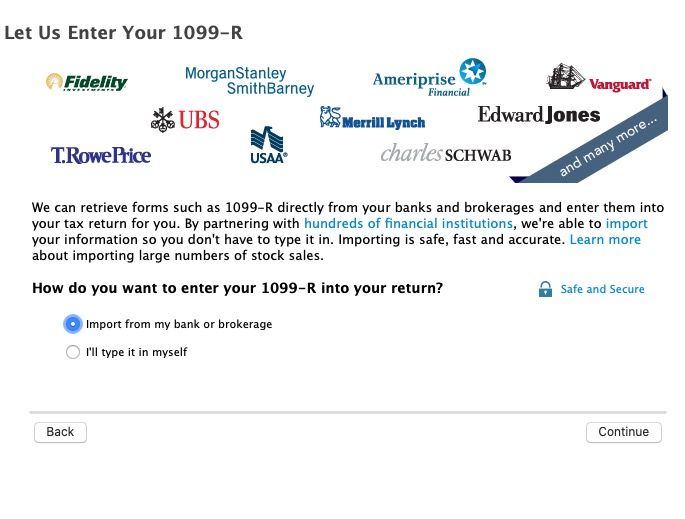

Go to the 1099-R section and select import and then select TIAA - it is listed 3 times for different types of accounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Don't enter the bank or broker name and don't try to import it. It should be just as fast and easy to manually enter it. At the bottom pick - Change How I enter my Form

Then on the next screen pick I'll Type it in Myself

Enter a 1099R under

Federal Taxes Tab or Personal (Home & Business)

Wages & Income at the top

Then scroll way down to Retirement Plans and Social Security,

Then IRA, 401(k), Pension Plans (1099R) - click Start or Revisit

If you are filing a Joint return be sure to pick which person it is for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Sorry to be so dense, I have done this many years and am stumped why I am having such a hard time importing 1099R this year. What do you mean by "Go to the 1099-R section and select import and then select TIAA - it is listed 3 times for different types of accounts". I am in turbotax now and go to Form 1099R and it choose one of my last year's form. My options seem to be Print, Delete Form, Close Form. I do not see any import option. Thanks so much for helping.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Yes, you have to enter your 1099-R into your tax return. The IRS does document matching, and they have a copy, too. The income in Box 1, Distributions, may be taxable, whether your form shows any Federal Tax withheld or not.

The easiest and most error-free way to do this is to type it manually yourself from the 1099-R you have received. You are in FORMS mode now, so click on 'Step by Step' in the upper right corner.

Then, in the Search Area (magnifying glass near top right), type '1099-R', then click on the blue 'Jump to 1099-r'.

If you have no other 1099-R's entered, choose 'Add a Form 1099-R'. Then choose 'I'll type it in myself' and Continue.

Type the data into the entry fields in TurboTax as shown on your 1099-R.

Click this link for more info on How to Enter 1099-R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

@DeniJaye wrote:

Sorry to be so dense, I have done this many years and am stumped why I am having such a hard time importing 1099R this year. What do you mean by "Go to the 1099-R section and select import and then select TIAA - it is listed 3 times for different types of accounts". I am in turbotax now and go to Form 1099R and it choose one of my last year's form. My options seem to be Print, Delete Form, Close Form. I do not see any import option. Thanks so much for helping.

To import it is a new 1099-R form. You need to delete last years form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

@DeniJaye You seem to be in the Forms Mode. You need to be in the Step by Step interview mode. Are you on Windows? Click on Step in the upper right.

Then.......The easiest way to get to the 1099-R entry screen is to simply search for 1099-R (upper- or lower-case, with or without the dash) in your TurboTax program and then click the "Jump to" link in the search results.

Enter a 1099R under

Federal Taxes Tab or Personal (Home & Business)

Wages & Income at the top

Then scroll way down to Retirement Plans and Social Security,

Then IRA, 401(k), Pension Plans (1099R) - click Start or Revisit

If you are filing a Joint return be sure to pick which person it is for.

Don't enter the bank or broker name and don't try to import it. It is just as fast and easy to manually enter it. At the bottom pick - Change How I enter my Form

Then on the next screen pick I'll Type it in Myself

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

Need help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

@Matibenn This is a long thread. What do you need help with?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Why can’t I enter my 1099-R? And do I even have to if there were no taxes withheld?

I have a paper 1041-r. When I try to do a manual entry ('I'll type it in myself'), the software does not bring up a form to do so. How do I enter the data if there is no form?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

marie3329

New Member

billdayreef

New Member

tonybeo

Level 3

jottaviani

New Member

elizabethelmoreesq

Level 3