in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Hello Turbotax Community,

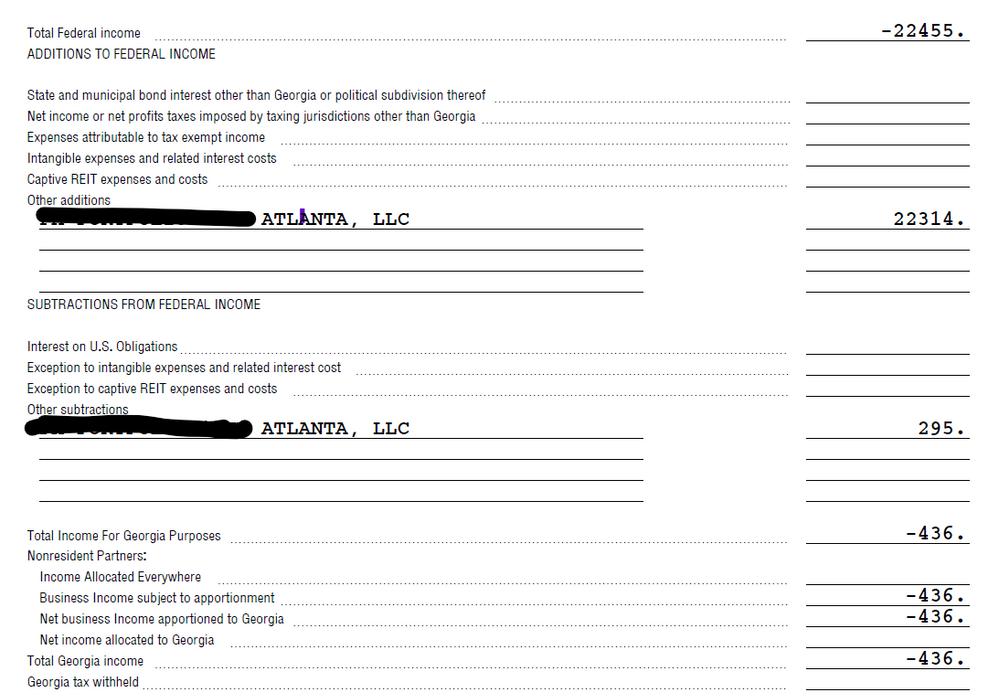

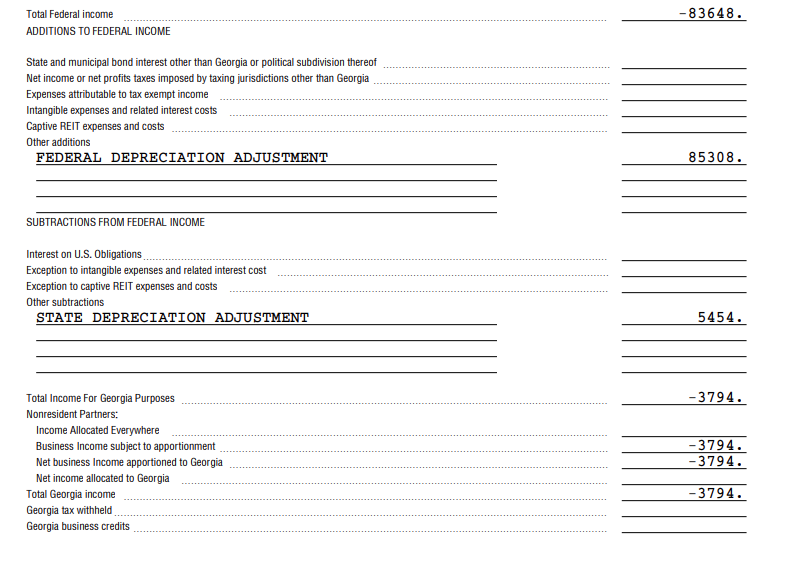

I am a resident of NJ. I invested in a real estate syndication fund back in Dec 2021 which has apartments in GA. I did not receive any distributions/income during 2021. I got my 1065 K1 over the weekend with a GA 700 form attached to it. As expected, it was a net loss due to the depreciation (-$22,455). See the GA 700 screenshot below. I was able to properly file the Federal K1. But I don't know if I am doing it correctly for the GA nonresident state tax return.

Questions:

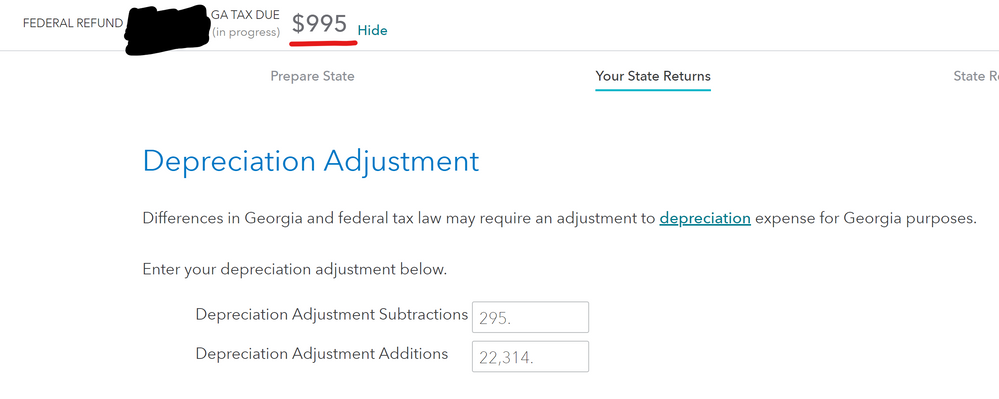

1. What does the $22,314 additions, $295 subtraction, and -$436 Total George Income mean? How do I enter these on the Georgia state tax return?

2. Where can I track the unallowed passive loss at the state level? I can only see it on the federal level through form 8582. Is there a similar form in Georgia?

Appreciate any insights you can share.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

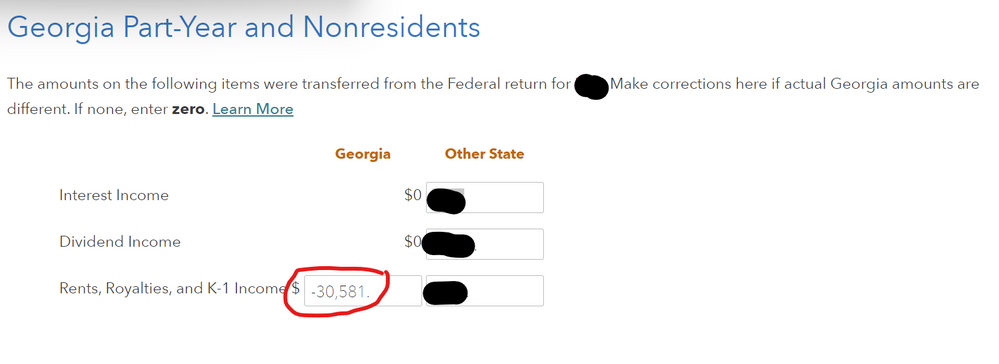

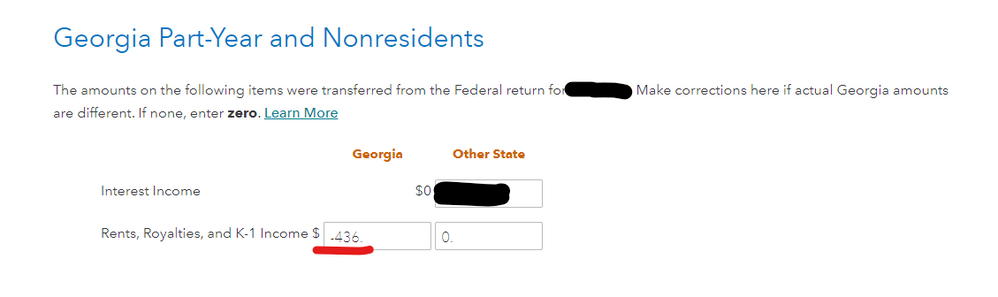

That is correct, my state return did not pull in the correct info from my K1 entered on my federal return. What I had to do was manually enter the loss myself as below circled in red:

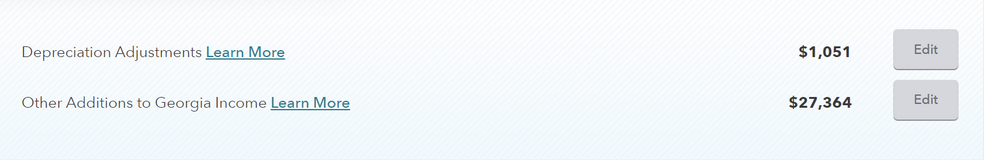

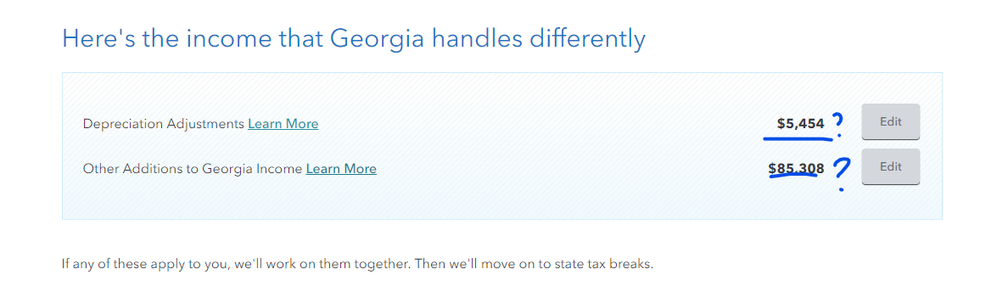

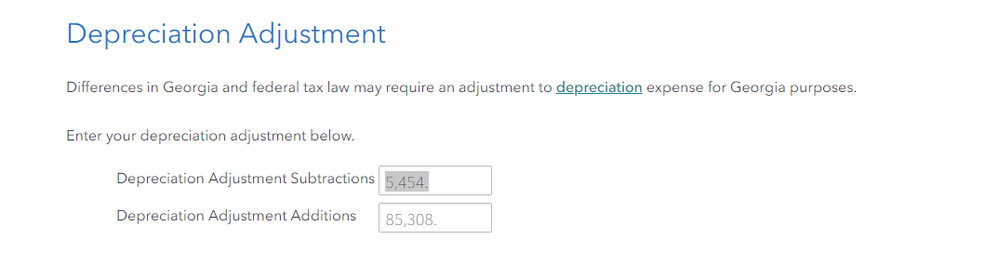

On my form 700, the additions to GA income is bonus depreciation (i.e. $27364). It is not called bonus depreciation I just figured that is what it was. The Depreciation adjustment is what GA will allows you to take (i.e. $1051). I entered those amounts in the screen titled: "Here's the income that GA handles differently"

I after I did all of this everything matched my form 700.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

The $22,314 addition is an adjustment for bonus depreciation taken at the federal level. Georgia does not recognize bonus depreciation, so it is added back to determine total income. The $295 subtraction is the state depreciation. The $436 loss is the amount of income/loss applicable to Georgia after the adjustments. You will have to track your passive losses at the state level independently.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Thanks, @DavidD66! I really appreciate your explanation. I do have follow-up questions.

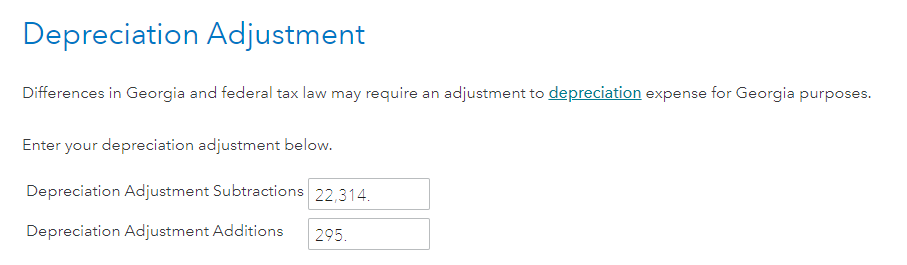

1. Am I adjusting the depreciation from the GA-700 correctly on Turbotax? The way I am understanding it, I need to make depreciation adjustments on my GA state return so Turbotax won't use the entire federal loss (due to bonus depreciation $22,455).

- I entered $22,314 under Depreciation Adjustment Subtractions (to deduct from the federal bonus depreciation of $22,455)

- Then, I entered $295 under Depreciation Adjustment Additions (for the GA state depreciation).

2. Where do I enter the -$436 of Total Income/Loss for Georgia Purposes? I assume I need to enter it under the Rents, Royalties and K-1 Income. I just need to track this passive loss manually moving forward.

Is Step1 above (depreciation adjustment) necessary? Or can I just enter the -$436 of Total Income/Loss for Georgia Purposes?

Appreciate your guidance.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

@jkm88 Both of those entries look fine. Not an easy bunch of tax questions to deal with. Good job.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Hi,

Thank you for the explanation regarding the form 700.

I too am in a real estate syndicate and received a form 700. No Georgia (GA) tax was withheld. My total income for Georgia purposes was negative. However, when I enter this information into TurboTax my GA tax is positive. Am I doing something wrong?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Since we can't see your return in this forum, if you could post a screenshot similar to the user above you, we'll try to help.

@alta-tax1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Hello @MarilynG

Good evening.

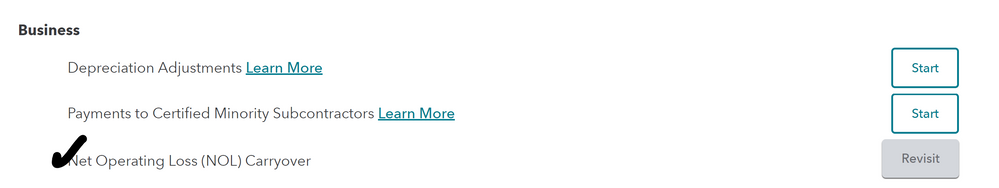

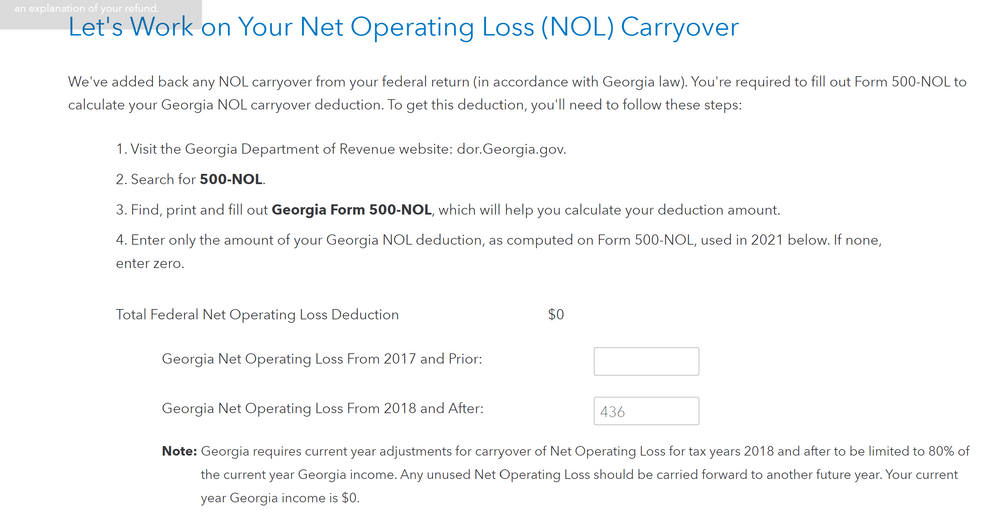

I saw a section on the GA state return relating to Net Operating Loss.

Thinking should I be using this section to record my loss so I can use it in the future to offset any gain from the partnership?

The problem I am having is TT doesn't seem to support the GA 500-NOL form mentioned below. I have to do it manually which is tough. I am not a tax expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

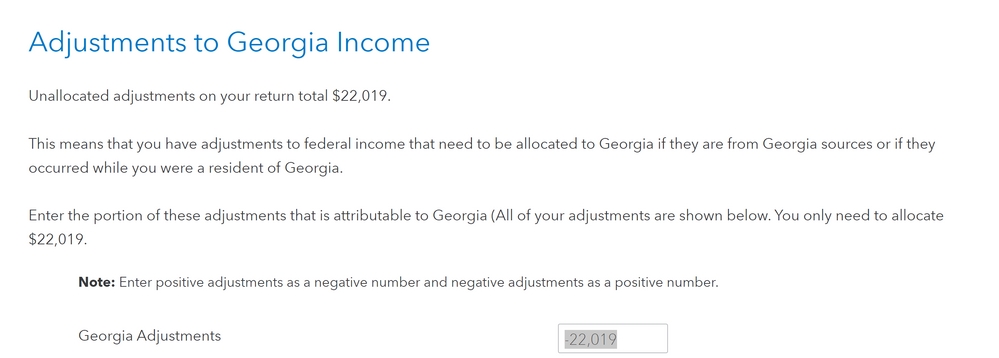

I think I figured out my problem. Since this is the first time I am filing taxes in GA, I simply needed to enter my loss from my K1, then remove the bonus depreciation (federal depreciation adjustment) since GA does not allow for it and add back the state depreciation adjustment. Once I did this, I ended up with an overall loss as reported in my GA Form 700 line "Total GA income." I did not need to use the NOL carryover form since this is my first year. I presume I will need to use NOL carryover next year because I am booking a loss with the state of GA for this year.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Per Alumni @IreneS:

"First enter the federal K-1.

Georgia does not have an actual entry for Form 700. What you need to do is compare the amounts on the federal K-1 with the amounts reported on the GA 700. Any differences will be reported on the GA return as additions to or subtractions from Georgia income.

To enter this information:

- In your GA return go to the screen, Here's the income that Georgia handles differently.

- In the Miscellaneous section click on Start/Revisit box next to either:

- Other Additions to Georgia Income - Additions are items that get taxed on your Georgia return but not on your federal return and increase the income that Georgia will tax.

- Other Subtractions from Georgia Income - Income that is not taxable for GA purposes that was reported on your federal return.

Follow the instructions on the screens."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Hello @alta-tax1,

I think your explanation on not using GA NOL carryover this year might make sense.

Where did you enter your loss from K1, and how did you remove the bonus depreciation and add back the state depreciation? Tried back the depreciation adjustments of $22,314 and subtracting $295 but it increased my amount due to GA.

Also, TT is telling me that I have $22,019 unallocated adjustments. It seems the state return is not pulling the info from my federal K1 loss of $22,455.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

That is correct, my state return did not pull in the correct info from my K1 entered on my federal return. What I had to do was manually enter the loss myself as below circled in red:

On my form 700, the additions to GA income is bonus depreciation (i.e. $27364). It is not called bonus depreciation I just figured that is what it was. The Depreciation adjustment is what GA will allows you to take (i.e. $1051). I entered those amounts in the screen titled: "Here's the income that GA handles differently"

I after I did all of this everything matched my form 700.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Thank you very much @alta-tax1 ! 😊

I really appreciate your help.

I think your explanation makes sense. My GA state tax summary now matches my GA 700 form as well.

I guess good luck to us next year on filling that GA NOL Carryover form 🤣 Hopefully, Turbotax has a solution for this next year so I can continue using it. Keep in touch, and hopefully, we can help each other again. 👍

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

@jkm88 @alta-tax1 @MarilynG @DavidD66

Friends, I could really use your help. I am also filing for GA non-resident tax for a real estate syndication. I am a limited partner on this project.

I am using the Turbo Tax Amend to file for 2021.

Please see below for my GA form 700. And my questions, too.

And please let me know what number I should fill out on Turbo Tax.

This is my first time doing this, and I am really lost...

The following page...

Much appreciated!

-Tony

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

The net on your Georgia NR return is a negative. TurboTax should already have entered that for you since the depreciation adjustments that you show are correct. So you'll just be reporting that you lost money this year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RandlePink

Level 2

RandlePink

Level 2

dtarter

New Member

Luna_Tax

Level 3

in Education

maple1122

New Member