- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Hi ep1214, If you have capital gains or losses, our Turbo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

Hi ep1214,

If you have capital gains or losses, our TurboTax Premier product can help you with filing a Schedule D. When logged into TurboTax, type "schedule D" in the search function at the top of your page and you'll be taken right to that section.

Best,

TTerinS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

Hi ep1214,

If you have capital gains or losses, our TurboTax Premier product can help you with filing a Schedule D. When logged into TurboTax, type "schedule D" in the search function at the top of your page and you'll be taken right to that section.

Best,

TTerinS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

This answer is not helpful. There doesn't appear to Turbo Tax support for for 1099-cap.

Using Schedule D directly???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

@bhmorris wrote:

This answer is not helpful. There doesn't appear to Turbo Tax support for for 1099-cap.

Using Schedule D directly???

TurboTax does not support Form 1099-CAP, Changes in Corporate Control and Capital Structure

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

The answer is in IRS publication 550 on page 65

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can i enter income reported on a 1099cap statement

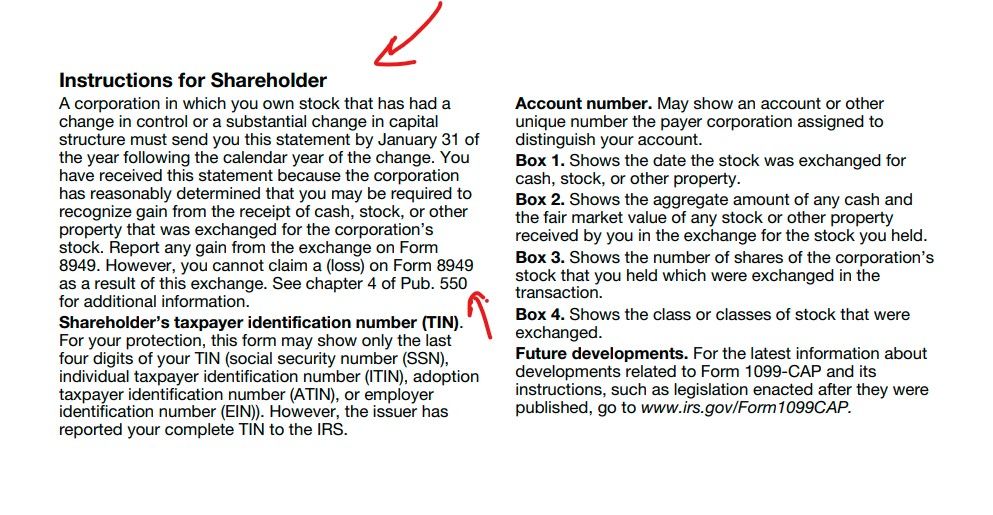

From the form itself : https://www.irs.gov/pub/irs-access/f1099cap_accessible.pdf

This form is not entered directly into the program ... if you have a taxable gain then you must make an entry once you have calculated the gain if any ... review pub 550.

Instructions for Shareholder

A corporation in which you own stock that has had a

change in control or a substantial change in capital

structure must send you this statement by January 31 of

the year following the calendar year of the change. You

have received this statement because the corporation

has reasonably determined that you may be required to

recognize gain from the receipt of cash, stock, or other

property that was exchanged for the corporation’s

stock. Report any gain from the exchange on Form

8949. However, you cannot claim a (loss) on Form 8949

as a result of this exchange. See chapter 4 of Pub. 550

for additional information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zyppy

Returning Member

mars844

New Member

rebecca113coins

New Member

user17657476396

Level 1

lasq90

Returning Member