- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

From the form itself : https://www.irs.gov/pub/irs-access/f1099cap_accessible.pdf

This form is not entered directly into the program ... if you have a taxable gain then you must make an entry once you have calculated the gain if any ... review pub 550.

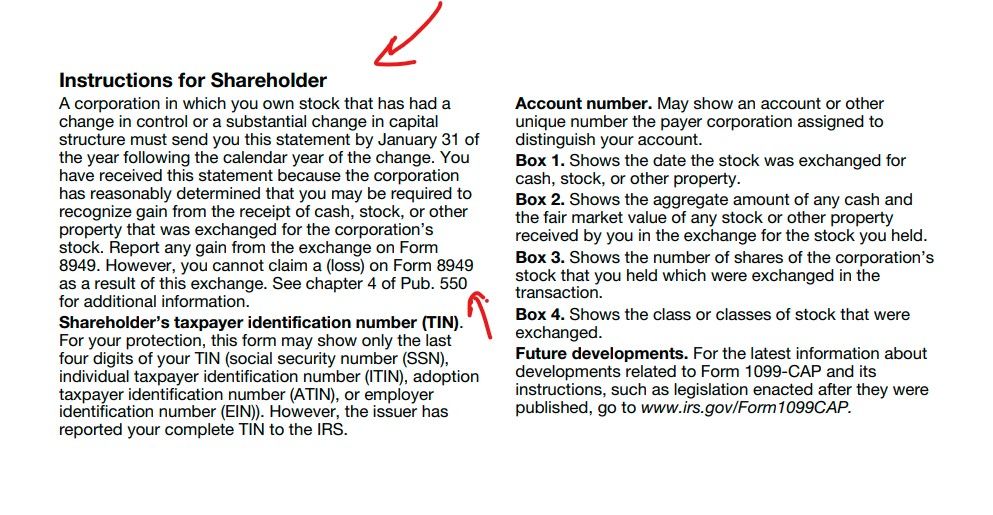

Instructions for Shareholder

A corporation in which you own stock that has had a

change in control or a substantial change in capital

structure must send you this statement by January 31 of

the year following the calendar year of the change. You

have received this statement because the corporation

has reasonably determined that you may be required to

recognize gain from the receipt of cash, stock, or other

property that was exchanged for the corporation’s

stock. Report any gain from the exchange on Form

8949. However, you cannot claim a (loss) on Form 8949

as a result of this exchange. See chapter 4 of Pub. 550

for additional information.